Nasdaq index today

The Nasdaq composite closed today at 16,834.13. Compared to yesterday’s close, the benchmark index rose by 39.27 points, or 0.23%. Year to date, the benchmark index is up by 12.48%.

Nasdaq chart today

The Nasdaq composite has historically had a high correlation with the S&P 500. The two indexes even share common components, including Apple, Microsoft and Alphabet.

Like the S&P 500, the Nasdaq typically reacts to macroeconomic catalysts such as U.S. gross domestic product growth, corporate earnings, investor sentiment and geopolitical headlines.

Nasdaq performance

Despite periods of extreme market volatility, such as the dot-com bubble and the COVID-19 pandemic, the Nasdaq has generated an overall gain of 302.17% in the past 10 years. That’s significantly higher than the S&P 500, gaining 184.17% in that period.

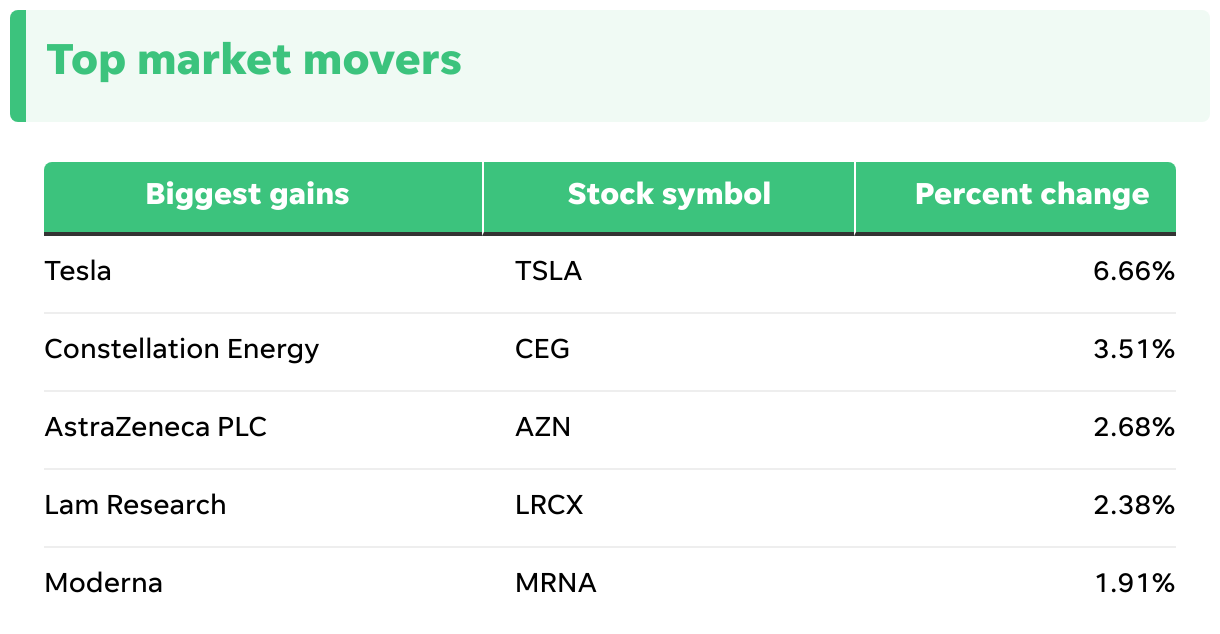

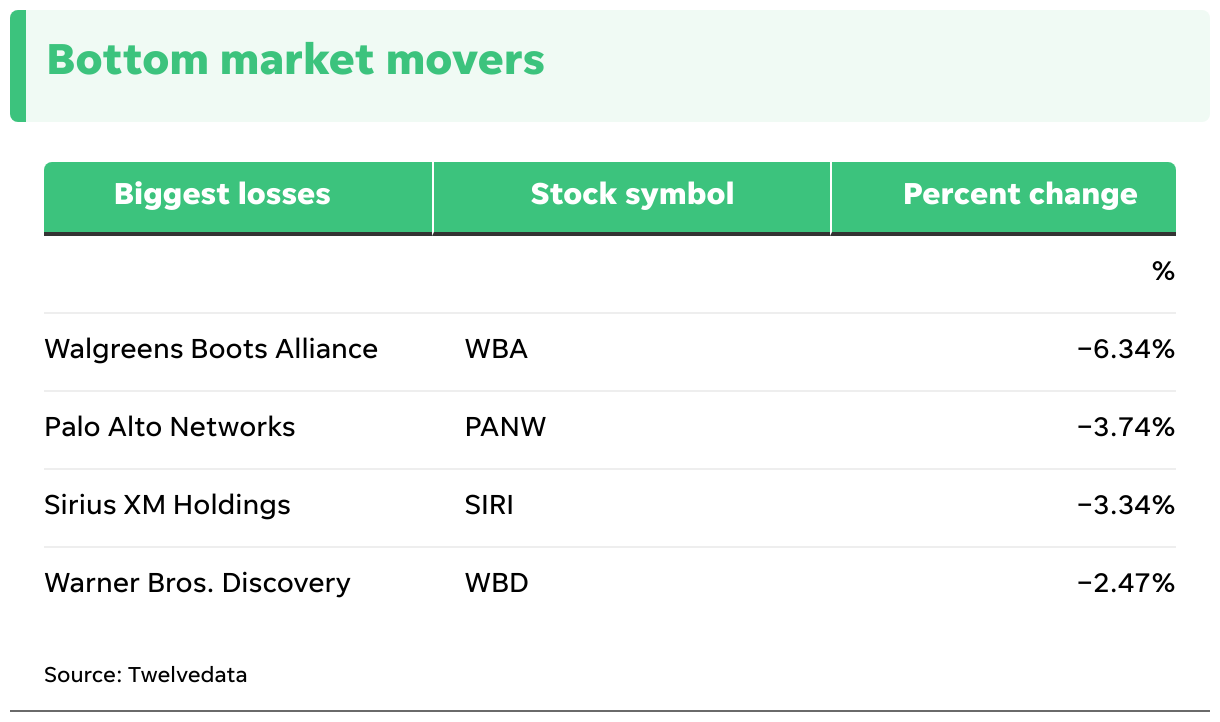

Nasdaq 100 companies

The Nasdaq 100 index is a subset of the Nasdaq composite that includes the 100 Nasdaq stocks with the largest market caps. Listed below are the top and bottom market movers among Nasdaq 100 companies.

Dow and Nasdaq today

The Nasdaq composite and Dow Jones Industrial Average are the most popular U.S. stock market benchmarks.

The Nasdaq closed today at 16,834.13, compared to the Dow, which closed at 39,879.92. Year to date, the Nasdaq is up, with a return of 12.48%, while the Dow is up, with a return of 5.74%.

While both indexes are well diversified, each has a unique focus that may appeal to different types of investors.

The Dow is known as the blue-chip index because its 30 components are typically large companies with industry-leading businesses, valuable and recognizable brands, and long track records of stability and profitability.

The Nasdaq contains more growth stocks with unproven track records. As a result, the Nasdaq can be more volatile during periods of market weakness but tends to outperform the Dow when the economy is booming.

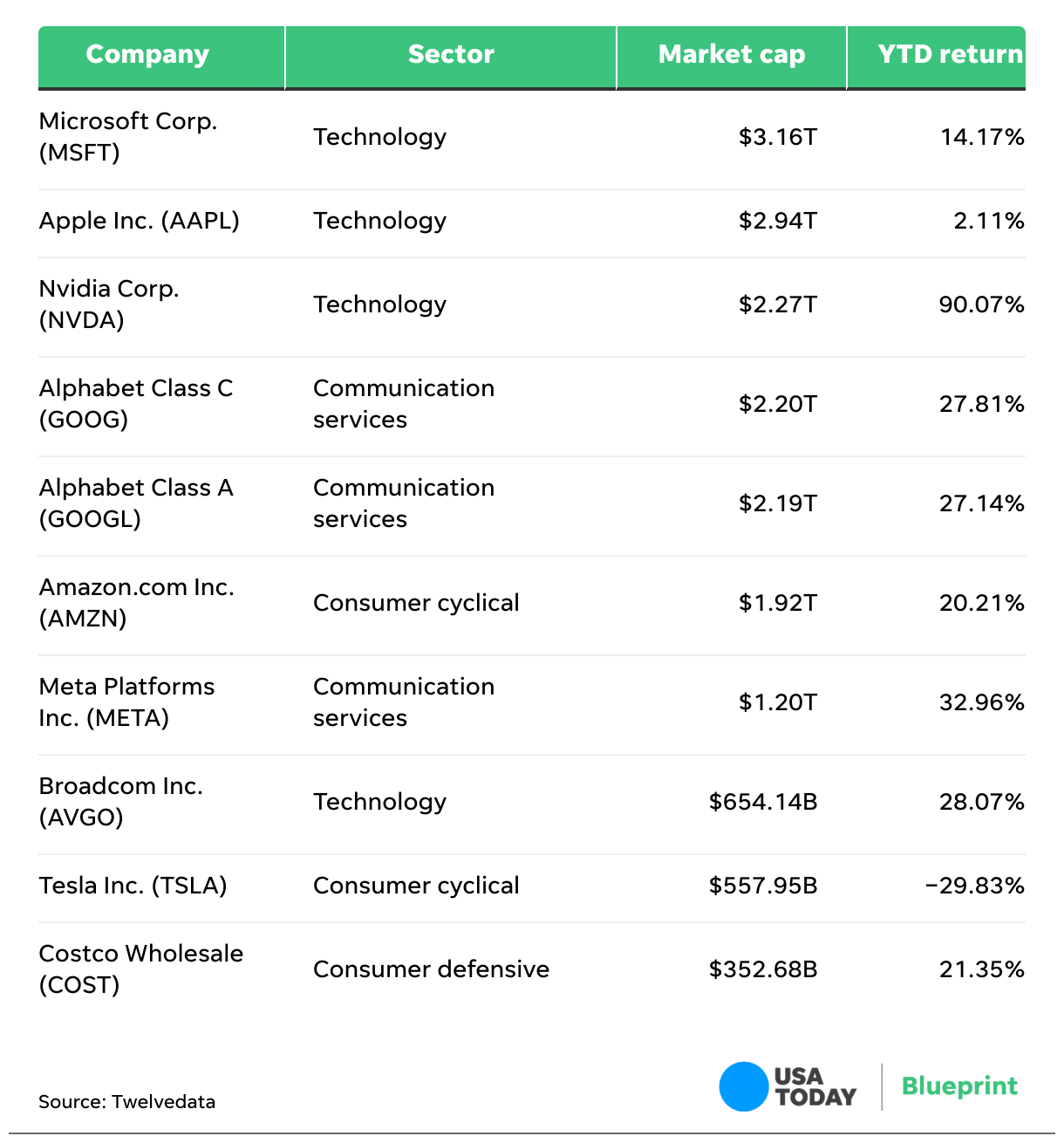

Top 10 Nasdaq stocks

The Nasdaq composite is market capitalization weighted, meaning larger, more valuable companies have a greater impact than smaller, less valuable companies.

The top 10 companies represent a total combined index weighting of more than 50%.

As of Dec. 29, 2023, the Nasdaq’s top 10 components by weight were Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Nvidia (NVDA), Alphabet Class A (GOOGL), Alphabet Class B (GOOG), Tesla (TSLA), Meta Platforms (META), Broadcom (AVGO) and Costco (COST).

What is the Nasdaq composite?

The Nasdaq composite is an index that tracks the share prices of all the stocks listed on the Nasdaq Stock Market. It is maintained by Nasdaq and has more than 3,400 total components.

To be included in the index, a stock must be a common stock of a company listed exclusively on the Nasdaq Stock Market. Real estate investment trusts, American depository receipts and limited partnership shares are eligible for inclusion, while preferred stock, exchange-traded funds and some other types of securities are not.

Because the Nasdaq composite includes all common stocks listed on the Nasdaq Stock Market, there are no specific eligibility requirements for the index related to market cap, trading volume or other characteristics. However, the Nasdaq Stock Market has eligibility requirements for listing on the exchange.

To gain eligibility for an initial listing on the Nasdaq Stock Market, a company must meet at least one of four sets of eligibility requirements, which include a bid price of at least $4 and at least 1.1 million unrestricted publicly held shares.

Once listed, companies must continue to meet Nasdaq’s continued listing standards, which include at least 400 total shareholders.

The Nasdaq composite is reconstituted daily, with new constituents added or removed based on security information from the previous trading day.

Investing in the Nasdaq

Because the Nasdaq composite is an index, not an asset, you can’t buy it directly. However, there are several options for tracking the performance of the Nasdaq without buying shares of more than 3,400 companies. You can buy index mutual funds and ETFs designed to track the Nasdaq composite.

More advanced traders can also trade Nasdaq derivative contracts, such as futures and options. Nasdaq even offers more than 150 annuities and indexed life products linked to Nasdaq indexes.

Nasdaq ETFs

Exchange-traded funds contain baskets of securities constructed to match the performance of an underlying index, such as the Nasdaq composite. You can purchase shares of the popular Fidelity Nasdaq Composite Index ETF (ONEQ) directly in your brokerage account, just like a stock.

Several ETFs track a related index called the Nasdaq 100. The Invesco QQQ Trust Series I ETF (QQQ) tracks the Nasdaq 100 index, with an expense ratio, or annual management fee, of just 0.2%.

More aggressive traders can buy leveraged Nasdaq ETFs, such as the ProShares UltraPro QQQ (TQQQ), which provides triple leveraged exposure to the Nasdaq 100. However, investors should understand that leveraged ETFs come with unique risks and often underperform their targets over the long term.

Nasdaq futures

Nasdaq futures are derivative contracts tied to the Nasdaq composite index. Nasdaq futures give traders a way to speculate on the future price movements of the Nasdaq or affordably hedge against long or short positions in Nasdaq index funds.

Each CME E-mini Nasdaq Composite Futures (QCN) contract costs $20 times the value of the Nasdaq composite. The CME E-mini Nasdaq 100 Futures (NQ) costs $20 times the value of the Nasdaq 100.

These futures contracts trade on CME Globex from Sunday at 6 p.m. ET to Friday at 5 p.m. ET, with a daily maintenance period from 5 p.m. ET to 6 p.m. ET.

Frequently asked questions (FAQs)

Nasdaq was originally an acronym for the National Association of Securities Dealers Automated Quotations. Today, Nasdaq Inc. is the name of the financial services company that owns and operates the Nasdaq Stock Exchange and several other global exchanges.

The Nasdaq composite’s all-time intraday high was 16,839.02 on May 21, 2024.