Last week, I highlighted the global macroeconomic impacts that will make significant growth in Scotland very unlikely. This week, I address the lack of economic levers available to the Scottish Government as it seeks economic growth. I highlight a very uncomfortable fact: Scotland can only grow when the UK economy grows.

For the last few years, I have argued that the Scottish Government lacks the economic levels to complete a just transition or any other significant economic transformation. In this article, I will extend that scope to include any significant increase in GDP.

Let’s assume that contrary to everything I evidenced last week and maintain that given the current global environment, Scotland could grow its economy by 2% each year. What could stymie our progress towards that number? I asked Danny Blanchflower, Professor of Economics at Dartmouth College and former Bank of England’s MPC member, if Scotland could achieve this target. You can watch the short interview here.

He said: “It depends what you’re fighting against. It depends on what the central bank is doing, what the treasury is doing, what regional policy is. So imagine you’re pushing for 2% growth, whereas the central government is doing something else. You’re pushing for it, but the Bank of England doesn’t care about unemployment in Scotland, so it keeps interest rates unmercifully too high. And your ideas of trying to generate 2% growth are extremely limited. My view would be that’s a problem.”

Professor Blanchflower highlights where the economic power lies in the UK.

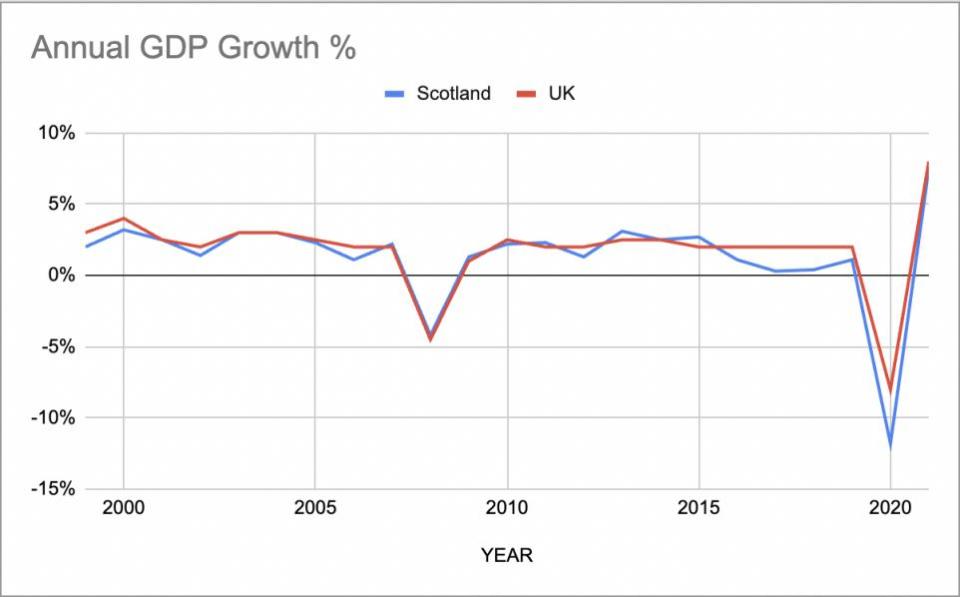

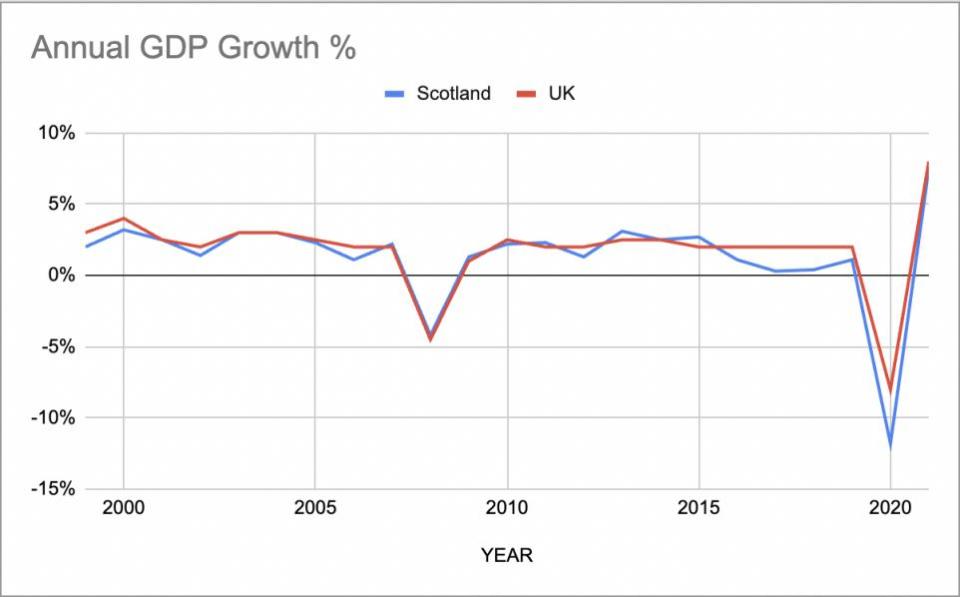

The simple fact is that when the UK economy as a whole grows, so does the Scottish economy. When the UK economy contracts, Scotland’s economy does, too. The correlation between the growth rates is approximately 0.969, which indicates a very high positive correlation. The eye doesn’t deceive the reader.

So, the only way for the Scottish economy to grow consistently by around 2% is if the UK economy as a whole grows by 2%. The idea that Scotland has its own economic destiny for growing its economy is fanciful.

As Wes Streeting let slip on Sunday, “all roads lead back to Westminster”. This comment was jumped on by several SNP MSPs and MPs: As if the cat had just jumped out of the bag! These same parliamentarians support the new Scottish administration’s focus on GDP growth. Surely, at some point, the penny will drop. It’s all getting rather embarrassing.

As Scotland wants to grow by 2% (at the very least), the Scottish Government will have to fight tooth and nail against the UK Government institutions.

Despite Labour‘s rhetoric, their plans will likely limit GDP growth across the UK to below 1% over the next term—if there is any growth at all. As evidenced above, there is very little the Scottish Government can do to boost Scotland’s GDP growth if the central government is not heading in the same direction.

So, in determining how the Scottish Government will increase GDP, we look not to Holyrood but to Westminster. And there is the crux of that problem.

READ MORE: Census: More Scots than ever identifying as ‘Scottish, not British’

The Bank of England will keep interest rates “unmercifully high” for the next few years, foolishly thinking that they can reduce inflation caused by supply bottlenecks and profiteering with high interest rates. It is worth highlighting that the current SNP plan for independence, depressingly, is for the Bank of England to run Scotland’s monetary policy for likely a decade after a successful independence vote. The madness has a long road to run yet.

But back to the next few years. Under a Labour government, the Treasury will adhere to the ridiculous fiscal rules that ensure government spending is in line with the last decade of decline.

Westminster itself will carry on as normal, ignoring the devolved nations and regions north of Watford. Martin Wolf, the FT’s chief Economic Correspondent, said earlier this year: “The country, in sum, needs not a smaller state, but a more active and more focused one.” He called for a breakup of the UK Treasury and stronger regional policies. If Starmer is deaf to the FT, what chance do Swinney and Forbes have?

Interestingly, Starmer’s six commitments launched last week included “economic stability,” not economic growth, as has previously been the plan. Has Labour learned that setting impossible targets leads to electoral failure?

In sum, the Scottish Government will not grow Scotland’s economy when the central government wields its economic wrecking ball of tightening immigration, high interest rates, and growth-constricting fiscal rules. Everything Holyrood does will be like flicking a pea at a charging rhino.

Next week, I will take another leap of faith and imagine that the Scottish and UK governments work in tandem to target 2% growth in Scotland. I will detail why that target is still way out of reach.