The House truly always wins.

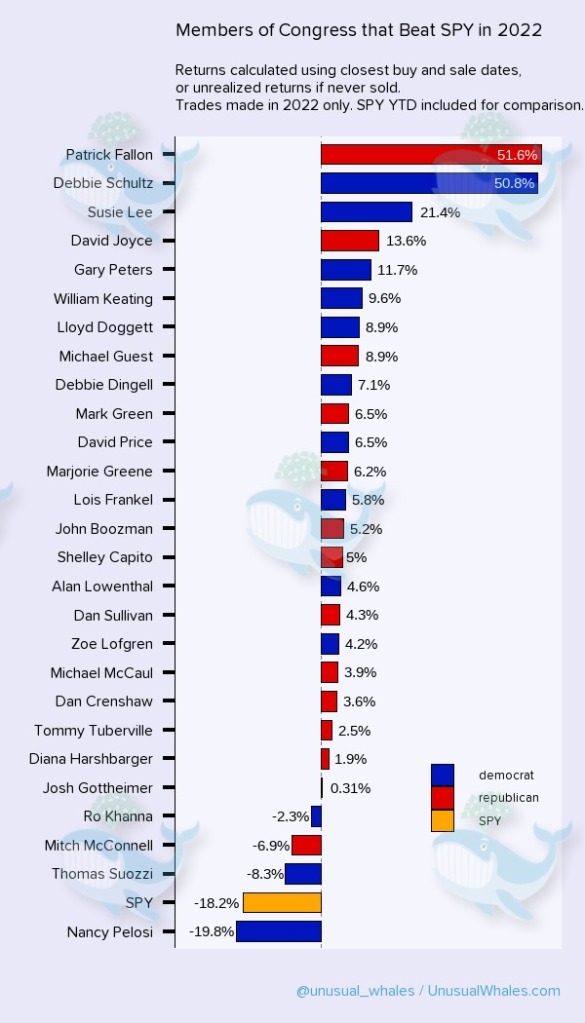

More than two dozen members of Congress beat the stock market despite Wall Street suffering its worst year since 2008, according to an analysis by a popular stock-trading news site.

But there was one notable loser last year: Nancy Pelosi. The outgoing House Speaker’s portfolio dropped 19.8% in 2022 — worse than the 18.2% decline in the ETF that tracks the S&P 500, according to the 100-page report by Unusual Whales.

Topping the list of winners was Rep. Patrick Fallon (R-Texas), who made 51.6% on his investments in 2022, according to the data. Right behind him was Rep. Debbie Wasserman-Schultz (D-Fla.) with a 50.8% spike, the report showed.

Fallon’s most lucrative bet was on Twitter. He snatched up as much as $150,000 worth of stock in January 2022 and flipped it after Elon Musk announced plans to acquire the social media company — making as much as $75,000, according to the Unusual Whales analysis.

The congressman strongly pushed back against the overall analysis by Unusual Whales.

“My active stock portfolio in 2022 lost nearly $600,000 in value (a loss of 20%). Anyone that says otherwise is dead wrong,” Fallon told The Post in a statement on Friday. “Like many Americans, I have been kicked in the teeth by the market over the past two years.”

Wasserman-Schultz, a member of the House Natural Resources Committee, made her biggest gains on shares of an energy company. She purchased as much as $45,000 worth of Patterson-UTI Energy, which provides drilling and pressure pumping services for energy sources — services that jumped in value as oil prices surged.

Reps for Wasserman-Schultz did not respond to request for comment.

The Usual Whales report relied on financial disclosure forms filed by 131 — or 24% — of the 535 members of Congress who reported trading activity in 2022. The members of the House and Senate traded up to $788 million in volume this year, a dip from the roughly $918 in 2021, the data show.

Overall, Democrats lost 1.76% on average on their investments, while Republicans gained 0.4%, according to the data.

The report also showed that Rep. Michael McCaul (R-Texas) made more than 1,600 transactions worth as much as $176 million, while Rep. Diana Harshbarger (R-Tenn.) made over 1,000 transactions worth as much as $21 million.

Among the top stocks purchased were Apple ($6.3 million), Disney ($6.25 million), Google ($6.2 million), Musk’s electric car company Tesla ($6.08 million) and tech giant Nvidia ($5.68 million while top stocks hawked included Visa ($11.2 milion), Nvidia ($6.35 million), Exxon Mobile ($5.32 million), pharmaceutical titan Eli Lilly ($5.21 million) and Microsoft ($3.4 million.

The required financial disclosure reports are notoriously opaque. The filings allow members of Congress to obscure their net worth by listing value ranges rather than precise figures.

The windfall for many in Congress comes as multiple bills cracking down on trading continue to languish despite many in the House and Senate promising to push them through.

The only rule currently governing trades is the STOCK Act, which was passed in 2012 and was supposed to rein in lawmakers’ trades. Under the legislation most members of Congress are still free to make the trades that could conflict with their legislative duties — as long as they disclose the information within 45 days.

“Speaker Pelosi promised to make changes a year ago… and it’s been nothing but lip service,” one senior GOP aide told The Post. “Meanwhile you have multiple members of Congress continuing to get inside information and a lot of them are profiting massively — either buying or getting out of stocks and it’s still hurting the average Joe.”

Pelosi, whose district covers Silicon Valley, had reported impressive returns in both 2021 and 2020 with her stock trading savant husband, Paul Pelosi, as tech stocks surged. But the sector cratered in 2022 as the Fed hiked interest rates.

“While she didn’t pass legislation unfavorable to tech companies, she clearly didn’t have any influence over the rate hikes that destroyed tech,” Thomas Hayes, Founder of Great Hill Capital told The Post. “The headwinds of The Fed made Paul Pelosi a mere mortal like the rest of us.”

The data scientist behind the Unusual Whales account was quick to note “this is one bad year and Pelosi’s general strategy has worked plenty, especially in 2020-2021.”

Republican Kevin McCarthy — whose bid to become the new Speaker has been derailed by members of his own party — has promised to introduce legislation banning stock trades.

Last year, The Post reported Pelosi and her husband raked in as much as $30 million from bets on the Big Tech firms she was responsible for regulating during her time in Congress.

Capital gains and dividends from their holdings in just five Big Tech firms — Facebook, Google, Amazon, Apple and Microsoft — reaped the Pelosis at least $5.6 million and up to $30.4 million between 2007 and 2020, according to an analysis of publicly available disclosures shared with The Post.

And the Pelosis’ overall portfolio — which also included companies like Disney and Roblox — beat the S&P 500 by 4.9% in 2019 and a 14.3% in 2020, according to data crunched for The Post by FinePrint, an outfit pushing for greater transparency of financial holdings on both sides of the aisle.

“It just shows that the factors that impact a stocks performance are often broader than American public policy especially legislation,” Jeff Hauser, Founder of the Revolving Door Project told The Post. “Tech had a good year in 2022 from the standpoint of Congress but the Federal Reserve was catastrophic for tech… trading solely off what was happening in Congress wouldn’t help you predict the stock price.”