After the customer had typed this into the chat, Revolut lifted the restrictions on their account.

“I am glad to inform you that your account is fully operational and can be used normally,” the Revolut agent said.

Another Revolut customer, posting in a forum on financial website Money Saving Expert in April, reported a similar security check.

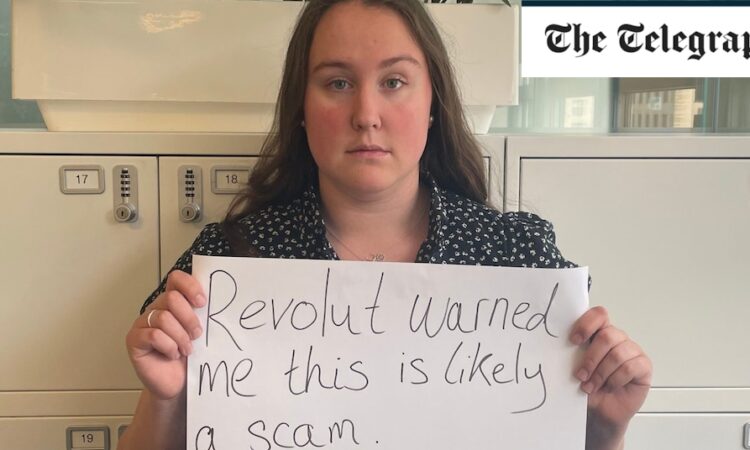

After blocking their account due to security concerns, Revolut asked the customer to take a selfie holding a piece of paper reading: “Revolut warned me this is likely a scam; I confirm that I am not being guided and understand the limited fund recovery possibility if I proceed.”

Scammers can be extremely convincing and Revolut said interventions like this were needed to make victims stop and think about the risk they may be taking.

Mark Taber, consumer finance campaigner, said Revolut’s selfie intervention was unusual.

“It’s an unusual twist on the fraud warnings all banks put out. Taking a selfie and holding up a piece of paper might help a bit, but it shouldn’t be the bank’s way of saying ‘we’ve done all we can’. Fraudsters do tell victims they are genuine and tell them to ignore the warnings and the security checks.”

Stuart McFadden, of claims management firm Refundeee, criticised Revolut’s decision to intervene with scam victims over in-app chat.

“Chat is ineffective in our experience,” he said. “With a phone call, it usually doesn’t take long for the bank to notice it’s a scam.”

Jason Costain, of CEL Solicitors, another claims management firm, said he had seen the selfies referenced in fraud disputes. “It’s pretty horrible for the victim. They look like hostage photos,” he said.

A spokesman for Revolut said: “We ask our customers to contact us through our secure in-app chat, so they can be 100pc certain they are speaking to Revolut customer support, and not a fraudster. If we were to call a customer, we would always first confirm it through our secure in-app chat function.”

Last month the Telegraph revealed that Revolut was locked in a payout row with the Financial Ombudsman Service (FOS) following a surge in fraud complaints.