Shareholders in investment trust Odyssean have had an enjoyable – yet bumpy – journey since the fund was launched six years ago.

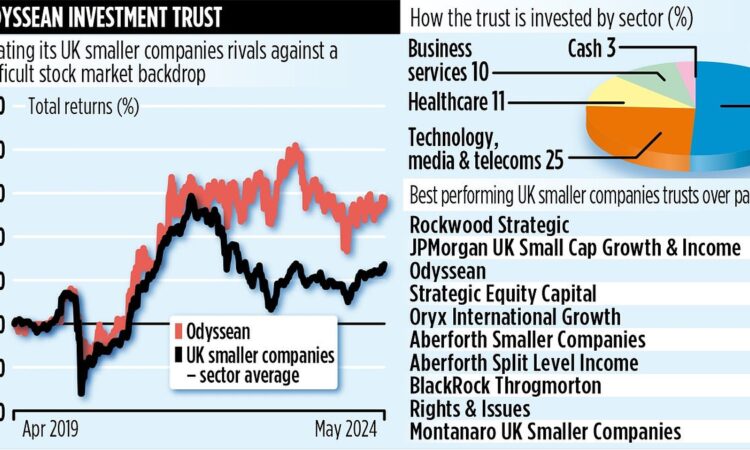

Investors in from the start have seen gains of 59 per cent. To put this into perspective, the average UK smaller companies trust has generated a return of 23 per cent over the same period, while the FTSE All-Share Index has delivered 36 per cent.

However, if the trust’s managers are right in their reading of the runes, bigger profits could be earned in the coming years.

‘We are confident of making annual returns of 15 per cent from each of the holdings we now have in the trust over the next three to five years,’ says Stuart Widdowson, who with Ed Wielechowski runs the £195 million stock market- listed fund.

His boldness is based on the prospect of a better economic backdrop, lower inflation and future interest rate cuts. It is also founded on an expected rerating of the sector that Odyssean targets – UK smaller companies.

These factors, he says, could provide the trigger for a period of sustained performance from these smaller companies. Furthermore, Widdowson is confident that the trust’s portfolio is well positioned to benefit.

The managers are stock pickers who back their judgment. If they like a stock, they build a big position. As a result, the trust has only 16 holdings. Its biggest position is in chemicals company Elementis, which some believe is not realising its full potential.

This reflects the managers’ approach: buying companies when they are out of favour, then waiting for them to come good.

‘We search for unloved gems,’ says Widdowson, ‘and hope they turn into polished diamonds.’

Related Articles

HOW THIS IS MONEY CAN HELP

This transition may result from an improvement in profit margins, corporate restructuring, or new revenue-generating products. It may also come from being bought by a rival (public or private).

It’s an investment approach that requires meticulous research plus great discipline — because it can take time for investments to prove their worth.

‘If you look at our recent numbers, the trust had a great 2021 with the share price advancing nearly 29 per cent,’ says Widdowson. ‘Calendar year 2022 was good too, with a 5 per cent share price gain, but last year was tough with the shares falling by more than 9 per cent. But that is how it goes. Our investment style can be out of favour, and then suddenly it’s back in vogue and our shareholders reap the benefits.’

Widdowson says last year enabled him and Wielechowski to build positions in companies at favourable prices – such as marine services provider James Fisher; Gooch & Housego, an optics and photonics designer and manufacturer; and Xaar, which produces inkjet technology for industrial printers.

He is confident they will prove stellar investments. Over the past month, all posted positive share-price gains.

Apart from the investment experience of the managers, the trust benefits from a panel of industry experts who provide advice on potential portfolio additions.

Two further aspects of the trust should appeal to investors. First, its shares seldom trade at a discount to the underlying assets, which means shareholders’ holdings are not diminished in value. And the managers have skin in the game – shareholdings – so they have a financial interest in ensuring the trust performs well.

The stock market identification code is BFFK7H5 and the ticker OIT. The annual charges total 1.45 per cent.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.