As mortgage costs rise, UK house prices have experienced their sharpest decline in eight months, intensifying financial strain ahead of impending elections. Amidst diminished affordability and stalled recovery from last year’s recession, prospective buyers delay plans while current homeowners face challenges in refinancing. Despite recent upticks in property transactions, mounting borrowing expenses cast doubt on sustained market improvement. As interest rate shifts reshape housing dynamics, the landscape of buying and selling adapts to a new reality.

Sign up for your early morning brew of the BizNews Insider to keep you up to speed with the content that matters. The newsletter will land in your inbox at 5:30am weekdays. Register here.

By Irina Anghel

UK house prices fell at the sharpest pace in eight months after the cost of mortgages crept higher, one of the country’s biggest lenders said, underscoring continued cost-of-living pressures on consumers ahead of a general election later this year.

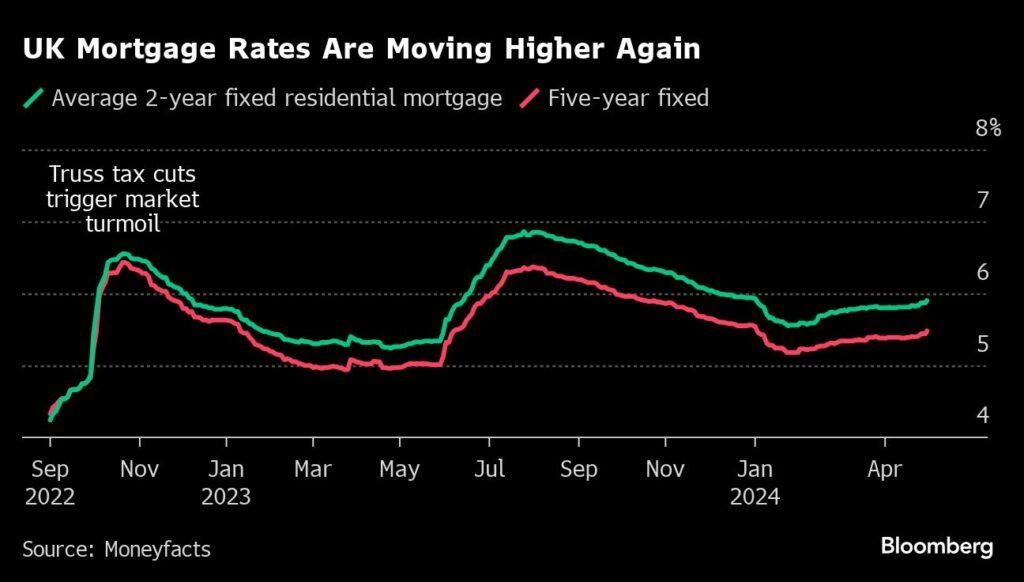

The figures from Nationwide Building Society followed a scaling back of bets on Bank of England interest rate cuts this year, which pushed up the cost of home loans in markets. That’s strained the ability of people to afford to buy a property and held back a recovery from last year’s slump.

Higher borrowing costs have hurt Prime Minister Rishi Sunak’s government in the eyes of voters and reminded voters of the big jump in mortgage rates that Liz Truss triggered during her short term as premier in late 2022. The UK slipped into a recession last year, and the weak recovery so is reflected in the housing market.

“Though mortgage affordability is much better than it was last summer, it remains very stretched relative to historical norms,” said Peter Arnold, chief economist at EY UK. “A strong recovery in house prices and activity is unlikely.”

The Conservatives are defending seats in local authorities including mayors in West Midlands and Tees Valley in key local elections on Thursday. Sunak is widely expected to call a general election in the autumn.

Nationwide estimated house prices fell 0.4% in April after an 0.2% decline the month before. Economists had expected a 0.1% monthly increase. The average cost of a home is now £261,962 ($326,680), which is about 4% below the peak in the summer of 2022.

What Bloomberg Economics Says …

“The shift in the interest rate outlook was the catalyst for the change in sentiment at the start of the year, encouraging buyers to enter the market. However, borrowing costs have risen recently as investors reappraise how far the Bank of England will cut interest rates over concerns about persistent price pressures in both the UK and US. The best-buy five-year fix are above 4.1% having dropped below 4% at the start of the year. That will hit affordability.”

—Niraj Shah, Bloomberg Ecoomics. Click for the REACT.

Home prices have stagnated over the past year, up just 0.6%. That’s much less than the 1.2% gain economists had expected.

“The slowdown likely reflects ongoing affordability pressures, with longer term interest rates rising in recent months, reversing the steep fall seen around the turn of the year,” Robert Gardner, chief economist at Nationwide, said in a report Wednesday.

Nationwide said research it did with Censuswide found that almost half of the prospective first-time buyers looking to secure a home in the next five years have delayed their plans.

“Among this group, the most commonly cited reason for delaying their purchase is that house prices are too high (53%), but it is also notable that 41% said that higher mortgage costs were preventing them from buying,” Nationwide said.

Another 55% of people said they’d be willing to buy in a cheaper area of the country or where they could get a bigger property — half willing to move more than 30 miles away.

The UK housing market has defied expectations of a sharp downturn last year, yet its recovery over the last few months has remained weak. Prospective buyers are still finding it hard to come up with the money for a deposit, while the benchmark lending rate is at a 16-year high.

BOE officials warning of lingering price pressures have pushed up two- and five-year swap rates, used to set the bulk of mortgage products. That suggests households would still be spending a higher share of their incomes on mortgage payments than they did in the decade to 2007, according to Bloomberg Economics.

Nationwide’s figures contrast with more upbeat data from the BOE showing mortgage approvals rose to the highest in 18 months in March. Banks and building societies authorized 61,325 home loans, up from 60,497 in February and the most since September 2022.

Separate data released Tuesday from HM Revenue & Customs, the UK tax authority, showed property transactions climbing for a third month to 84,200 in March.

However, a recent resurgence in borrowing costs has raised questions over whether the recovery can continue. Natwest, Santander and Nationwide all have increased mortgage rates this month in response to rising swap rates, which are used to set the bulk of mortgage products.

For the 1 million households due to refinance fixed-rate mortgages by end of the year, new loans will be pricier than the ones they are currently on.

“Buyers and sellers are starting to accept the new reality of the housing market in the face of current interest rate levels,” said Nathan Emerson, CEO of Propertymark.

Read also:

© 2024 Bloomberg L.P.

Visited 541 times, 541 visit(s) today