(Bloomberg) — Federal Reserve Chair Jerome Powell is making life tougher for his peers around the world as the prospect of higher-for-longer US interest rates reduces room for easier policy elsewhere.

Most Read from Bloomberg

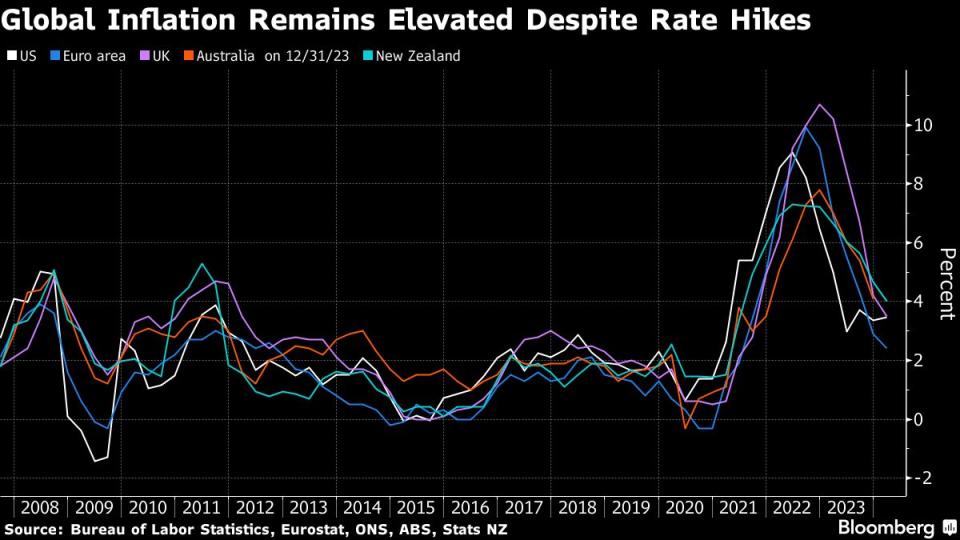

Powell on Tuesday signaled the Fed will wait longer than previously anticipated to cut borrowing costs following a series of surprisingly high inflation readings — marking a notable shift from his December pivot toward easing. Treasury yields reached fresh year-to-date highs and the dollar strengthened.

For the central bank chiefs gathering from around the world in Washington for the spring meetings of the International Monetary Fund and World Bank, Powell’s latest pivot creates a quandary. If the likes of the European Central Bank, Bank of England and Reserve Bank of Australia launch themselves into their own easing cycles, that risks driving their currencies down — raising import prices and undermining progress in getting inflation down. But not easing could risk growth.

“The risk is, the longer we see these big central banks waiting to cut rates, the bigger the risk to the underlying economy,” Lucy Baldwin, global head of research at Citigroup Inc., said on Bloomberg Television.

For some policymakers, the currency fallout is already apparent. The yen’s slide to 33-year lows may force Bank of Japan Governor Kazuo Ueda to follow up his historic departure from sub-zero settings with another hike sooner rather than later, economists warn. In China, the door might have shut for lowering rates with pressure rising anew on the yuan.

As for the developing world, life gets tougher with every tick higher in the greenback. Bank Indonesia already had to raise rates in October after an extended bout of currency weakness. With the rupiah weakening beyond 16,000 for the first time in four years, it may have to do so again. For countries from Malaysia to Vietnam, economists now expect fewer rate cuts.

Here’s a look at the challenges confronting Powell’s peers:

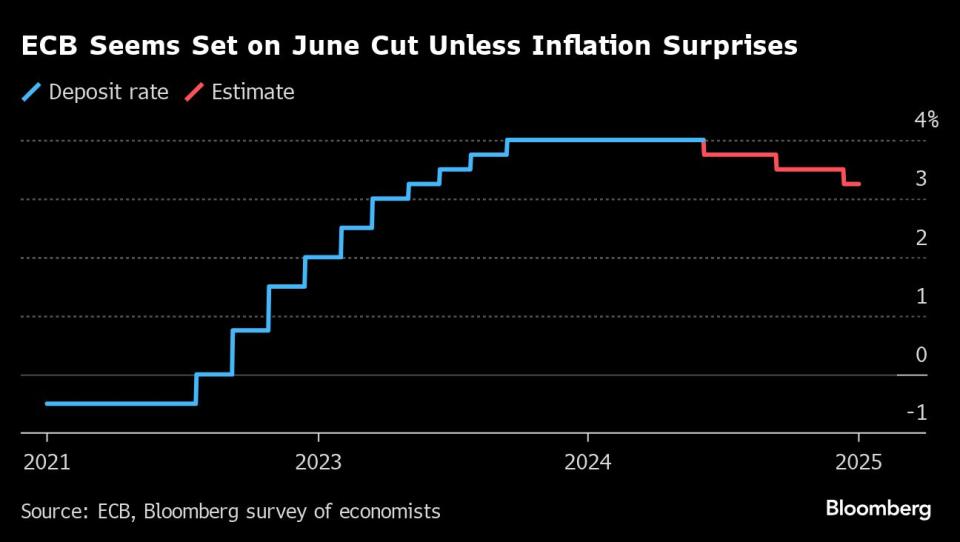

Lagarde’s Resolve

ECB President Christine Lagarde still appears on course to cut rates in June as inflation recedes, which would make the euro zone the first of the world’s major jurisdictions to lower borrowing costs this cycle. That’s not without risks.

A weaker euro could see imported inflation pick up — a key worry at a time of rising oil prices. While Lagarde has insisted the ECB isn’t “Fed dependent,” officials will tread carefully in the shadow of the world’s preeminent policy setter.

“We should, barring major shocks or surprises, decide on a first rate cut at our next meeting on June 6,” Bank of France Governor Francois Villeroy de Galhau said Tuesday in New York. “I would then argue in favor of a policy of pragmatic and agile gradualism: There’ll have to be further cuts this year and next; their pace will be guided by the data, in a genuine meeting-by-meeting approach.”

Yen Risks

With the yen sliding to its weakest since 1990 this month, pressure may build for a rate hike. Recent inflation and wage data already are building a case for a move by July.

“Ueda’s otherwise dovish support for easier financial conditions and policy continuity should not obscure his earlier remarks that inflationary pressure from a weaker currency could warrant a policy response,” said Bruce Kasman, chief economist at JPMorgan Chase & Co.

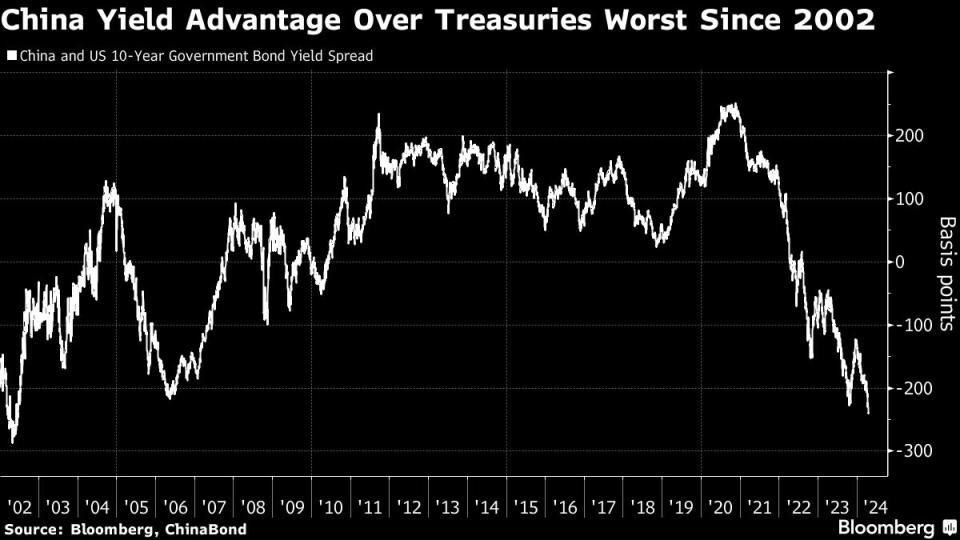

Yuan Pressure

China doesn’t have such inflation worries, but the rise in the premium of US 10-year government bond yields over their Chinese equivalents to a record high has sparked concerns over continuous depreciation in the yuan. The People’s Bank of China has fought a constant battle to prevent such a psychology taking roo and spurring capital outflows.

The delay in Fed cuts “makes life much tougher for Pan Gongsheng,” the PBOC chief, said Larry Hu, chief China economist at Macquarie Group Ltd. “The chance of a benchmark interest-rate cut in China is very low if US inflation and interest rates stay elevated,” leaving the nation’s leaders more reliant on fiscal policy to support the recovery.

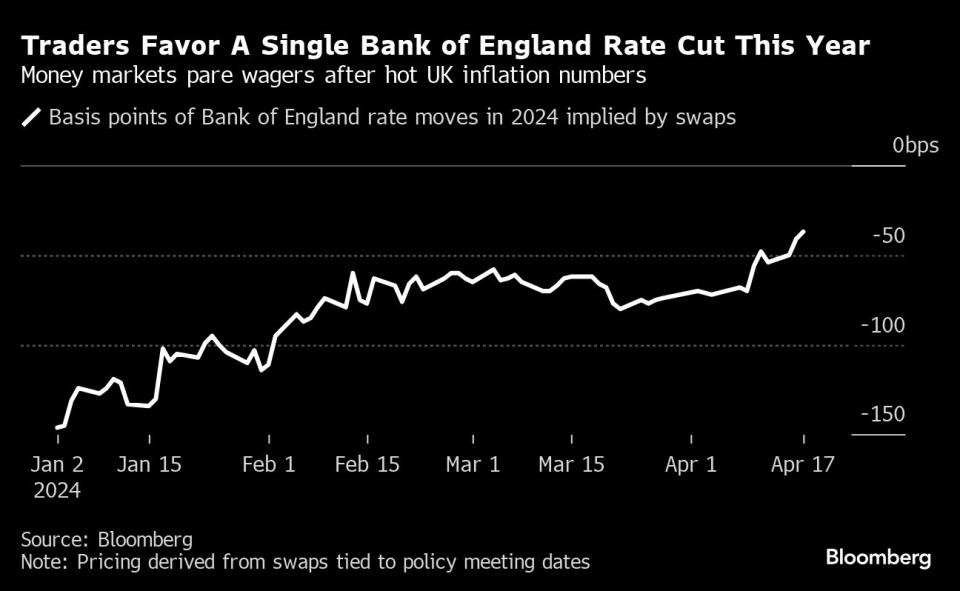

BOE’s Bind

Britain had the worst bout of inflation in the Group of Seven last year, but since then price pressures have receded. That’s opened the door to rate cuts that just three months ago looked a long way off.

But developments in the US have prompted wild swings in bets on when the BOE can move. As recently as a month ago, investors fully priced in three quarter-point reductions by December and the prospect of a fourth, taking the key rate down from a 16-year high of 5.25%. Now, just one is priced in for November.

“If the UK moves too far ahead in cutting rates, then the US bond market looks extremely attractive, money flows to the US market, sterling comes down, and then you have that issue of ‘actually, you’re importing inflation again,’” Hargreaves Lansdown Head of Investment Analysis & Research Emma Wall told Bloomberg TV.

Less easing could hold back a recovery from the recession that the UK suffered last year — and hurt Prime Minister Rishi Sunak’s chances of winning reelection in a vote widely expected at the tail end of the year.

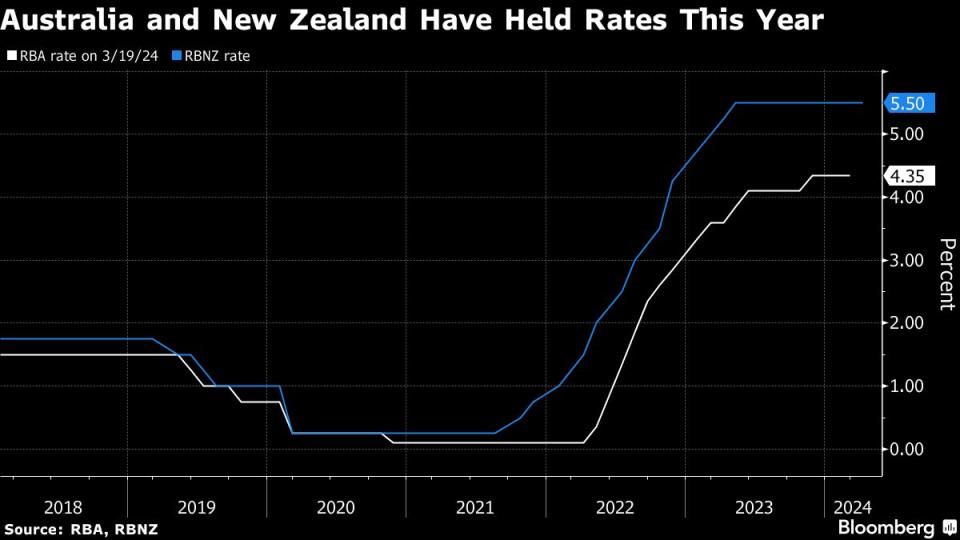

Reserve Bank of New Zealand Governor Adrian Orr was widely expected to begin cutting rates by mid-year following an aggressive rate-hiking campaign that drove the nation’s economy to a recession.

Inflation data on Wednesday showed still-elevated price pressures which — together with a more hawkish Fed — prompted some economists to push out rate-cut forecasts.

For neighboring Australia, economists expect just one cut toward the end of the year.

Emerging Markets

Meantime, Oversea-Chinese Banking Corp. now predicts fewer cuts than previously anticipated for central banks in Indonesia, Malaysia, Philippines, Thailand and Vietnam.

“The balancing act for the Asean-5 central banks has become more delicate,” said OCBC’s senior Association of Southeast Asian Nations economist Lavanya Venkateswaran. “Interest rate differentials to the US and the potential portfolio flow implications are being monitored closely by regional central banks.”

—With assistance from Garfield Reynolds, Kriti Gupta, Guy Johnson, Jana Randow, Francine Lacqua and Zoe Schneeweiss.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.