US Treasury Secretaries change their minds on trade and inflation policies – Chemicals and the Economy

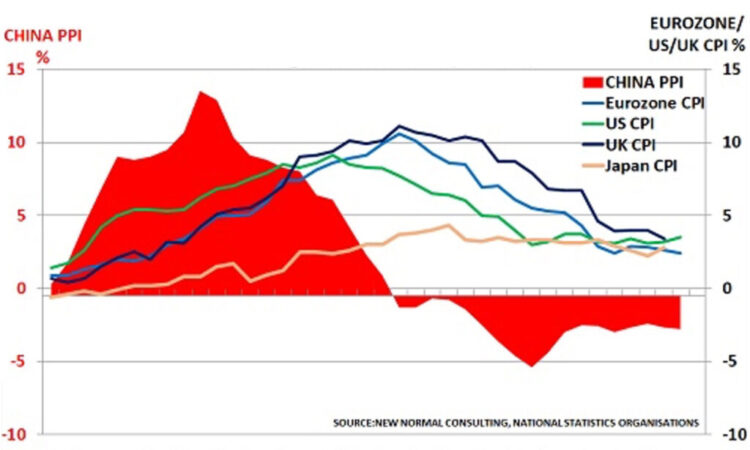

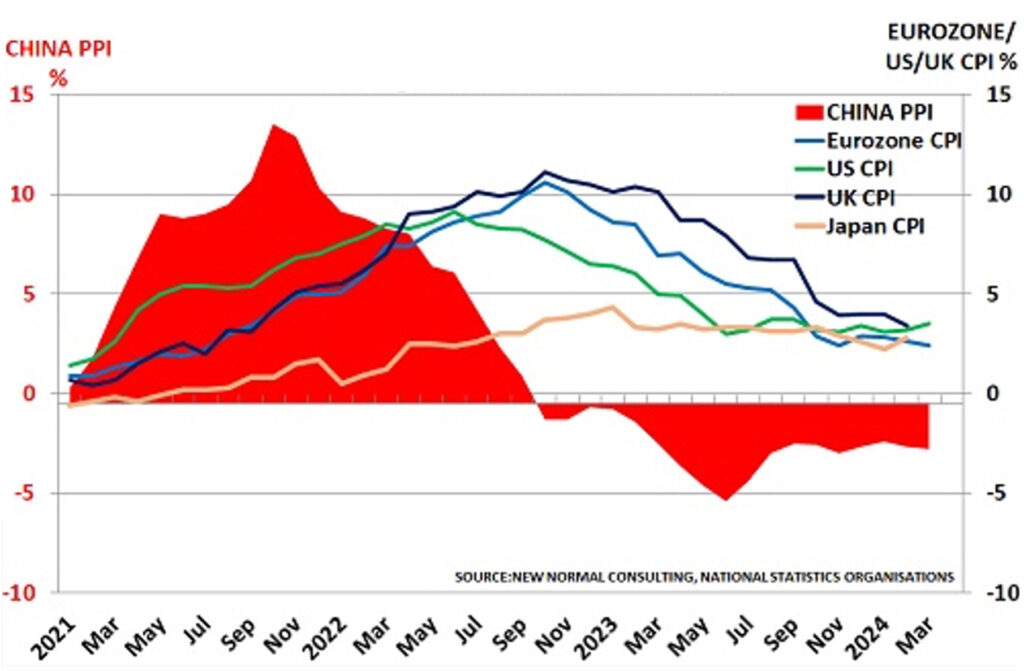

CHINA PPI v EUROZONE, USA, UK CPI % change, 2021 – 2024 (to date)

It’s not every day that a US Treasury Secretary admits they have been wrong on a major issue.

But that’s what happened this month when the current Treasury Secretary, Janet Yellen, told the Wall Street Journal ahead of her China visit that:

“People like me grew up with the view: If people send you cheap goods, you should send a thank-you note. That’s what standard economics basically says,” she said. “I would never ever again say, ‘Send a thank-you note.’”

It isn’t long ago, either, that her predecessor as Treasury Secretary, Larry Summers, suggested the whole economics profession had also been wrong on inflation. They had adopted Milton Friedmans’ theory that “inflation is always and everywhere a monetary phenomenon“. But as he noted:

“The utter failure of the Bank of Japan’s extensive efforts to raise inflation suggest that what was previously treated as axiomatic is in fact false: Central banks cannot always set inflation rates through monetary policy.”

POLICYMAKERS ARE GIVING UP ON THE POLICIES OF THE PAST 20 YEARS

We have long argued that it makes little sense to believe that 12 men and women in Washington DC can somehow control a global economy of 8bn people. The problem today is that their policies have created major problems in the economy:

- Central banks believed they could control inflation and economic growth

- So their policies encouraged a constant flow of cheap consumer goods into the West

- But whilst this has led to lower inflation short-term, it has also led to lower domestic wages in the long-term

And only now has Janet Yellen realised that the long-term problem is more important that the short-term gain.

- The focus on cheap goods has hollowed out whole industries in the West

- Critical supply chains for the future have been “offshored” and now need to be urgently “reshored”

These admissions suggest that pioneering former Bank of Japan Governor, Masaaki Shirakawa was right to argue in his book, Tumultuous Times: Central Banking in an Era of Crisis in 2021 that central banks had got the wrong policy remit:

“In my view, the fundamental role of monetary policy – to be more precise of central bank policy – should lie in fostering a stable financial environment…A central bank cannot enhance medium- to long-term growth.”

GOVERNMENTS NOW NEED TO URGENTLY ADOPT SHIRAKAWA’S CONCEPT

The chart above showing inflation since 2021 highlights the key issues. China became the manufacturing capital of the world when it joined the World Trade Organisation in 2001.

It’s Producer Price Inflation (PPI) has therefore been a key influence on Consumer Price Inflation (CPI) in the West. And China’s economy has suffered just as much Western economies, from the focus on cheap goods:

- China’s domestic consumption is very low, as the government kept wages low to promote exports. World Bank data shows this is only around half that of the US – at 35% of GDP versus 70% in the US.

But now China’s property market is in a major downturn. And it is hard to see how the economy can overcome the debt burden, which is 3x GDP.

Policymakers in the West and the East now find themselves adrift in increasingly stormy seas, without a compass. Their two key policy tools on trade and inflation have proved to be wrong. New thinking on the role of central banks is urgently required.