Share this article

The Beijing Municipal Development and Reform Commission has updated its implementation plan to curb the excessive energy use for crypto mining.

According to the updated plan, “virtual currency ‘mining’ activities” will be restricted, with authorities enforcing stricter classifications and penalties for violators.

Chinese authorities claim that the move is part of a broader initiative to improve energy efficiency and advance the country’s efforts at achieving carbon neutrality, citing the potential environmental damage from crypto mining. While less restrictive than China’s 2021 blanket ban on crypto trading and mining, the move could drive crypto mining activity underground or overseas without necessarily shutting down the companies that operate in this sector.

Bitmain, one of the largest producers of ASIC (application-specific integrated circuits) chips designed for crypto mining, ceased spot delivery of sales for its products in China after the 2021 ban. Bitmain is still headquartered in Beijing and maintains BTC.com and Antpool, two of the largest Bitcoin mining pools, through its mining operations outside of China.

While energy-efficient algorithms like proof-of-stake have been explored and implemented in blockchains like Ethereum, concerns over crypto’s ecological impact are still rising. Proof-of-stake is regarded as a more sustainable alternative to proof-of-work consensus algorithms found in blockchains like Bitcoin, Litecoin, Ethereum Classic, and Monero.

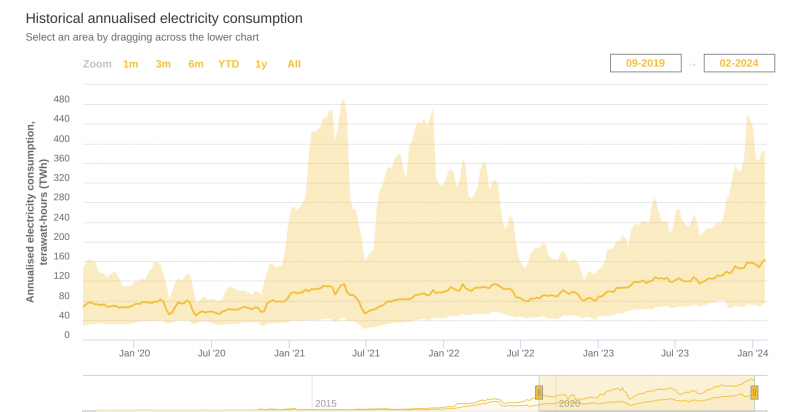

According to recent data from the Cambridge Bitcoin Electricity Consumption Index (CBECI), the annualized consumption for Bitcoin currently has 163.06 TWh (terawatt-hours), with the historical data pointing to an upward trend since 2022, returning to energy demand levels comparable to 2021.

The US has also begun assessing the energy impact of crypto mining. A new initiative from the Energy Information Administration will gather data on commercial mining energy usage. Insights from this “emergency survey” could inform future regulations based on the industry’s national energy footprint.

In Europe, an unconfirmed report indicates that the European Commission, working with the European Securities and Markets Authority (ESMA) and the European Central Bank (ECB), is formulating new definitions for crypto mining, with a potential ban on Bitcoin mining slated for 2025.

Share this article