In a resurgence of foreign interest, particularly from the US, UK companies are finding themselves at the centre of acquisition fervour. Gone are the days of bargain deals as buyers face hefty premiums. From logistics to communications, transatlantic deals are surging, challenging conventional valuation norms. With UK boards demanding premiums reflecting fundamental worth, the M&A landscape is evolving. Will this trend mark a new era of UK acquisitions or reveal deeper market dynamics?

Sign up for your early morning brew of the BizNews Insider to keep you up to speed with the content that matters. The newsletter will land in your inbox at 5:30am weekdays. Register here.

By Chris Hughes

Foreign acquirers — mainly from the US — are targeting UK companies again. This time they’re being forced to pay up. Forget the apparent cheap valuations of London stocks when a handful of shares are traded. Buying an entire UK company means burning a hole in your pocket. ___STEADY_PAYWALL___

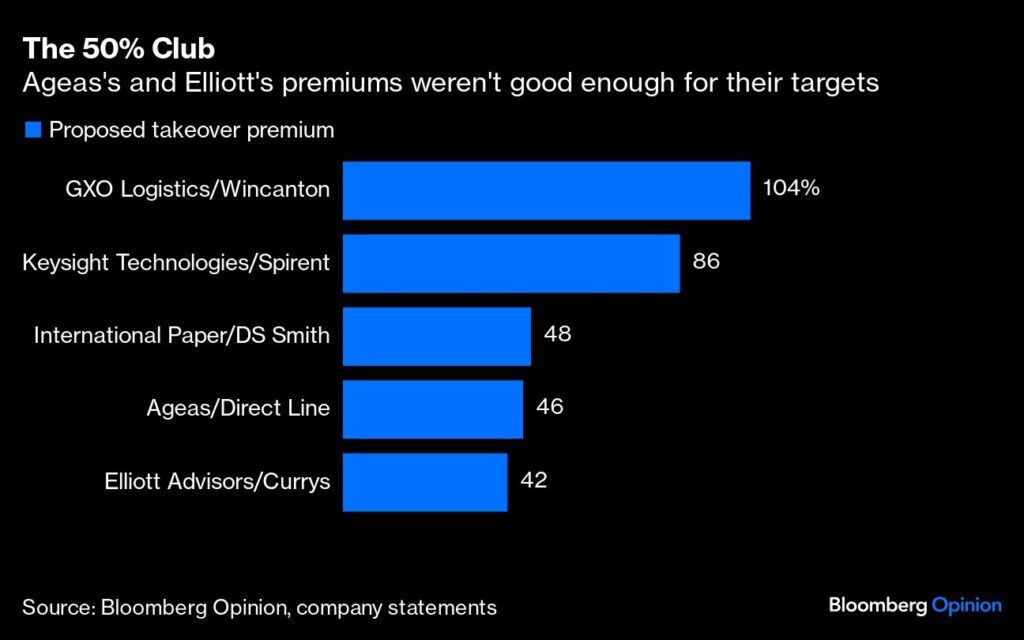

The first quarter of 2024 has seen a rash of eye-catching approaches. Connecticut-based GXO Logistics Inc. agreed to buy UK warehouse and transportation peer Wincanton Plc at more than double the stock’s pre-bid market price, trumping a rival offer agreed at a 62% premium. Keysight Technologies Inc. of California agreed to buy Spirent Communications Plc for an 86% premium, again elbowing aside another high-priced deal endorsed by the UK target.

Memphis-headquartered International Paper Co. has proposed buying DS Smith Plc at 48% above the packaging peer’s undisturbed share price, beating a competing proposal pitched at a more conventional one-third premium. Meanwhile, UK insurer Direct Line Insurance Group Plc succeeded in scaring off suitor Ageas SA despite the Belgian suitor’s opening shot being priced at a 43% premium and a small sweetener being added.

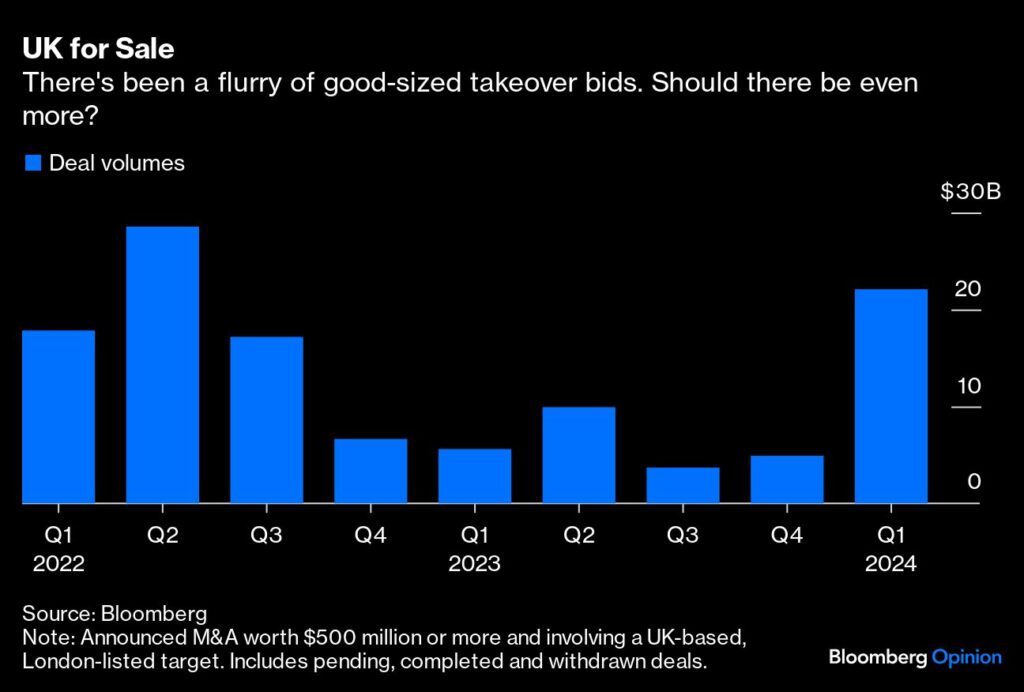

There’s a clear sense that things have picked up since Mars Inc. agreed to pay a 170% top-up to nab high-class confectioner Hotel Chocolat late last year. In the first quarter of 2024, announced UK bid approaches exceeding $500 million nearly matched the total for all 2023. Corporate buyers are leading the charge, whereas last year there was a notable spike in private equity-led activity. This isn’t just about buyout firms putting restless funds to work.

It’s tempting to ask why there’s so much foreign interest. Perhaps the real question should be: Why aren’t we seeing even more? UK stocks famously trade on lower multiples of expected profit than US peers, so it’s to be expected that overseas buyers would take advantage. If anything, activity is lower than you might think given the UK-US stock-market valuation gap.

One issue is that the gulf of real significance is the one between UK trading prices and UK merger and acquisition valuations. The marginal stock market investor may not be willing to pay much for a few London-listed shares. But shareholders already invested in these companies (especially ones with large stakes) and the boards safeguarding their interests appear less willing to accept the 30% to 40% premiums that would have sufficed previously.

They’re holding out for a number reflecting their assessment of the company’s fundamental worth and will have no embarrassment if the equity value on that basis is more than 50% over the market capitalization. A board’s spine will be rightly stiffened when confronted with a corporate bidder who can increase the value of what they’re buying by stripping out overlapping costs.

Are UK directors being greedy by taking this approach? Not obviously. Consider the case of broadcaster ITV Plc. For years, analysts have tipped it as a takeover target due to a low valuation. Last month, it conducted some self-help, disposing of its 50% stake in the BritBox International streaming service for £255 million ($320 million) and promising to give the net proceeds to shareholders. The shares are now around one-third above their 52-week low in February, and shareholders retain control. If a bidder had popped up prior to the disposal, it’s quite clear ITV would have been right to repel anything but a knockout offer.

From the perspective of an acquisitive US chief executive officer, this makes for a dilemma. Do you approach a seemingly cheap UK company only to be forced into paying a fair, instead of bargain, price? Or would you rather shell out a premium for a richly valued business in your backyard and risk overpaying? Much will depend on the CEO’s confidence in the growth potential and synergies of the two opportunities, and whether the UK target generates a lot of revenue outside its sluggish home market. Buying a low-growth UK firm at a reasonable price may seem riskier than paying a reassuringly expensive valuation for a faster growing US company.

Alternatively, we may be just at the beginning of a new boom of inbound UK M&A. It’s frustrating that investors aren’t willing to pay higher prices for UK stocks before a takeover bid happens. Financial theory says the market should correct itself. Weak domestic ownership and thin trading volumes in small- and medium-sized UK companies — a vicious circle — perhaps explain why that isn’t happening. And why overseas bids are the last remaining market mechanism to give London-listed firms fair value.

Read also:

© 2024 Bloomberg L.P.

Visited 1 times, 1 visit(s) today