Early bird investing: Using your Isa allowance at the start of the year gives it extra time to grow, and protection from the taxman

Early bird Isa investors can get higher returns by gaining up to a whole year of dividends and potential market growth ahead of those who leave it until the last minute, new analysis highlights.

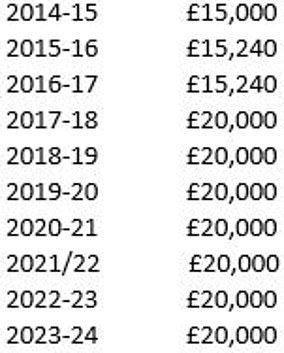

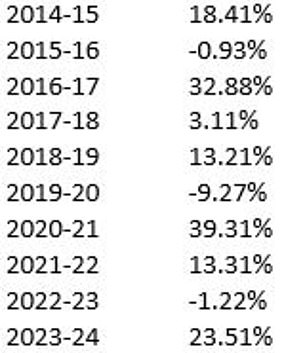

Someone who invested their full Isa allowance in a global tracker on the first day of the tax year for the past decade would have seen their investments grow to £360,500, compared with £322,500 if they left it to the last day.

If you spread your investment evenly over the year using regular investments you would have £343,500, according to number crunching by Hargreaves Lansdown.

It used the actual performance of the Legal & General International Index fund over the past 10 years, and calculated the total return after fund fees but before platform fees.

The fund, which has an ongoing charge of 0.11 per cent, tracks global markets excluding the UK.

‘The earlier you use your Isa allowance in the tax year, the better, because your investments have longer to grow, and are protected from tax straight away,’ says Sarah Coles, head of personal finance at Hargreaves.

But she notes: ‘The early birds aren’t sitting pretty every tax year, and at times of market falls, those who got in towards the end of the tax year will have dodged the drops earlier on.

‘However, the fact the early birds do so much better over time shows how these years are soon forgotten among average stock market performance.’

Coles says if you don’t have a lump sum to invest at the start of a new tax year, you can still begin drip feeding your money into the market through regular investments.

‘By investing gradually in a stocks and shares Isa, you take advantage of market falls as well as rises, through what’s known as pound cost averaging.

‘Over the past ten years, this would have left you lagging the early birds very slightly, but way ahead of the last-minute dashers.’

Hargreaves analysed the behaviour of investors on its platform and found around one in 20 of those paying into its stocks and shares Isas were invested in the first two weeks of the 2023/24 tax year.

Men are more likely to be early birds than women. Some 62 per cent of Hargreaves Isa clients are men, and men make up 68 per cent of early birds.

‘This may come down to the fact men tend to be on higher incomes, so they may have more investments outside an Isa that they want to move into a tax-efficient environment as quickly as possible,’ says Coles.

‘Given that more of them are higher and additional rate taxpayers, they also have an incentive to protect their investments from higher rates of dividend tax and capital gains tax.’

Hargreaves found that the ‘squeezed middle’ – people aged 30-54 – are the age group most likely to get started early on Isa investing.

‘This is particularly impressive given that so many of them are in the midst of the time of life when they have an awful lot of demands on their time and money,’ says Coles.

‘It owes something to the fact that this is when we’re likely to have peak income, so more to put aside in savings and investments.’

Sarah Coles: People tend to be wedded to being either earlybirds or last-minute dashers when it comes to their Isa investing habits

Those aged 65-80 are the second most likely group to invest early.

‘This is striking given that this is often a time when investors are falling back on existing investments and spending rather than saving,’ says Coles. ‘Some will be continuing to build investments, while others will be maximising the tax efficiency of what they already have.’

Hargreaves also found people tend to be wedded to being either early birds or last-minute dashers when it comes to their Isa investing habits – only one in 100 people invest at the end of one tax year and the start of the next.

Coles adds: ‘If you’ve always been a dasher, this is your chance to get ahead of the game, and make the most of your Isa for the whole of the approaching tax year.’

AJ Bell also found early bird Isa investors do better in its own analysis of investment timing stretching back to 1999.

Laith Khalaf, head of investment analysis at the firm, said: ‘The statistics clearly favour early bird Isa investing over last minute Isa investing. That extra year of investment, when compounded over the years, makes an awful lot of difference.

‘Even if you happen to invest at a dreadful time, in the long term you can still expect to come up smelling of roses if you put money to work in the market sooner rather than later.’

‘Of course, many people leave their Isa contribution to the end of the tax year as they don’t have the money available right away or are waiting until the last minute to see how much they can afford to stash in the tax shelter.

‘It still makes sense in these circumstances to use the tax shelter as soon as possible, because when the new tax year rolls around, the old allowance is gone for good.’

Meanwhile, recent analysis of the behavour of Isa millionaires by the Interactive Investor platform found they typically make the most of the Isa allowance at the start of each new tax year.

It found 40 per cent of the total 12-month subscriptions from the firm’s Isa millionaires were added between 6 and 30 April in 2023, compared with 23 per cent among all its Isa customers.

‘Those long-term early bird investors will have had close to an additional year in the market, which will also help power portfolios in a rising market,’ said Myron Jobson, senior personal finance analyst at II.

What are the benefits of early bird Isa investing?

Sarah Coles runs through the advantages of investing at the start of every tax year.

– Early bird Isa investors who have a lump sum to invest at the outset gain up to a whole year of dividends and potential growth in the stock market.

– By investing early, you get an extra year of protection from tax.

– If you hold investments outside an Isa, the fact that the dividend tax allowance has been halved, to £500, means investors run the risk of paying tax on their dividends far earlier in the year. By switching them into an Isa using share exchange (otherwise known as Bed and Isa), they’re protected from this tax immediately.

– Likewise, the slashing of the capital gains tax allowance to £3,000 means investors planning to realise gains early in the tax year risk busting their allowances.

Switching into an Isa on day one gives you the freedom to sell what you want when it makes the most sense for your finances, without thinking about tax.

– For those who are building a portfolio, starting early gives you the opportunity to set up regular monthly payments into a stocks and shares Isa each month, and automatically spread your investments across the tax year.

You will take advantage of market falls, through what’s known as pound cost averaging. If you invest a fixed sum every month you will be able to buy more units when a fund’s value falls, providing the potential for greater profits when they have risen in value.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.