-

Market breadth is on the rise as 118 S&P 500 stocks hover around their 52-week highs, marking a notable uptrend in the market’s performance.

-

Despite the broader market rally, investor interest remains focused on mega-cap tech stocks, which have significantly contributed to the S&P 500’s growth this year.

-

We will take a look at three stocks that lead the pack with the highest percentage of buy ratings among S&P 500 stocks, according to recent data.

- Investing in the stock market, want to get the most out of your portfolio, try InvestingPro, sign up NOW and take advantage of up to 38% off for a limited time on your 1-year plan!

118 stocks are currently trading at or near their 52-week highs, indicating that the positive trend in the market is beginning to look overextended.

This marks the highest number of stocks reaching annual highs in the past three years, showing a notable improvement in market breadth.

Despite more stocks joining the index rally, investors are still keen on big tech. Mega-cap tech stocks are notably contributing to the index’s growth this year.

In the first quarter alone, the Magnificent Seven accounted for 37% of the S&P 500’s +10.2% gain. This is a decrease from 2023, where they were responsible for about two-thirds of the index’s growth.

Currently, among S&P 500 stocks, 53.8% have buy ratings, 40.5% have hold ratings, and 5.7% have sell ratings.

- Delta Air Lines (NYSE:): 96%.

- Targa Resources (NYSE:): 95%

- Amazon (NASDAQ:): 95%

- Microsoft (NASDAQ:): 95%

- Schlumberger (NYSE:): 94%

- Lamb Weston Holdings (NYSE:): 93%

- NiSource (NYSE:): 92%

- Uber Technologies (NYSE:): 90%

- NVIDIA (NASDAQ:): 90%

Those with the highest percentage of sell ratings are:

- Expeditors International of Washington (NYSE:): 53%

- T Rowe (NASDAQ:) Price: 50%

- Robert Half (NYSE:): 50%

- Franklin Resources (NYSE:): 40%

- Hormel Foods Corporation (NYSE:): 38%

- Illinois Tool Works (NYSE:): 38% Paramount Global: 38

- Paramount Global Class A (NASDAQ:): 38%.

Let’s take a look at some of the stocks that have a higher buy rating percentage. For this, as always, we will use InvestingPro, which will provide us with valuable information about each company.

1. Delta Air Lines (DAL)

It is a commercial airline born in 1924 and based in Atlanta, Georgia. It is the largest U.S. airline in transatlantic flights, reaching more destinations in Europe and Asia than any other and is the second largest U.S. operator in Latin America after American Airlines (NASDAQ:).

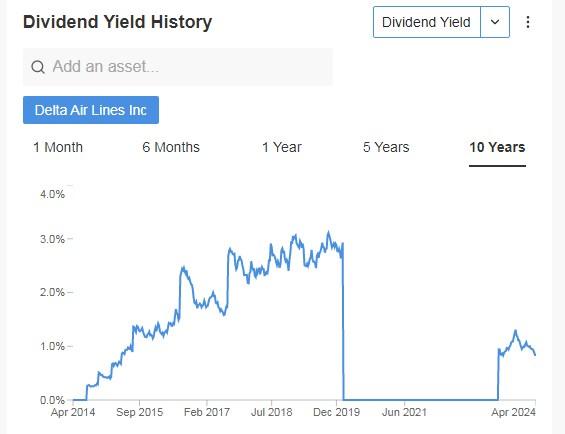

Its dividend yield is +0.84%.

Source: InvestingPro

It reports results on April 10 and revenue growth of 8.70% is expected.

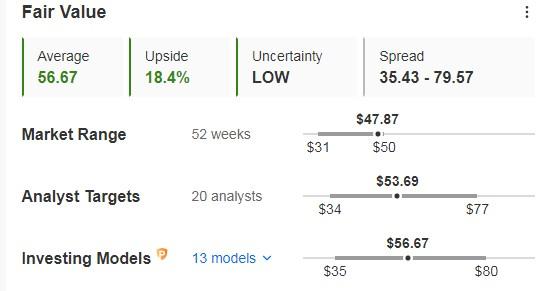

Source: InvestingPro

It has upside potential for FY24 and FY25 margins driven by revenue while further cost control from 2H2024 onwards.

Over the last 12 months it is up +40.21%.

The percentage of buy ratings is 96%, hold 4% and sell 0%.

The market gives it a potential at $53.69, while InvestingPro models are more optimistic and see it at $56.67.

Source: InvestingPro

2. Amazon (AMZN)

It is an American e-commerce corporation founded in 1994 and headquartered in the city of Seattle, Washington. It is one of the first major companies to sell over the Internet and the most valuable retail brand in the world.

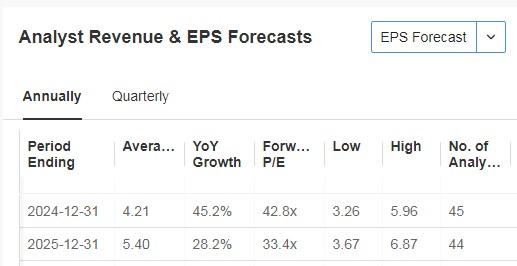

On April 25 we will know its accounts and for 2024 it is expected an increase in earnings per share (EPS) of +45.2% and revenue of +11.6%.

Source: InvestingPro

Its shares are up +76.14% in the last 12 months. The percentage of buy ratings is 95%, hold 5% and sell 0%.

The market gives it a potential at $206.32.

Source: InvestingPro

3. Schlumberger (SLB)

It is the world’s largest oilfield services company. Its main offices are in Houston, Paris, London, and The Hague. The company was formerly known as Societe de Prospection Electrique.

Schlumberger was founded in 1926 and is headquartered in Houston, Texas.

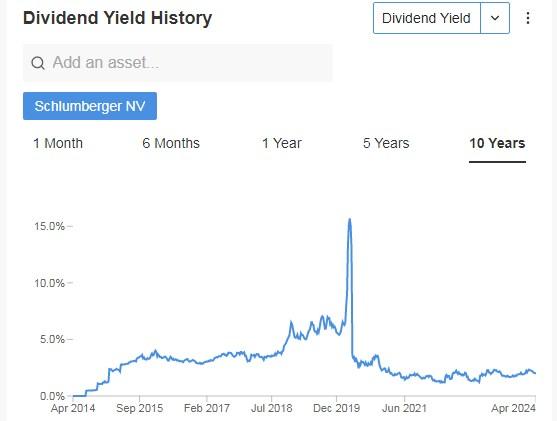

Its dividend yield is +2.01%.

Source: InvestingPro

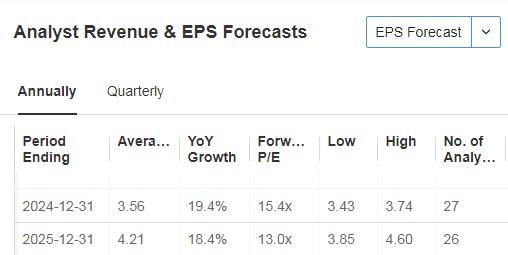

We will know its numbers on April 19 and looking ahead to 2024 the forecast is for earnings per share (EPS) growth of +19.4% and revenue of +12.7%.

Source: InvestingPro

Its shares are up +6.86% in the last year.

The percentage of buy ratings is 94%, hold 6% and sell 0%.

The potential given by the market is at $67.36.

Source: InvestingPro

4. Lamb Weston (LW)

It is an American food processing company, one of the largest producers of frozen French fries. It was founded in 1950 and is headquartered in Eagle, Idaho.

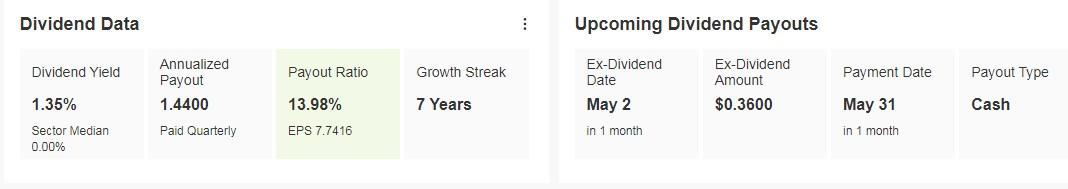

On May 31 it distributes a dividend of $0.36 per share and to be eligible to receive it you must own shares before May 2.

Source: InvestingPro

On April 4 we will have its report and earnings per share (EPS) are expected to increase by +23.97%.

Source: InvestingPro

Its shares are up +3.44% in the last 12 months.

The percentage of buy ratings is 93%, hold 7% and sell 0%.

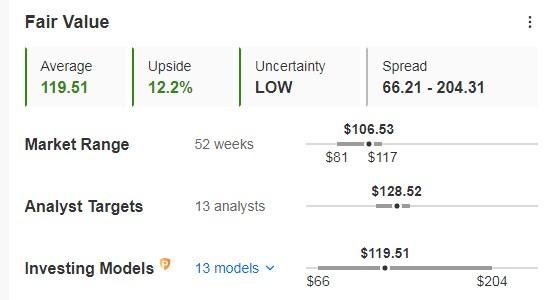

The potential given by the market stands at $128.52, while InvestingPro models put it at $119.51.

Source: InvestingPro

***

Are you investing in the stock market? To determine when and how to get in or out, try InvestingPro.

Take advantage HERE & NOW! Click HERE, choose the plan you want for 1 or 2 years, and take advantage of your DISCOUNTS.

Get from 10% to 50% by applying the code INVESTINGPRO1. Don’t wait any longer!

With it, you will get:

- ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a large amount of complex financial data into a few words.

- Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

- And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution – get your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.