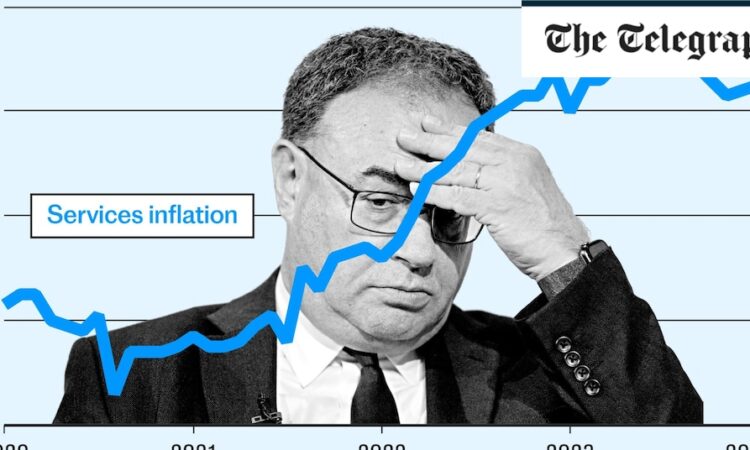

Services costs are rising rapidly everywhere you look: care home fees are up by one-tenth. Cinema tickets have risen almost 7pc. Car insurance is up one-third. Even funerals cost 8pc more than they did a year ago.

Surging prices have been driven by a tight job market, which has given staff the power to demand higher wages to cope with inflation. This is passed on to customers through higher prices.

Ian Stewart, chief economist at Deloitte, notes that households had a big pile of savings built up during Covid that let them keep spending even as prices rose.

Catherine Mann, an MPC member, told a recent Financial Times conference that “a lack of consumer discipline” – effectively a failure to rein in spending – has allowed companies to keep ramping up prices.

Companies, similarly, had high cash balances that let them keep spending on wages despite higher borrowing costs.

At the same time the Government has borrowed extremely heavily to support the economy through the pandemic, the energy crunch and even today. This has sustained wage growth and spending in the public sector.

However, there are signs that this dynamic is beginning to burn itself out as high borrowing costs finally start to weigh.

Yael Selfin, chief economist at KPMG UK, says: “All of that is a little behind us – we have lower vacancies, inflation is well below wage growth, and people are recovering that purchasing power, so we do expect wage growth to ease gradually.”

Even still, the classic signs that a huge rise in rates have slammed the brakes on the economy are not yet evident – unemployment is lower than it was a year ago, house prices have not dropped and Britain has had the mildest possible recession rather than a serious crunch.

Beck points to this as evidence of the Bank’s ineffective tools.

“If it had worked, we would probably have had a very severe recession given the extent of interest rate rises. But in reality we have not.”

That does not necessarily mean the inflation crisis will persist.

“Pay growth has slowed quite a bit on more timely measures, but that is less to do with interest rates and more that wages tend to follow price rises on the way up and down,” Beck says. “Inflation has come down of its own accord.”

For officials at the Bank, however, this crisis has raised difficult questions about whether they have the right tools to do the job next time inflation rears its ugly head.