(Bloomberg) — The European Investment Bank is considering ways to expand its support for the defense industry, in a move that would help the EU bolster its security in response to the growing threat from Russia.

Most Read from Bloomberg

The lending arm of the European Union is in talks with the bloc’s executive and other stakeholders to begin investing in military companies that produce defensive products, according to a person familiar with the plans. EU leaders will discuss the EIB’s role in defense readiness when they meet next week.

The EU has been scrambling to build out its defense capabilities following Russia’s invasion of Ukraine and after years of underspending by member states. The bloc announced this month that it would set aside an initial €1.5 billion ($1.6 billion) to boost the sector, but EU industry chief Thierry Breton has urged an investment of €100 billion.

“We are ready to do more to contribute to joint projects that boost the European industry and reinforce Europe’s protection and deterrence,” EIB President Nadia Calvino said last month after a meeting of EU finance ministers.

The move would require the EIB to extend its definition of dual-use goods — which can be used in both civilian and military contexts — that it already finances.

EU leaders will discuss the EIB’s role in improving the bloc’s defense readiness when they meet next week, and will call on “reconsidering the definition of dual-use goods and the defense industry lending policy” at the bank, according to draft conclusions seen by Bloomberg. The multilateral financial institution is currently prohibited from financing activities that include ammunition and weapons as well as equipment or infrastructure dedicated to military or police use.

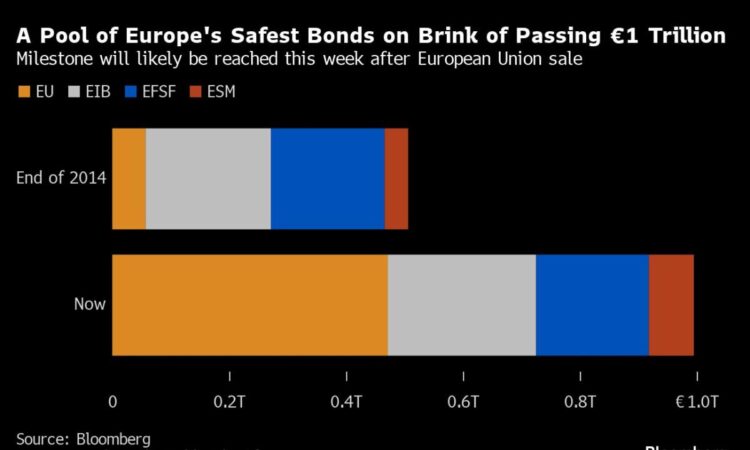

The EIB is one of the region’s biggest supranational bond issuers, with nearly €430 million of debt outstanding across different currencies, according to data compiled by Bloomberg. Alongside its traditional bonds, it also issues notes with a sustainability focus that finance environmental or social initiatives such as access to healthcare and education.

The EIB change could include removing the bank’s general exclusion from funding military infrastructure that isn’t dedicated to military purposes, said the person, who spoke on the condition of anonymity. It could also lead to the financing of materials, parts and components of the manufacturing plants that produce ammunition.

In 2022, the EIB decided to back the technology sector and civilian-security infrastructure through its Strategic European Security Initiative, which made funding available for dual-use projects with a chiefly civilian purpose.

Calvino also said that the bank is prepared to create a one-stop shop for security and defense projects to accelerate the deployment of €6 billion in investments that remain under an existing initiative to finance dual-use goods.

But unlike goods with both civilian and military use, weapons and ammunition are currently on a list of excluded activities and aren’t eligible for financing. The bank is against financing these activities as it fears the impact it would have in its rating among investors and its sustainable label.

European Commission President Ursula Von der Leyen said last November that “it is time to finally move ahead” to enhance the EIB’s support for defense despite the potential concern among investors. Some countries, including Lithuania and Finland, are also supportive of reviewing the EIB mandate so it could finance arms and ammunition production, another person said.

–With assistance from Alice Gledhill.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.