The tech world is currently living through the Fourth Industrial Revolution as Artificial Intelligence (AI), cryptocurrencies and clean energy have emerged as some of the biggest secular megatrends of our time. AI and Machine Learning (“ML”) have become the biggest consumer tech buzzwords thanks in large part thanks to ChatGPT, OpenAI’s generative AI chatbot. ChatGPT has become AI’s poster child, managing to garner 100 million users 60 days after its November 2022 launch.

Energy companies are increasingly deploying AI tools to analyze vast troves of data and geological maps, digitize records and potentially identify problems such as pipeline corrosion and/or excessive equipment use. Last year, Dutch energy giant Shell Plc (NYSE:SHEL) announced plans to use AI-based technology from big-data analytics firm SparkCognition in its deep sea exploration and production in a bid to boost production and improve operational efficiency. Generative AI for seismic imaging can dramatically cut exploration timelines from nine months to less than nine days. Back in 2019, BP Plc (NYSE:BP) teamed up with AI start-up Belmont Technology and developed a cloud-based geoscience platform nicknamed “Sandy.” Sandy allows BP to interpret geophysics, geology and reservoir project information and also perform simulations using the program’s AI neural networks.

On the crypto scene, the bitcoin craze has gone into overdrive as the leading cryptocurrency keeps taking out new highs with FOMO (Fear Of Missing Out) keeping markets bustling as more and more traders pile in to take advantage of the wild rally. Bitcoin price was up 4.2% on Monday’s intraday session to trade at $72,486, a couple hundred bucks off its all-time high. The latest bitcoin surge has been chalked up to bitcoin’s upcoming halving event on April 20–bitcoin’s fourth halving event–during which mining rewards will be halved from 6.25 BTC to 3.125 BTC, effectively reducing the rate at which new bitcoin is introduced into circulation.

Related: Europe’s Secret Weapon In Its Energy War With Russia

Meanwhile, many countries are doubling down on renewable energy after a brief hiatus during the Covid-19 pandemic. According to BloombergNEF, in 2023, clean energy investment globally increased by 17% to $1.8 trillion, with 1.7 dollars going into renewable energy for every dollar invested in fossil fuels.

Unfortunately, these exciting and seismic shifts in tech and financial circles are coming at a huge cost: high energy consumption. According to the North American Electric Reliability Corporation (NERC), the AI boom, cryptocurrency mining and increased clean technology manufacturing are straining U.S. energy supplies leading to energy sources struggling to keep pace. NERC’s most recent long-term reliability assessment has projected that power demand in the summer of 2024 will hit its highest level since 2016 while winter demand will hit its highest level since at least 2015.

“The [Bulk Power System] is currently forecast to have its highest demand and energy growth rates since 2014, mainly driven by electrification and projections for growth in electric vehicles over this assessment period,” NERC wrote.

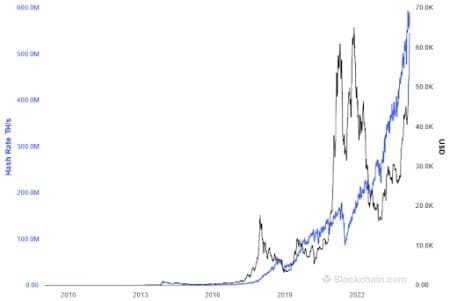

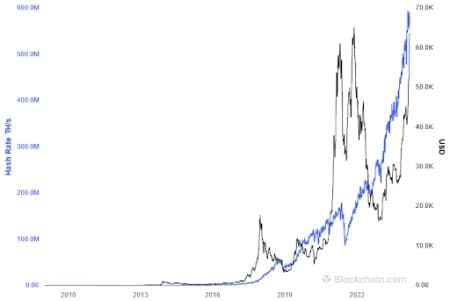

Bitcoin Total Hash Rate (TH/s)

Source: Blockchain.com

Power Hungry Technologies

According to NERC, resource growth is “becoming more challenging” as more and more fossil fuel generation sources are retired adding that “[m]ore than 83GW of generator retirements are planned through 2033, and more are expected. Generation plans need to consider growing energy needs and grid stability.”

“Across the board, we are seeing power companies say, ‘We don’t know if we can handle this; we have to audit our system; we’ve never dealt with this kind of influx before, ” Andy Cvengros, the managing director of data center markets at commercial real estate firm JLL, has told The Washington Post.

Industry insiders have started acknowledging that these technologies powering the fourth industrial revolution are indeed power hungry. OpenAI CEO Sam Altman has declared that the world needs an energy breakthrough like fusion if AI is to achieve its full potential.

“There’s no way to get there without a breakthrough. It motivates us to go invest more in fusion,” Altman has said. Altman has invested $375 million in private nuclear fusion company Helion Energy.

Even more alarming is the likelihood of AI power demand skyrocketing from here.

According to Sreedhar Sistu, vice president of artificial intelligence for Schneider Electric, excluding China, AI represents 4.3 GW of global power demand, and could grow almost five-fold by 2028. AI tasks typically demand more powerful hardware than traditional computing tasks.

AI-servers are power-hungry devices: Digiconomist estimates that a single NVIDIA DGX A100 server consumes as much electricity as several U.S. households combined. This implies that powering a couple of millions of these devices could easily strain the power grids they are supposed to make more efficient.

Meanwhile, bitcoin mining shows no signs of slowing down, hitting 565 exahashes per second (EH/s) currently, a five-fold increase from three years ago. Digiconmist estimates that bitcoin mining consumes 148.63 TWh of electricity per year, comparable to the power consumption of Malaysia, and emits 82.90 Mt CO2 per year, similar to the carbon footprint of Bangladesh. The U.S. Energy Information Administration (EIA) estimates that bitcoin mining accounts for up to 2.3% of U.S. electricity consumption. Galaxy Digital analysts had earlier estimated that between 15% and 20% of the hash rate coming from eight ASIC models could go offline when the halving occurs, because the economics would no longer make sense. However, it had used BTC price of $45,000 in its assumptions, much lower than the current BTC price approaching $75,000. In other words, few, if any, bitcoin miners will be put out of business after the April 20 halving event thanks to the wild bitcoin rally.

Last year, the White House proposed a plan to have crypto miners pay extra for the energy they consume. Dubbed the Digital Asset Mining Energy (DAME) tax, miners would pay a tax equal to 30% of the electricity they use in crypto mining.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com: