The value of the U.S. dollar is the strongest it has been in a generation, devaluing currencies around the world and unsettling the outlook for the global economy as it upends everything from the cost of a vacation abroad to the profitability of multinational companies.

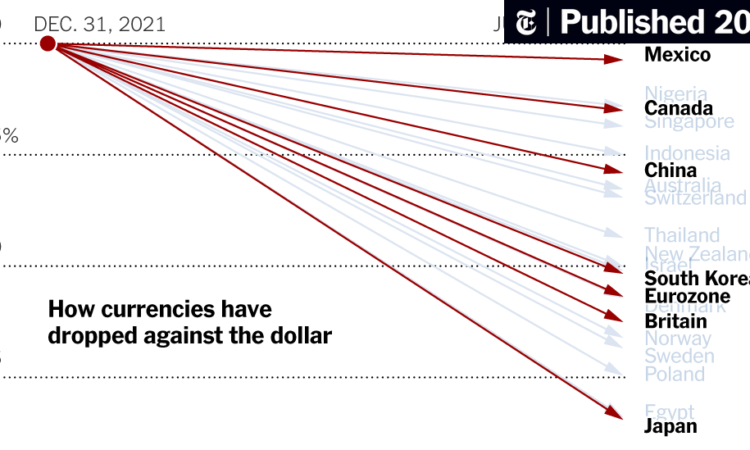

How currencies have dropped against the dollar

The percentage change

to July 15 from Dec. 31 of

each country’s official

currency versus the U.S. dollar.

The percentage change to July 15

from Dec. 31 of each country’s

official currency versus the U.S. dollar.

Source: FactSet

The dollar lubricates the global economy. It is one side of about 90 percent of all foreign exchange transactions, accounting for $6 trillion in activity every day before the pandemic, from tourists using their credit cards to companies making major international investments.

As the world’s most important currency, the dollar often rises in times of turmoil, in part because investors consider it to be relatively safe and stable. The dollar has gained in recent months as inflation has soared, interest rates have increased and the worries over growth have worsened. “That’s a pretty tough mix,” said Kamakshya Trivedi, the co-head of a market research group at Goldman Sachs.

The main way to gauge the dollar’s strength is by indexing it against a basket of currencies of major trading partners like Japan and the eurozone. By that measure, the dollar is at a 20-year high, after gaining more than 10 percent this year, a huge move for an index that typically shifts by tiny fractions each day.

Source: Refinitiv

The index comprises the euro, Japanese yen, British pound, Canadian dollar, Swedish krona and Swiss franc weighted against the U.S. dollar.

In the past week, the yen sank to a 24-year low against the dollar and the euro fell to parity, a one-for-one exchange rate, with the dollar for the first time since 2002. But pick just about any currency — the Colombian peso or the Indian rupee, the Polish zloty or the South African rand — and it has probably lost value against the dollar, especially over the past six months or so.

The factors roiling the global economy partly explain why the dollar has suddenly become so much stronger.

As central bankers around the world try to tame inflation by raising interest rates, the Federal Reserve is moving more quickly and more aggressively than most. As a result, rates are now markedly higher in the United States than they are in many other large economies, luring investors attracted by the higher returns on even relatively conservative investments such as Treasury bonds. As money has poured in, the value of the dollar has increased.

“It’s a very, very strong dollar,” said Mark Sobel, a former Treasury official who now serves as the U.S. chair of the Official Monetary and Financial Institutions Forum, a think tank. The currency has been stronger on only three occasions since the 1960s.

Analysts at Bank of America estimated that more than half the rise in the dollar this year could be explained by the Fed’s comparatively aggressive policy alone.

The analysts cited its status as a haven in times of worsening economic conditions and stock market turmoil. They also said the dollar was rising because high energy prices were hitting the economies of importers, including most of Europe, harder than the United States, which is less reliant on buying oil and gas from abroad.

“Not only are recessionary fears rising but the U.S. also looks better off than the rest of the world,” said Calvin Tse, a markets strategist at BNP Paribas.

While a stronger dollar can be a mixed blessing for people and companies, such a sharp, quick move in the value of the world’s most widely used currency can have a destabilizing effect of its own.

Americans traveling abroad this summer will find that their money goes further. “One of the only ways an American can reap the rewards of a strong dollar is by going on holiday,” said Max Gokhman, the chief investment officer at AlphaTrAI, an asset management firm. “But even then, the airfare is going to be much more expensive because of the rise in oil prices.”

Companies based outside the United States have seen their sales bolstered by the strong dollar. Burberry, the British luxury goods maker, said on Friday that it would add more than $200 million to its revenue this year because of movements in the currency — helping to offset a decline in sales in China, where the economy is slowing.

But American companies with large international operations are taking a hit when they convert foreign sales back into dollars. Profits at both Microsoft and Nike, for example, have recently eroded. Apple generates more than 60 percent of its sales outside the United States; it and other tech giants, which dominate many stock indexes, are likely to suffer from the dollar’s strength when they reveal their latest financial results in the coming weeks.

Ben Laidler, global markets strategist at eToro, estimates that the rise in the dollar will shave 5 percent off the earnings growth of S&P 500 companies this year, or roughly $100 billion. That’s a sizable impact given that earnings among those companies are forecast to grow around 10 percent this year, according to FactSet.

Reflecting the drag, companies that generate most of their revenue in the United States have performed better than rivals with more international exposure, according to indexes compiled by S&P Dow Jones Indices.

Stock performance of

S&P 500 companies with

more exposure in:

Stock performance of

S&P 500 companies with

more exposure in:

Source: Refinitiv

Data are the percentage change since Dec. 31, 2021, in the S&P 500 U.S. Revenue Exposure Index and the S&P 500 Foreign Revenue Exposure Index, which comprise companies with higher- or lower-than-average revenue gained either in the U.S. or foreign countries.

Many companies and governments abroad borrow in dollars, and the currency’s strength is a big problem. This is particularly true for poorer countries attracted to dollar-denominated debt as an alternative to less developed local markets. As John B. Connally, a former Treasury secretary, famously told his counterparts at a summit in the early 1970s, “The dollar is our currency, but it’s your problem.”

Likely to be most affected are countries where dollar debt represents a large portion of their gross domestic product. Paying interest to creditors in dollars has become particularly difficult for countries with rapidly depreciating currencies like Argentina and Turkey, especially as interest rates on any new debt will also go up. In some cases, including for Sri Lanka, it has become seemingly impossible.

The dollar, however, has not beaten every currency this year. The rise in energy and food prices, which accelerated after Russia’s invasion of Ukraine, has been a boon for the currencies of countries like Angola, a major oil producer; Uruguay, a major food exporter; and Brazil, which sells a lot of energy and agricultural commodities.

The Russian ruble, perhaps surprisingly, has been one of the best-performing currencies against the dollar this year. High oil and gas prices, as well as capital controls imposed by Russia to keep money inside the country, have propped up the official exchange rate. What little ruble-dollar exchanges that ordinary Russians are able to make are likely at a weaker rate.

The percentage change to July 15

from Dec. 31 of each country’s

official currency versus the U.S. dollar.

The percentage change to July 15

from Dec. 31 of each country’s official

currency versus the U.S. dollar.

Source: FactSet

Can the buck be stopped? The U.S. economy is looking shakier, but as Europe faces an energy crisis, Japan resists raising interest rates, China’s Covid-19 lockdown policies snarl its supply chains and other countries teeter under the weight of high inflation, demand for the dollar looks robust. Though it remains unclear how long.

“For now, we still expect the dollar to trade on the front foot,” said Mr. Trivedi of Goldman Sachs. “There might be a bit more to go, but probably the largest part of the dollar move may well be behind us.”

The Bank of America analysts noted that they were “struck by our investor conversations focusing on what could lead to a peak” in the dollar’s value, “as opposed to what takes it another 10 percent stronger.”