Over the last century, the global market has always been dominated by a single currency. Initially, it was the pound sterling, which has now been replaced by the United States (US) dollar, accounting for 59.02 percent of the Official Foreign Exchange Reserves (COFER). The dominance of the US dollar has been driven by its role as an anchor currency for the lion’s share of international trade, making it the most demanded and widely accepted currency. The rationale for adopting an anchor currency for bilateral trade is usually to eliminate exchange rate risk as well as to trade in a currency that is commonly accepted. This phenomenon of using the US dollar as a substitute for the domestic currency, to varying extents, is often referred to as dollarisation.

Dollarisation can take different forms—financial dollarisation, which is the substitution of domestic assets or liabilities with foreign assets or liabilities; real dollarisation, where domestic transactions are pegged to the exchange rate; transaction dollarisation, which involves using the US dollar for domestic transactions. Dollarisation often culminates as a result of the poor performance of the domestic currency, either due to political turbulence or economic uncertainty, brewing in the form of volatile inflation, resulting in unstable real exchange rates. However, dollarisation might also follow as a result of financial market liberalisation and economic integration into the global economy, which subsequently results in greater capital inflow due to reduced exchange rate risk.

Dollarisation often culminates as a result of the poor performance of the domestic currency, either due to political turbulence or economic uncertainty, brewing in the form of volatile inflation, resulting in unstable real exchange rates.

De-dollarisation, the global move to resist and reverse dollarisation, has its theoretical foundation in the macroeconomic trilemma which posits that capital mobility, independent monetary policy and a stable exchange rate cannot be achieved together—only two of these policy goals can be targeted by the central bank at any time. Beyond rendering monetary policy ineffective, a high degree of dollarisation also results in loss of seigniorage, balance sheet risks, higher possibility of liquidity crises, and other financial risks. Given the US hegemony over global financial markets, the trend in recent years has been to sidestep the US dollar and invoice bilateral trade in domestic currency, as an attempt to diminish the US’s control over global affairs by immobilising its most potent tool—its currency.

De-dollarisation can be attained via a combination of macroeconomic stabilisation policies and microeconomic measures that deter the use of the dollar while making the domestic currency more attractive. Higher exchange rate flexibility; efficient liquidity management to reduce interest rate volatility; fiscal consolidation to limit the government’s dollar-denominated external debt; a deep domestic financial market with assets denominated in the domestic currency can reduce exposure to the US dollar. In turn, gradual de-dollarisation can liberate the economy from its costly dependence on the dollar and enable it to focus on domestic monetary policy that can be manoeuvered to strengthen the country’s macroeconomic structure.

De-dollarisation in motion?

Shifting to trade in local currency has become the usual route that countries follow in an attempt to de-dollarise the economy, challenging the US dominance and itsweaponisation of the US dollar. Brazil has been expanding its bilateral currency trade with Japan and has recently struck a deal with China to trade in their domestic currencies. Following the sanctions imposed against Russia by the Western countries, there has been a move to dump the dollar, which is being led by China and the other BRICS nations are following suit. Recently, Indonesia has switched to a Local Currency Trade (LCT) system, which will significantly lower the share of US dollar in its current account transactions. At a time when African nations are contemplating eliminating the US dollar and opting for domestic currencies for intra-Africa trade, the de-dollarisation of trade and establishment of an integrated payments system becomes a challenging action area to be discussed at the upcoming BRICS Summit on 24th August.

Shifting to trade in local currency has become the usual route that countries follow in an attempt to de-dollarise the economy, challenging the US dominance and itsweaponisation of the US dollar.

The Summit is also expected to deliberate over the possibility of a common currency but India will withdraw itself from such arrangements as it is a party to multi-billion-dollar trade deals with both the US and Europe, and is performing considerably well among the BRICS nations. The resistance to a common BRICS currency does not imply India’s reluctance to de-dollarise—the Reserve Bank of India (RBI) issued a circular in July 2022 arranging for the invoicing, payment, and settlement of exports or imports in the Indian Rupee (INR). This move was initiated due to India’s imports of cheap crude oil from sanction-stricken Russia and the latter’s interest to accept payments in INR, which has significantly lightened the import burden for India.

India is trying to develop and implement systems that can bypass the dollar and strengthen the INR, particularly by entering into agreements with multiple nations to settle trade in domestic currencies. Eighteen countries including the United Kingdom (UK), Russia, Sri Lanka, and Germany have already opened Special Rupee Vostro Accounts (SRVAs), which allows them to transact in INR. These accounts are held with domestic banks in India and are denominated in INR, which are directly credited or debited as a country exports to or imports from India. Recently, the Union Bank of India opened an SRVA through the India International Bank of Malaysia to facilitate India-Malaysia trade in INR.

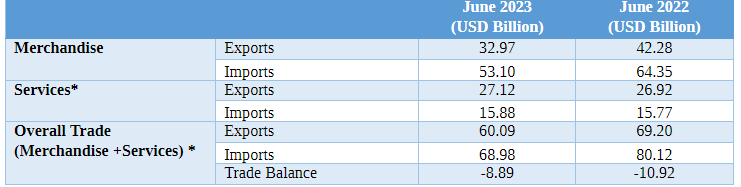

Table 1: India’s Trade Deficit

Source: Ministry of Commerce and Industry, Government of India

Source: Ministry of Commerce and Industry, Government of IndiaAlthough India is a net importer with a trade deficit (Table 1), it has sufficient reserves (Table 2) to safeguard its currency. As India establishes itself as a major player in the global economy, the INR is expected to strengthen over the remaining part of the decade and reserve a higher share of claims in the COFER. This transition is being driven by the bilateral and multilateral agreements that the country enters into, such as the most recent Memorandum of Understanding signed with the United Arab Emirates. Since signing of the Comprehensive Economic Partnership Agreement (CEPA) in 2022, bilateral trade between the countries rose by 15 percent to US$85 billion. The MoUs will facilitate increased use of domestic currencies i.e., INR and AED for bilateral trade as well as the interlinking of payment and messaging systems. Such cooperation will promote the invoicing of trade in INR, which will further relieve the country’s dependence on foreign reserves and allow greater autonomy to domestic monetary policy.

Table 2: India’s Foreign Exchange Reserves

| Foreign Exchange Reserves* | ||||||||

| Item | As on July 28, 2023 | Variation over | ||||||

| Week | End-March 2023 | Year | ||||||

| ₹ Cr. | US$ Mn. | ₹ Cr. | US$ Mn. | ₹ Cr. | US$ Mn. | ₹ Cr. | US$ Mn. | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | |

| 1 Total Reserves | 4967138 | 603870 | -8293 | -3165 | 212873 | 25421 | 417486 | 29995 |

| 1.1 Foreign Currency Assets # | 4403421 | 535337 | -4118 | -2416 | 214289 | 25645 | 350261 | 24079 |

| 1.2 Gold | 369359 | 44904 | -4502 | -710 | -2140 | -296 | 55085 | 5262 |

| 1.3 SDRs | 151715 | 18444 | 300 | -29 | 551 | 52 | 9131 | 459 |

| 1.4 Reserve Position in the IMF | 42642 | 5185 | 27 | -11 | 174 | 19 | 3007 | 194 |

| * Difference, if any, is due to rounding off. | ||||||||

| # Excludes (a) SDR holdings of the Reserve Bank, as they are included under the SDR holdings; (b) investment in bonds issued by IIFC (UK); and (c) amounts lent under the SAARC Currency swap arrangements. |

Source: Reserve Bank of India

However, while de-dollarisation is an appealing idea, complete and quick de-dollarisation is not practicable, especially when all countries are not willing to move out of the sticky dollar paradigm. The adherence to dollarisation is a culmination of the US’ economic as well as geopolitical dominance for the greater part of the last century, which has also led to the negation of conventionally accepted economic ideologies such as the Mundell-Fleming paradigm. A depreciation of the INR, which should ideally stimulate exports often has a limited effect as a result of US dollar invoicing of trade—resulting in the Dominant Currency paradigm, as posited by Gita Gopinath, the former chief economist at the International Monetary Fund (IMF). A hasty move to invoice the country’s trade in INR will certainly backfire and debilitate the Balance of Payments (BOP), further increasing the requirement of US dollar reserves to maintain the currency.

Possible rupeefication?

Although de-dollarisation has gained traction across the globe, it can be argued that the extent of de-dollarisation has been exaggerated. The fall in the dollar share of COFER might be interpreted as a result of central bank intervention to maintain the domestic currency as well as a consequence of interest rate movements. Despite these factors, it is obvious that the world, and especially the Global South, have recognised the cost of dollarisation and the associated exchange rate risks. In India, while a complete overhaul of the trade invoicing system is not feasible, de-dollarisation can be complemented with internationalisation of the INR—rupeefication. Rupeefication will require complete freedom over buying or selling of the INR by any entity, the ability of the country’s exporters to invoice their trade in INR, and holding as well as issuing of the INR and financial instruments denominated in it by foreign entities.

A hasty move to invoice the country’s trade in INR will certainly backfire and debilitate the Balance of Payments (BOP), further increasing the requirement of US dollar reserves to maintain the currency.

Rupeefication will entail advantages both for the private and public sectors. Exporters can benefit at large by limiting exchange rate risk and deepen their markets as the INR becomes more widely accepted. With greater access to international financial markets and reduced cost of borrowing, profitability can be increased in the private sector, which will also encompass the non-financial sector. The public sector will be able to finance its deficit by issuing international debt denominated in INR and have the option to finance its current account deficit without depleting its official US dollar reserves. For a country constantly battling domestic developmental issues, following a strict regime of macroeconomic and monetary policy is arduous and might also be misconstrued as the misutilisation of resources. However, there is no binding tradeoff between rupeefication and development—on the contrary, from a microeconomic perspective, gradual rupeefication can enhance the private sector leading to the growth of livelihoods. This serves as a motive for the internationalisation of the INR, which can only be implemented when the degree of dollarisation of the economy has been substantially reduced. It should be noted that while de-dollarisation is only a tool in India’s arsenal, the focus should be on gradual and consistent rupeefication to establish itself as a global leader.

Arya Roy Bardhan is a Research Intern with the Centre for New Economic Diplomacy at the Observer Research Foundation

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.