The investment trust sector has been pushing for changes in fee disclosure rules for investment vehicles and is hoping that this week’s Spring Budget might be the chance for things to change.

“What investors are presented with today is completely misleading,” said William MacLeod, managing director at Gravis.

The issue of fee disclosure has long been an issue for the sector, with the Association of Investment Companies (AIC) leading the charge against this ‘double dipping’.

Currently, institutions and wealth managers must disclose investment trust costs as part of their own, making the products look more expensive.

While this is also the case for open-ended funds, investment trusts are traded instruments, which, campaigners argue, means their market values should fully reflect fees.

MacLeod pointed to a submission from the London Stock Exchange to the Treasury in January, which gained 329 signatories in support of treating investment trusts like other listed companies when it comes to costs, rather than open-ended funds.

He added: “The best analogy is to compare this to a taxi journey; for open-ended funds the meter is on for as long as the journey lasts. In reality, investing in an investment company is like riding the Tube; one fee covers the cost of the journey.”

Annabel Brodie-Smith, communications director of the AIC, said the Budget was a “great opportunity” for the Chancellor to remove the “misguided rules” on cost disclosures.

She suggested removing investment trusts from the scope of consumer composite investments (CCI) regulation, arguing it would be “the easiest and quickest way to fix these issues”.

MacLeod added that it was “possible” that City minister Bim Afolami “has been able to secure a temporary suspension of cost disclosures”.

However, Darius McDermott, managing director of Chelsea Financial Services, said that while there had been “a lot of progress on the fees and charging issue behind the scenes,” he was not aware of any plans to announce changes in the Budget.

The investment trust sector has been suffering recently, as discounts on the vehicles have hit record highs, leaving the sector eager for any regulatory tailwinds to benefit it.

“We have also called for the abolition of stamp duty on investment trust shares, which would put trusts on a level playing field with other kinds of funds and resolve the issue of double taxation when investment trusts invest in UK shares,” said Brodie-Smith.

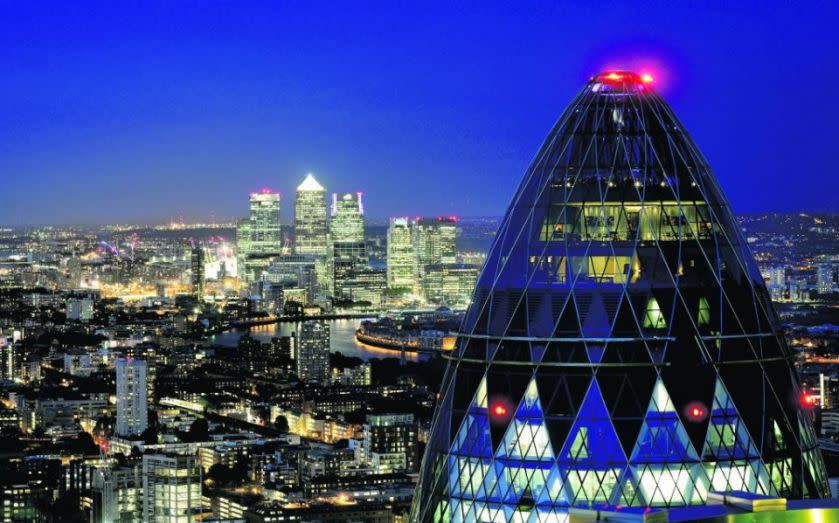

“Investment trusts make up more than a third of the FTSE 250 and this change would address unfairness in the tax system while also stimulating UK capital markets.”

McDermott added that as investment trusts are listed equities, any moves in the Budget to give stimulus to the UK market as a whole “would naturally benefit investment companies too”.

The investment industry has been calling for Chancellor Jeremy Hunt to scrap the stamp duty on buying shares in a bid to boost London’s capital markets and support growth.

Abolishing the tax could lead to a nearly £7bn increase in business investment from FTSE-listed firms, research from the Centre for Policy Studies found.