Welcome to the Mortgage Origination and Servicing

chapter of our annual report Consumer Financial Services 2023 Year in

Review.

Looking Ahead to 2024

Enforcement efforts are expected to increase in 2024 and will

likely reflect anticipated industry growth (e.g., total mortgage

origination volume is expected to increase to $1.95 trillion in

2024 from the $1.64 trillion expected in 2023).

The CFPB will likely focus its efforts on RESPA violations,

force-placed insurance, and time-barred loans.

Key Trends From 2023

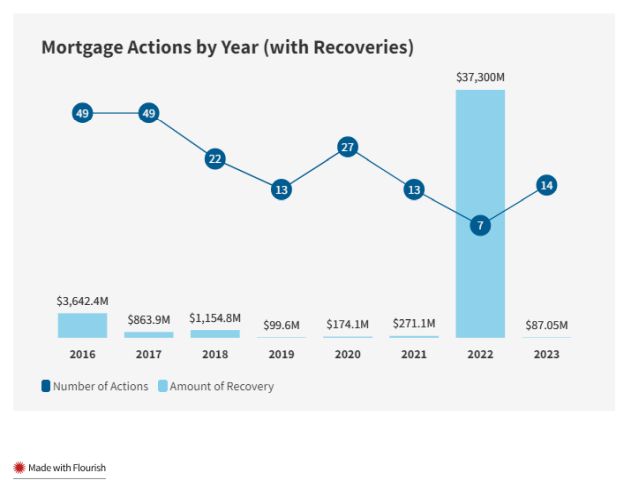

In 2023, Goodwin tracked 14 publicly announced enforcement

actions related to mortgage origination and mortgage servicing.

These 14 actions (ten federal and four state) produced recoveries

of more than $87 million. Of these recoveries, $25 million was

attributable to a federal action alleging improper mortgage loan

payments by a payment processing company and $24 million was

attributable to a federal action alleging False Claims Act

violations. Although 14 actions is more than the seven tracked last

year, it reflects a general decrease in the number of mortgage

origination and servicing enforcement actions over the past nine

years — from several dozen per year in 2015, 2016, and 2017

to a mere 13 in each of 2019 and 2021. The amount recovered in 2023

was also substantially less than the $37.3 billion recovered the

prior year and is the lowest annual recovery amount in the nine

years that Goodwin has tracked such activity.

In the News

Statements from the CFPB in 2023 suggest three areas in which

the Bureau may focus its efforts in the coming year: RESPA

violations; force-placed insurance; and time-barred loans.

CFPB Advisory Opinion Notes RESPA Issues With Mortgage

Comparison Websites

Regarding RESPA — specifically, its prohibition on

kickbacks for settlement-service referrals — the CFPB issued

an advisory opinion in February about possible

RESPA issues associated with mortgage comparison websites. The

opinion did not establish any new law or rules, but it did function

as a warning to market participants that displaying or benefitting

from “non-neutral” content on an online mortgage

comparison platform might, in the Bureau’s view, violate RESPA.

Listing several examples of potentially violative conduct, the

opinion cautioned against steering customers to one service

provider over another based on anything other than neutral

criteria, which might amount to unlawful referral activity. The

Bureau’s opinion, according to Director Chopra’s

accompanying statement, was “part of a broader

all-of-government effort to end the illegal biasing of ostensibly

neutral platforms.”

CFPB Signals Anticipated Monitoring of Mortgage Servicer

Compliance Regarding Force-Placed Insurance

Regarding force-placed insurance, Chopra gave public remarks in November, in which he

anticipated that the increasing frequency and severity of natural

disasters could precipitate problems with home insurance needs.

Specifically, if existing coverage is revoked or canceled by

insurers unwilling to cover certain hazards in certain areas,

mortgage servicers may choose to force place property insurance and

charge the homeowner for it. Recognizing the potential for abuse,

noting the availability of insurance options, and emphasizing the

notice requirements already in place for force-placing insurance,

Chopra made clear that the CFPB would be “carefully

monitoring” mortgage servicers for compliance with rules

regulating force-placed insurance.

CFPB Issues Guidance Regarding Debt-Collection Efforts

on Time-Barred Mortgages

Regarding time-barred loans, the CFPB clarified, in guidance issued in April, that bringing or

threatening to bring an action to foreclose a time-barred mortgage

may violate the FDCPA. The opinion was issued “in light of a

series of actions by debt collectors attempting to foreclosure on

silent second mortgages, also known as zombie mortgages” but

pertains to any mortgage on which the statute of limitations has

expired. It warns that any debt collector covered under the FDCPA

may be in violation of that law if it tries to enforce a

time-barred mortgage loan, even if the debt collector did not know

the debt was time-barred.

New York’s Foreclosure Abuse Prevention Act Leads to

Court Split on Its Retroactive Applicability

Separate from regulatory activity, legislative acts in at least

one state have affected the mortgage servicing industry. Signed

into law on December 30, 2022, New York’s Foreclosure Abuse

Prevention Act (FAPA) strictly cabins the time limits for

commencing mortgage foreclosures by amending five New York

procedural rules and the state’s General Obligations Law.

According to its sponsor, the intent of the act was to overturn

certain precedent interpreting those rules and laws. Most

significantly, FAPA invalidated the holding of Freedom Mortgage

v. Engel, 37 N.Y.3d 1 (Feb. 18, 2021), a case in which New

York’s highest court concluded that a mortgage holder may

revoke a prior election to accelerate an installment debt

(acceleration is generally a precursor to foreclosure), thereby

preserving the option to accelerate again in the future. By undoing

Engel, and other precedent too, FAPA takes away this and

similar options from foreclosing plaintiffs.

Since FAPA’s enactment, homeowners in foreclosure actions

have invoked the act in an attempt to persuade courts that the

actions against them are now untimely and should be dismissed. New

York trial courts are split on whether FAPA can apply retroactively

without violating the state and federal constitutions, and none of

the state’s four appellate divisions has decided that issue

yet. Every trial court to hold that FAPA applies retroactively has

also concluded that FAPA is constitutional. In contrast, courts

refusing to apply FAPA retroactively have cited the lack of a clear

expression of retroactive intent and/or constitutional issues that

would arise if FAPA were to apply retroactively, particularly the

violation of due process.

At the current rate, a decision from New York’s Court of

Appeals on FAPA’s retroactivity is years away.

2023 Enforcement and Litigation Highlights

CFPB’s Summer 2023 Supervisory Highlights Identifies

Areas of Focus for Bureau Examiners

In Supervisory Highlights, the CFPB summarized

its 2023 efforts to identify and correct mortgage servicing

violations, which were primarily related to loss mitigation, such

as failure to examine loan modification or forbearance applications

in a timely way, failure to continuously maintain a single point of

contact for customers seeking loss mitigation help, and various

errors in required notices, including vague denial reasons, missing

Spanish-language translations, or incorrect payment details. The

Bureau’s supervisory efforts also addressed some comparatively

minor mortgage-origination issues, such as ensuring that loan

originators are compensated at the same rate whether the loan was

originated in-house or brokered out, and adjusting servicing

software to enable proper rounding of numbers when disclosing terms

of variable interest rate loans.

Beyond those efforts, the CFPB and other regulatory agencies

litigated a handful of civil actions related to mortgage

origination and servicing in 2023. The CFPB brought a federal

action alleging redlining in African American neighborhoods in

Chicago but it was dismissed. DOJ actions were more successful. One

DOJ action, which focused on alleged redlining targeting Black and

Hispanic neighborhoods in Philadelphia, resulted in a $3 million

settlement and consent order. Another, which alleged similar

conduct against a mortgage lender in Jacksonville, Florida,

produced a $9 million settlement. In state court actions, the

Massachusetts Division of Banks secured a settlement with a

California bank over allegations of misleading marketing, and the

New Jersey Division of Consumer Affairs settled claims that a

mortgage servicer violated state consumer fraud regulations with

unsolicited telemarketing and untimely payment applications, among

other actions. The significant cases are summarized below.

Massachusetts Division of Banks Enters Into Consent

Order With Mortgage Lender

In January, the Massachusetts Division of Banks (DOB) entered

into a consent order with a California-based mortgage

lender, Broker Solutions Inc. According to the DOB, the company,

which was licensed as a mortgage lender in Massachusetts, had

allowed a separate company to use its government-issued mortgage

license number. The DOB argued that this could mislead consumers

into thinking the two companies were not separate and distinct, in

violation of 940 Code of Massachusetts Regulations (CMR) 8.06(1),

which bans unfair or deceptive practices in advertising.

Massachusetts requires mortgage lenders to be licensed by the

DOB, which issues individual mortgage lender licenses. The DOB

alleged that the mortgage lender entered into an agreement in

October 2019 that allowed the separate entity to display its brand

alongside the mortgage lender’s license number on certain

webpages and marketing materials. The DOB further alleged that

those advertisements were misleading or had the ability or capacity

to mislead consumers into thinking that the mortgage lender and the

separate entity were not separate and distinct companies, which is

a violation of 940 CMR 8.06(1) and allegedly facilitates unlicensed

mortgage lender and mortgage broker activity.

Pursuant to the consent order, the mortgage lender agreed to pay

a $25,000 administrative penalty and to refrain from future

facilitation of unlicensed mortgage lending or brokerage

activity.

CFPB Secures Ban on Mortgage Lending Activities Based on

Repeated Deceptive Conduct

In February, the CFPB announced that it had entered into a consent order with mortgage lender RMK

Financial Corp. (doing business as Majestic Home Loan), resolving

allegations that the lender had engaged in “a series of repeat

offenses,” including violating a 2015 order prohibiting it

from engaging in what the CFPB alleged was deceptive advertising.

According to the CFPB, Majestic Home Loan sent advertisements to

military families falsely claiming the company was affiliated with

the Department of Veterans Affairs (VA) and the Federal Housing

Administration in violation of the CFPA, Regulation N, TILA, and

Regulation Z. Further, the CFPB alleged that the company had misled

borrowers concerning key terms of the loans, such as interest rates

and monthly payment amounts, and misrepresented loan requirements

and potential refinancing options.

Pursuant to the consent order, Majestic Home Loan was

permanently banned from engaging in mortgage-lending activities and

will pay a $1 million penalty into the CFPB’s victim relief

fund.

CFPB ECOA Action Against Townstone Financial

Dismissed

In February, a CFPB enforcement action brought in federal

district court against mortgage broker and lender Townstone

Financial Inc. and its owner was dismissed (CFPB v.

Townstone, 2023 WL 1766484 [N.D. Ill. Feb. 3, 2023]). The CFPB

had sued in July 2020, alleging under the ECOA and the CFPA that

Townstone had discouraged prospective applicants in African

American neighborhoods in the Chicago metropolitan statistical area

from applying for mortgages by making comments on local radio shows

that discouraged prospective African American borrowers from

applying with the lender. The court granted the defendants’

motion to dismiss the complaint with prejudice on the basis that

the ECOA applies only to applicants, not to prospective

applicants. Refusing to give “Chevron deference”

to Regulation B, which provides that a creditor shall not make

statements to “applicants or prospective applicants that would

discourage on a prohibited basis a reasonable person from making or

pursuing an application,” the court held that the plain

language of ECOA “clearly and unambiguously” prohibits

discrimination against an applicant (defined as “a person who

applies to a creditor for credit”), not a prospective one.

Thus, the court concluded that “Congress has directly and

unambiguously spoken on the issue at hand and only prohibits

discrimination against applicants,” and thus, it did not need

to reach step two of Chevron deference to consider whether

Regulation B, the agency interpretation, reflects a permissible

construction of the statute (id. at *5-*6).

The CFPB appealed the decision in April and filed its opening

brief in July. The appeal was argued in December, and a decision is

now pending in the Seventh Circuit Federal Appeals Court.

DOJ Addresses Allegedly Racially Discriminatory Mortgage

Lending and Serving

In 2023, in four federal lawsuits against mortgage lenders and

servicers, the DOJ turned its attention to the prevention of

racially discriminatory conduct.

In May, the DOJ announced that it had entered into a settlement with ESSA Bank & Trust (ESSA),

a Philadelphia-based bank and trust company, over allegations that

it had engaged in unlawful redlining in the Philadelphia

metropolitan area. In the complaint, filed contemporaneously with the

consent order in U.S. District Court for the Eastern District of

Pennsylvania, the DOJ alleged that ESSA’s practices violated

the FHA and the ECOA by failing to adequately service

majority-Black and -Hispanic neighborhoods in Philadelphia.

Specifically, the DOJ alleged that ESSA excluded predominantly

Black and Hispanic census tracts from its “assessment

areas” (as defined in the Community Reinvestment Act) and,

therefore, that its lending practices did not meet the needs of the

community that it served. The DOJ further alleged that ESSA failed

to adequately staff branches in majority-Black neighborhoods with

loan officers and did not engage in meaningful marketing and

outreach in minority communities around Philadelphia. Under the

consent order, ESSA agreed to establish a $2.92 million Loan

Subsidy Fund for consumers applying for first mortgages,

home-improvement loans, and refinance loans in majority-Black and

-Hispanic census tracts in ESSA’s lending area. ESSA also

agreed to spend at least $125,000 in partnership with community

organizations on outreach and education programs and to spend at

least $250,000 on advertising, outreach, financial education, and

credit counseling within majority-Black and -Hispanic census

tracts.

In October, the DOJ announced a $9 million agreement to resolve allegations against

mortgage loan originator Ameris Bank. According to the DOJ’s complaint filed in the U.S. District Court for

the Middle District of Florida, from 2016 through 2021, Ameris Bank

avoided providing mortgage services to majority-Black and -Hispanic

neighborhoods in Jacksonville, Florida, and discouraged people

seeking credit in those communities from obtaining home loans.

Specifically, even though Ameris operates 18 branches in

Jacksonville, it has never operated a branch in a majority-Black

and -Hispanic neighborhood in the city, and other lenders generated

applications in majority-Black and -Hispanic neighborhoods at three

times the rate of Ameris. Under the proposed consent order, Ameris

Bank will invest $9 million to increase credit opportunities for

communities of color in Jacksonville.

In December, the DOJ was joined by the CFPB, which announced a

suit against Colony Ridge, a Texas-based developer and lender, for

operating an allegedly illegal land sales scheme that targeted

Hispanic borrowers. The complaint, filed in the U.S. District Court

for the Southern District of Texas, alleges that Colony Ridge sells

borrowers “flood-prone land without water, sewer, or

electrical infrastructure” and then allows them to take out

loans they cannot afford, as evidenced by the fact that about one

in four Colony Ridge loans ends in foreclosure. Colony Ridge

allegedly targets Spanish-speaking borrowers by advertising almost

exclusively in Spanish, often via social media posts featuring

elements such as national flags and regional music from Latin

America. The complaint alleges violations of the CFPA, the ECOA,

the FHA, and, in a first for a federal court action brought by the

CFPB, the Interstate Land Sales Full Disclosure Act.

CFPB Enters Into $25 Million Consent Order With Payment

Processor Over Unauthorized Mortgage Payments

In June, the CFPB entered into a consent order with ACI Worldwide and one of

its subsidiaries, ACI Payments (ACI), for allegedly improperly

initiating approximately $2.3 billion in unlawful mortgage payment

transactions. ACI’s data handling practices negatively affected

nearly 500,000 homeowners. The CFPB alleged that although this

one-time event was discovered within hours of its occurrence and

ACI immediately set about to reverse the erroneous debits, by

unlawfully processing erroneous and unauthorized transactions, ACI

exposed homeowners to overdraft and insufficient funds fees from

their financial institutions. The order imposed, among other relief

measures, a $25 million civil money penalty.

New Jersey Division of Consumer Affairs Enters Into

Consent Order With National Mortgage Servicer

In July, the New Jersey Division of Consumer Affairs, Office of

Consumer Protection (the Division) entered into a consent order with a national mortgage

servicer. According to the Division’s press release, the

company, which was formerly licensed in New Jersey before

relocating to Florida, had violated the state’s consumer

protection laws in its mortgage sale and servicing practices.

Based on 1,400 nationwide complaints, the Division alleged that

the company violated the New Jersey Consumer Fraud Act, the

state’s advertising regulations, and the state’s

telemarketing do-not-call (DNC) law from January 2015 to June 2022.

Specifically, among other things, the servicer allegedly made

unsolicited telemarketing sales calls without being a registered

telemarketer, engaged in abusive and deceptive telemarketing

practices, engaged in “bait and switch” sales tactics,

did not timely disburse escrow payments or apply mortgage loan

payments (resulting in negative credit reporting and late fees),

and failed to timely escrow refunds and respond accurately to

consumer inquiries.

Pursuant to the consent order, the company agreed to a $502,000

settlement, including $365,200 in civil penalties and $136,800 in

reimbursement for attorneys’ fees and costs. The consent order

states that $50,000 of the civil penalties would be suspended

assuming the servicer complies with the terms of the settlement.

The servicer also agreed to appoint a complaint coordinator and

agreed that consumer complaints received by the Division would be

forwarded to the Division’s alternative dispute resolution unit

for binding arbitration if unresolved by the servicer.

CFPB Enters Into Consent Order With Mortgage Lender Over

Alleged Kickbacks

In August, the CFPB entered into a consent order with a Florida-based mortgage

lender, which agreed to pay $1.75 million into the CFPB’s

victim relief fund and cease allegedly illegal activities.

According to the CFPB, the mortgage lender had been providing real

estate agents and brokers with numerous incentives —

including cash payments, paid subscription services, and catered

parties — with the understanding they would refer prospective

homebuyers to the mortgage lender for mortgage loans, in violation

of RESPA and its implementing regulation. The CFPB separately

entered into an order with a real estate brokerage firm, Realty

Connect USA Long Island, in which the brokerage agreed to pay a

$200,000 penalty and cease its alleged unlawful conduct of

accepting numerous illegal kickbacks from the mortgage lender.

CFPB Initiates Multiple Enforcement Actions Over

Allegedly Inaccurate HMDA Reporting

In October, the CFPB filed another lawsuit against the same mortgage lender,

alleging that the company violated the Home Mortgage Disclosure Act

(HMDA), its implementing Regulation C, the CFPA, and a recent 2019

consent order. The mortgage lender allegedly reported HMDA data in

2020 that contained widespread errors, prompting the CFPB to file a

lawsuit in the Southern District of Florida seeking civil penalties

and injunctive relief.

The 2019 consent order alleged that the mortgage company

intentionally submitted mortgage loan data for 2014 through 2017

that misreported certain HMDA data fields, such as applicants’

race, ethnicity, and/or sex. The settlement that accompanied the

2019 consent order required the company to pay a civil money

penalty of $1.75 million and improve its compliance management to

prevent future violations. Despite the settlement and consent

order, the CFPB alleged that in 2020, the mortgage company

“collected, recorded, and reported inaccurate HMDA data”

and “did not maintain procedures reasonably adapted to avoid

errors in its 2020 HMDA data submission.”

Then, in November, the CFPB entered into a second HMDA-related

consent order, this time with a national bank,

under which the bank agreed to pay a $12 million civil money

penalty. In the consent order, the CFPB alleged that for at least

four years, hundreds of the bank’s loan officers failed to ask

mortgage loan applicants certain demographic questions as required

under HMDA, and that the loan originator then falsely reported that

the applicants had chosen not to respond to the demographic

questions.

Click to access all 12 chapters of our Consumer Financial Services 2023 Year in

Review, including a market overview about the industry overall

and chapters on 11 industry segments.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.