What sent the economy into recession at the end of last year? The government blames higher interest rates, ushered in by the Bank of England. The Bank in turn points the finger at shocks such as Russia’s war against Ukraine. Both are plausible answers – and certainly part of the equation. But the Office for National Statistics has offered up another explanation, one that the Chancellor Jeremy Hunt will be grappling with as he prepares for the Budget in two weeks’ time: mass worklessness.

‘If more people were in work, consuming, producing,’ said ONS chief economist Grant Fitzner when the recession was announced, ‘we would have higher GDP numbers.’ Those numbers would be quite a bit higher, according to The Spectator’s calculations. Had workforce participation stayed at the same rate as in 2019, the economy would be 1.7 per cent larger now and an end-of-year recession could have been avoided.

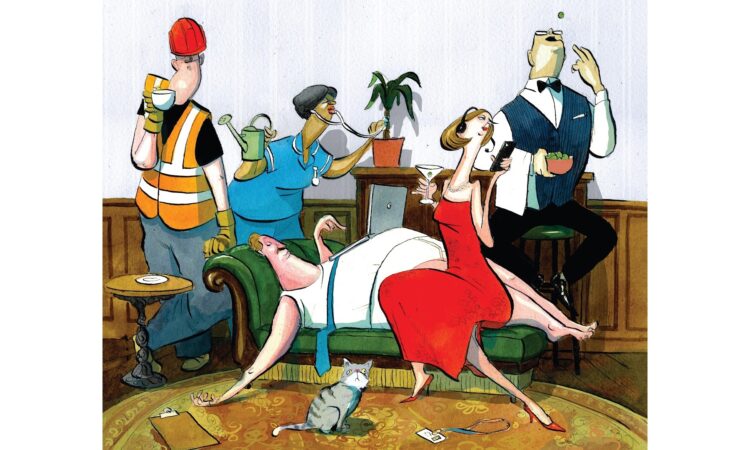

One factor seems to be the inability of medical and welfare services to help with mental health problems

On the face of it, the work crisis doesn’t make much sense. The UK’s unemployment rate is at a near-historic low of 3.8 per cent, but it’s a deceptive measure that only includes those looking for work. Several million are not looking for work. The number on out-of-work benefits has risen to 5.6 million, higher than in any period of British history, and some 4,000 new applications for sickness benefits are submitted every day.

In previous recessions, there were no jobs available. But UK employers are currently trying and failing to fill more than 900,000 vacancies – far more than at any time before the pandemic. For years, the government has been reliant on higher immigration figures for any chance of economic growth. But even with record levels of net immigration to the UK – 745,000 in 2022 – there is still this desperate shortage of workers. Neither the government nor the opposition want to talk about the crisis, because they don’t know how to solve it.

As things stand, joblessness is coexisting with job vacancies in a way that should be economically impossible. Employers are begging for workers, and yet over 22 per cent of the working-age population in Middlesbrough, for instance, is unemployed. In Hartlepool it’s 24 per cent; in Blackpool, 25 per cent. ‘We’re watching these people waste away,’ laments one Tory MP, ‘and we’re letting it happen.’ Another MP was horrified to discover that a big chain store in his constituency buses workers in from places an hour’s drive away because they can’t find enough local people who want the jobs.

The temptation is to blame the country’s economic woes on a ‘workshy’ Britain. But this time four years ago, on the eve of the first lockdown, UK workforce participation was at 79.5 per cent: its highest level since records began. Has the national character changed so much in so short a time? Or have the Tories created a web of benefits and taxes so complicated that they have removed the motivation to work from across the income spectrum?

When Rishi Sunak, as chancellor, introduced the furlough scheme in March 2020, he only intended it to last a few weeks. He was fully aware of the consequences that could arise from the government paying people to stay home, including the risk that people could fall out of the habit of work. In the event, his fears were proved right. The pandemic didn’t just unwind a decade of welfare reform – it created a mass of new incentives not to work.

Almost every EU member’s workforce has managed to recover since the pandemic, while the UK’s has not. In fact, Britain is one of only a handful of countries in the developed world whose workforce has not bounced back. Had the proportion of people in the UK workforce kept pace with that of the United States, there would be an additional 700,000 in employment. If it had kept pace with Canada, there would be more than 950,000 additional workers; with France, upwards of 1.2 million more. If the UK had achieved anything similar, it would be benefiting from smaller welfare bills and bigger tax receipts, not to mention a stronger society.

What has gone so badly wrong in Britain since the pandemic? Ministers are still trying to work it out, but one big factor seems to be the inability of Britain’s medical and welfare services to help with mental health problems. Even in 2019, a year before lockdowns, the number of working-age people who were off with long-term sickness had already risen to two million. Now it’s at almost three million. The Department for Work and Pensions forecasts say those on disability benefits will rise by another million – equivalent to a city the size of Leeds – in the next four years. Unlike with physical ailments (where efforts will often be made to make adjustments to keep people in work), a person who seeks help for severe anxiety or depression is more likely to be signed off work completely.

According to the ONS’s latest report, 53 per cent of people registered inactive with long-term sickness at the start of last year were reporting depression, bad nerves or anxiety as their main ailment, with the vast majority (more than a million) reporting one of these as a secondary health condition. Of those people assessed by welfare advisers, 80 per cent were categorised as too severely unwell to do any work at all. The ratio has doubled in the past decade.

All this wasted human potential is a scandal even before factoring in the financial cost, which threatens to cripple the next government. Working-age disability benefit spending is expected to rise from £19 billion to £29 billion over the next parliament, while the bill for working-age incapacity will jump from £26 billion to £34 billion.

In opposition, the Tories had plenty to say about the moral failure of consigning millions to welfare. Now, most MPs are silent. ‘I can’t think of even six people who will speak about this in parliament,’ says one ex-minister. ‘It doesn’t suit the Tories to admit to this, and Labour won’t highlight a problem they don’t know how to solve.’ Pilot schemes such as WorkWell – the brainchild of the Welfare Secretary Mel Stride, which is supposed to redirect claimants toward rather than away from work – are coming online at a snail’s pace. In the meantime, the expected rise in welfare costs alone equal the total cost of the justice system or the Foreign Office.

Then there are the pension costs. The trend of worklessness is not confined to those on lower pay. Many well-off older workers discovered during the pandemic that a few lifestyle changes meant they could opt out of work altogether. At the height of the exodus, more than 400,000 workers aged 50 to 64 left the jobs market; since then only about half have returned. The Treasury’s response to this has been mixed: on the one hand, the lifetime pensions allowance was lifted last March with the sole aim of getting older workers, especially those in medicine, to remain in the workforce. On the other, ministers once again committed to the triple lock on the state pension.

This requires tax hikes and creates a circular problem: workers are disincentivised from increasing their hours or pursuing promotions, as their efforts yield diminishing rewards. In April, the income tax to be paid by a cleaner working 35 hours a week on the minimum wage will be almost 50 per cent higher due to ‘fiscal drag’, the stealth tax whereby tax thresholds are frozen rather than raised in line with inflation. Some of the lowest-paid workers will be hit the hardest in proportion to their pay, with those on £16,000 losing £780 – equivalent to about 5 per cent of their earnings.

By 2028, some four million additional workers will be pulled into paying tax, with three million others moving into the higher rate. After tax, take-home pay rates are increasingly not worth the time required and the responsibilities demanded. A single parent working 30 hours a week could stand to lose 76p of every £1 they earned in extra work, due to the withdrawal of their universal credit and the loss of other benefits.

There are distortions at the other end of the income spectrum, too. Those who earn between £100,000 and £125,000 risk being drawn into the 62 per cent tax bracket, at which point they lose their personal allowance. (In Scotland, due to its new tax rises, it’s 69 per cent.) There is an incentive for those who have children to keep their wage below £99,999, so as to remain on the right side of the line for the ‘free’ extended childcare Hunt announced last year. Why anyone on a six-figure salary should be receiving welfare is a separate question, but such is the state of the trap-addled UK tax system.

In the 1970s, people spoke of a ‘British disease’: strikes, low capital investment rates, dire labour productivity and a sick economy. The same symptoms can be seen now, compounded by a work fatigue that the Tories have been unable to cure.

This article originally said the number on out-of-work benefits, at 5.6 million, is at at all-time high. In fact, it hit 5.9 million in 1993 and during lockdown in 2021.