Just 137 crypto miners use 2.3% of total U.S. power — government now requiring commercial miners to report energy consumption

The U.S Energy Information Administration (EIA) is now requiring large-scale commercial cryptocurrency mining operations to report their power consumption. This initiative is part of a larger effort to regulate and penalize cryptocurrency mining due to the exorbitant amount of energy the industry consumes yearly. For now, the EIA is only collecting data, but this new data should give birth to new regulations that will penalize miners in the future. This comes as the company has released a study (first reported on by Inside Climate News) suggesting that cryptocurrency mining represents up to 2.3% of U.S. power demand.

“We intend to continue to analyze and write about the energy implications of cryptocurrency mining activities in the United States…,” EIA administratior Joe DeCarolis said in a release in January. “We will specifically focus on how the energy demand for cryptocurrency mining is evolving, identify geographic areas of high growth, and quantify the sources of electricity used to meet cryptocurrency mining demand.”

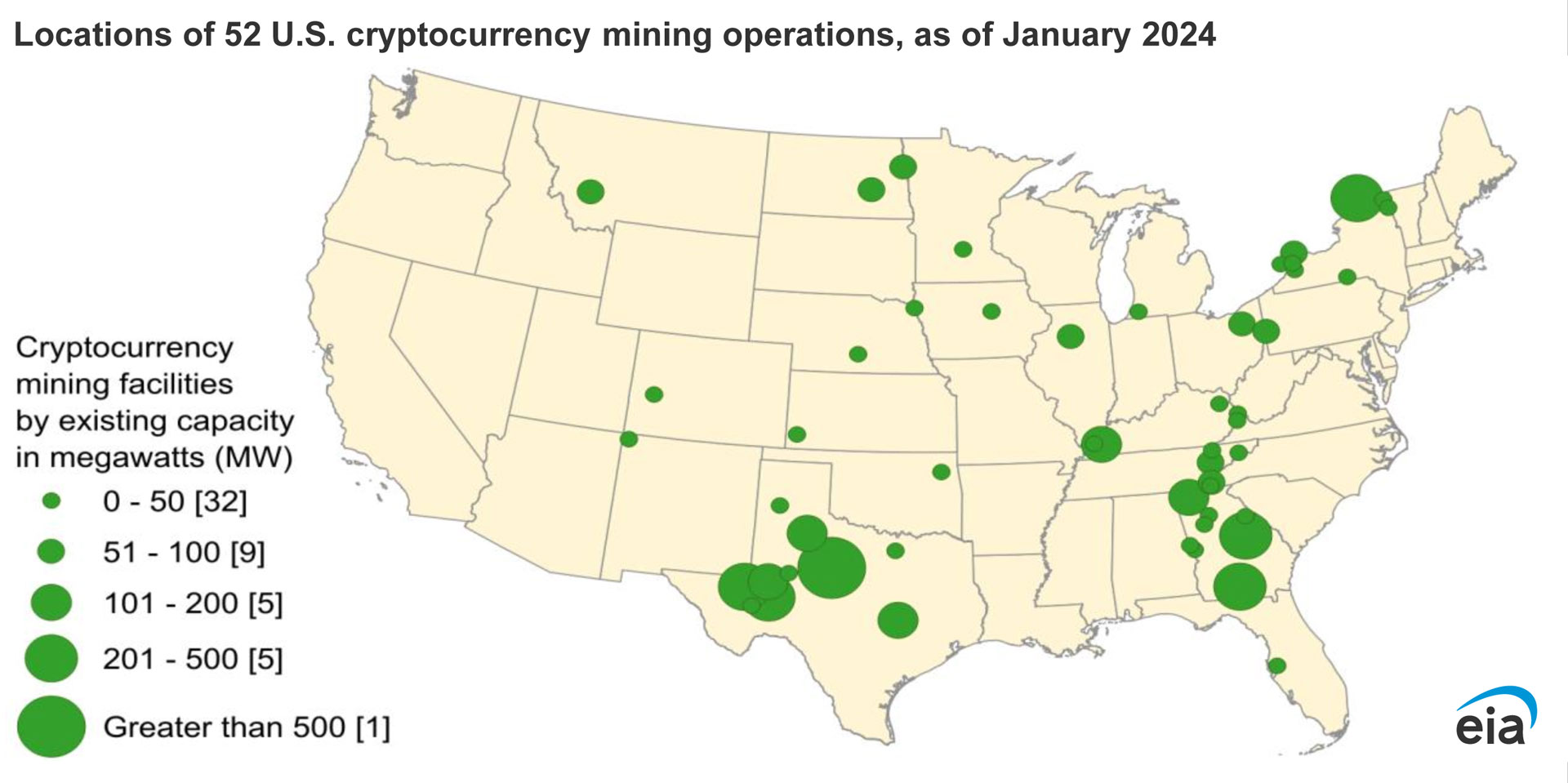

DeCarolis’ words summarize that the United States will pay close attention to the environmental challenges cryptocurrency mining might be causing. We can surmise that the United States government specifically wants to crack down on mining operations that impact the reliability and sustainability of power in highly populated areas. Potentially leading to higher residential power costs and power shortage issues during peak hours. As of January 2024, the EIA has identified 137 cryptomining facilities.

The EIA found that crypto-mining operations in the United States has grown substantially over the past few years, to the point where all U.S-based crypto-mining operations consume 0.6% to 2.3% of the nation’s entire electricity consumption alone. For comparison, the total U.S. Bitcoin mining industry consumes the annual power budget of Utah or West Virginia. The estimated power draw of Bitcoin mining worldwide is projected to be anywhere between 0.2% to 0.9% of global demand, equating to the same power draw as Greece or Australia by themselves.

Bitcoin mining is very power-hungry in the United States specifically due to the exorbitant amount of mining that actually takes place within U.S borders. The EIA found that the global share of Bitcoin mining that takes place in the U.S. grew from 3.4% in 2020 to a whopping 37.8% in 2022.

The incredible power demands of the Bitcoin industry are a result of the Bitcoin mining algorithm becoming more and more difficult every single year. Bitcoin today isn’t what it was eight to ten years ago, where you could mine it on a single computer and net a decent profit. Nowadays, Bitcoin needs to be mined on hundreds of specialized mining devices (ASICs) to be gathered at all. The continuous difficulty of the Bitcoin algorithm, in turn, creates higher and higher power costs as the cryptocurrency gets harder to mine.

We can expect this power phenomenon to become greater as Bitcoin grows in popularity. 2024 is expected to be one of the most eventful years in Bitcoin history, with the cryptocurrency expected to blow past its record $69,000 high sometime after its halving event in April (when the reward for Bitcoin mining is cut in half) thanks to reduced mining profit and large-scale institutional adoption.