CHUNYIP WONG/E+ via Getty Images

By James Smith

The mortgage squeeze is looking less aggressive

The UK economic outlook has started the year on a brighter footing. Green shoots are appearing in some of the sentiment indicators; most notable is the services Purchasing Managers’ Index (PMI), which has edged further into growth territory. That’s at odds with the wider eurozone, where the sector is still – at least judging by this survey – in modest contraction. After a year of stagnation – and perhaps even a very modest technical recession in the second half – we’re expecting modest and incremental positive quarterly growth through this year.

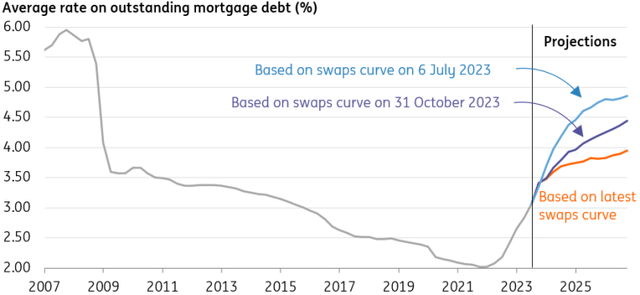

Much of this is down to the collapse in market rates. While that’s a boon for all economies, there are two ways in which this has a more direct feed-through in the UK than some of its neighbours. Twenty percent of mortgage holders will refinance this year, a higher proportion than in the likes of France and Germany, where longer-term fixes are more common. That means the average rate on outstanding lending will continue to rise this year. But the anticipation of rate cuts means this squeeze is much less aggressive than it had looked just a few months ago.

The average rate on outstanding mortgages won’t rise much further this year

Tax cuts are likely in March

Another direct impact of lower market rates is that it directly translates into extra “headroom” for the Chancellor. This is money that the Treasury can spend now (or cut in taxes) and still meet the fiscal rule of cutting debt as a percentage of GDP in five years’ time. Based just on the change in rate expectations, this extra headroom is likely to amount to roughly £12bn (in addition to £13bn left over in November). All in all, that leaves almost a percentage point of tax cuts that could be available, which would boost GDP by perhaps 0.2-0.4ppts this year, depending on the scope of what is announced.

At the same time, real wage growth is likely to be positive throughout this year. Inflation is set to fall below 2% in April, while nominal earnings growth is set to slow much less rapidly. Admittedly, we shouldn’t get too overexcited about the outlook. The jobs market is cooling, though for now not rapidly, while savings in real-terms are below the pre-Covid trend. Still, we think we should expect modest growth this year, and the chances of a near-term recession (i.e. not just a technical one) have faded.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.