Exchange-traded funds that focus on U.S. Treasury bonds are a simple way to add low-risk investment opportunities to a portfolio. These funds now come with an added benefit: higher yields without the kind of credit risk that could become a problem during a recession, when bond issuers have a hard time paying back the money they’ve borrowed.

We screened for U.S. Treasury ETFs and looked for the five with the highest yields. These funds are all yielding at least 4.38%.

- Vanguard Extended Duration Treasury ETF EDV

- SPDR Portfolio Long Term Treasury ETF SPTL

- Schwab Long-Term US Treasury ETF SCHQ

- Vanguard Short-Term Treasury ETF VGSH

- SPDR Portfolio Short Term Treasury ETF SPTS

Higher Treasury Bond Yields

Thanks to the Federal Reserve’s aggressive interest rate increases in 2022 and 2023, yields on U.S. Treasury bond funds have been at their highest levels in years.

For example, the highest-yielding fund in our group, Vanguard Extended Duration Treasury ETF, is paying out 4.43%. One year ago the yield stood at 3.75%, while two years ago it was 2.20%. Meanwhile, Vanguard Short-Term Treasury ETF is yielding 4.40%, little changed from one year ago but up significantly from 0.96% in February 2022. More broadly, the average yield on intermediate government bond funds is 3.47%. On short government bond funds, the average is 3.78%, while on long government bond funds it’s 3.85%.

Investors buying short-term bond funds must understand that because the funds hold bonds that mature in just a few months, those yields could also come down quickly should the Fed start to cut interest rates, as the market currently expects. That would mean the funds would have to buy new bonds at lower yields. Long-term bond ETFs are more sensitive to changes in interest rates than shorter-term bond ETFs. If interest rates fall, returns on longer-term funds would be expected to outpace those from short-term ones. The reverse would be true should rates rise again.

Comparing Yields On Bond Funds

One of the key comparison metrics here is the SEC yield, an annualized measure of what a fund has paid to investors over the past 30 days. That figure doesn’t reflect the yield investors would receive going forward.

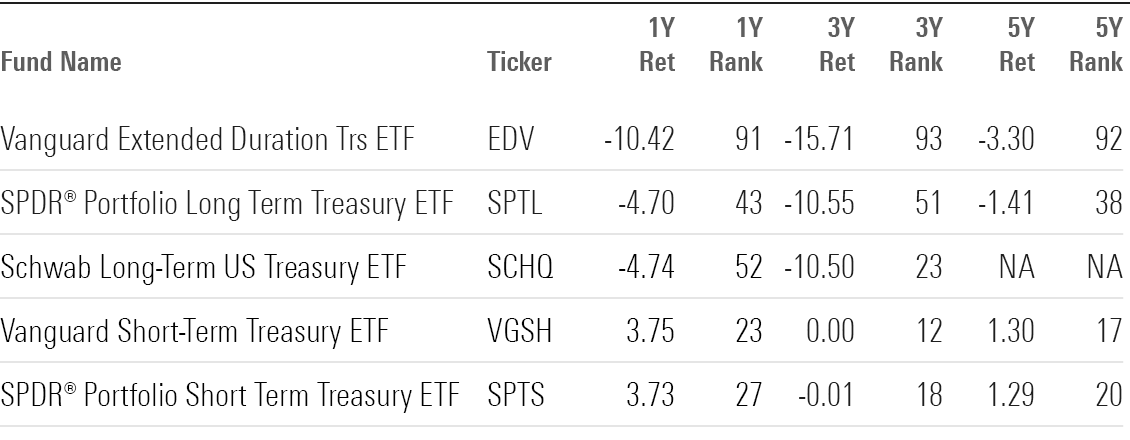

Morningstar associate analyst Zachary Evens notes that since Treasury funds all have similar credit quality, the main difference between them is their durations—how sensitive each investment is to changes in interest rates. As interest rates rose in 2022 and 2023, funds with longer durations suffered the most, but when interest rates began to fall late last year, longer-duration funds performed well.

Screening for High-Yielding U.S. Treasury ETFs.

For this screen, we perused government bond ETFs, limiting our search to funds that invest only in U.S. Treasury bonds. We looked for ETFs that carry Morningstar Medalist Ratings of Gold, Silver, or Bronze, as well as ETFs that have $100 million or more in assets. From there we ranked the ETFs based on their SEC yields, choosing the five highest. Four of the ETFs that passed the screen are in the long government bond category, while one is in the short category.

Vanguard Extended Duration Treasury ETF

SPDR Portfolio Long Term Treasury ETF

Schwab Long-Term US Treasury ETF

Vanguard Short-Term Treasury ETF

SPDR Portfolio Short Term Treasury ETF