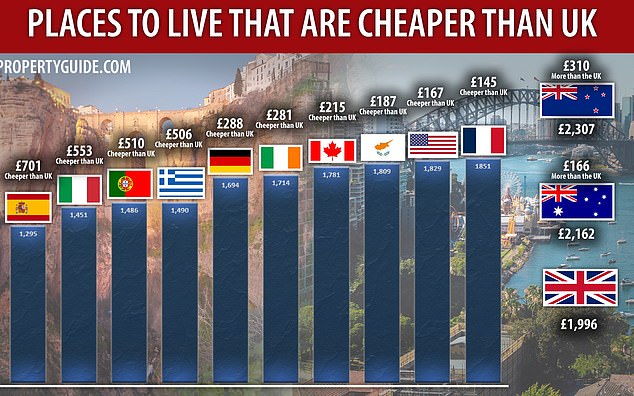

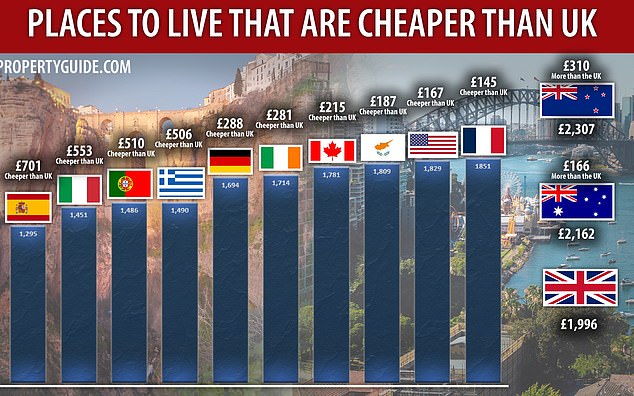

The countries cheaper to live in than the UK: How to be £700 better off and live in the sun by retiring to Spain

If you are jotting down dreams of retirement abroad then you should pop Spain at the top of your list.

Life in Spain is more than £700 a year cheaper than in the UK – and that’s before you account for the wealth of sunshine and delicious food.

Spain has been crowned the most affordable country to live in for UK expats in a report by overseas property expert Property Guides.

It found the same range of day-to-day expenditures, including groceries, healthcare, travel and leisure, which currently costs a total of £1,996 a year in the UK, costs just £1,295 in Spain.

That means you can enjoy the same standard of living in the Mediterranean country for 35 per cent less than in the UK – leaving you with £701 a year to spend on yourself.

Even great British staples like English breakfast teabags can be bought in Spain for less than they cost on the shelves in the UK.

Among the most popular countries for Britons to settle in, Italy ranked as the second cheapest, with prices £544 a year lower than in the UK.

Of the 13 expat hotspots around the world analysed by Property Guides, just two countries are more expensive to live in, according to the report.

Australia and New Zealand require a larger budget (£166 and £311 more, respectively) if you want to maintain the same lifestyle.

However, France, Portugal, Greece, Germany, Cyprus – and even the US – are all more affordable.

The results are perhaps no surprise after 18 months of high inflation at home.

Annual price rises in the UK slowed to the lowest level in more than two years at the end of last year, at 4 per cent in December, but the cost of living is still rising faster here than in most other developed countries.

By comparison, inflation in the Eurozone eased to 2.9 per cent in the year to December.

Christopher Nye, of Property Guides, says: ‘It seems harder and harder to make ends meet in the UK, and so more and more Britons are considering moving abroad for a more affordable, warmer and more exciting lifestyle.’

So how do prices compare and how easy is it to relocate if you’re dreaming of a retirement abroad?

If you are jotting down dreams of retirement abroad then you should pop Spain at the top of your list. Above: Calella de Palafrugell in Spain

Living in Spain

With the promise of 3,000 hours of sunshine a year, it’s no wonder millions have swapped Britain’s rainy weather for Spain’s warmer climate.

The country has a large expat community of more than 103,000 people receiving the British state pension in Spain as of 2020, according to the latest available official data.

And it’s a financially astute move as your retirement savings pot will stretch much further than in the UK.

The average weekly shop – a basket of 17 common grocery items, such as bread, fish and eggs – costs £27.76 less at a Spanish supermarket than on the British high street.

The same items in the UK would cost you almost 53 per cent more, at £79.99 versus £52.23, Property Guides finds.

Spanish supermarket prices are considerably cheaper for basic staples of the Spanish diet.

Alcohol tends to be far cheaper too – the report says that a bottle of gin would cost you £9.44 in Spain, compared to £25 in the UK.

The cost of travelling around, including petrol, train fares and hiring a car, is also far cheaper.

Hiring a small car in Spain for one week (with no insurance or extras) is £73, compared with £238 in the UK, according to the report.

When it comes to enjoying the local cuisine, like a traditional paella coupled with a fruity sangria, a three-course meal in a local restaurant will cost just £15 in Spain – £10 cheaper than in the UK.

Similarly, a cinema ticket would set you back just £7, less than half the price it is in the UK.

Among the most popular countries for Britons to settle in, Italy ranked as the second cheapest, with prices £544 a year lower than in the UK. Above: Cirie in Italy, the second cheapest country

Living in France

The country is an established British expat favourite, whether you dream of a chateau in a provincial village, a villa on the Mediterranean coast or a chalet in the mountains.

While life there is not quite as cheap as Spain, it remains around 7 per cent cheaper than in the UK, according to Property Guides.

France ranked fifth most affordable on the grocery front, coming in at £67.79 for a basket of supermarket essentials and a few luxury items, including a bottle of gin and a bar of dark chocolate. Fresh produce is markedly cheaper when in season, the report finds.

Wine lovers will be able to indulge – a bottle of house wine in a local mid-range restaurant costs just £13 in France compared to £20 in the UK.

Electricity in France is also markedly cheaper than in the UK, Spain, Cyprus and Portugal – with the average weekly consumption costing less than half than in the UK.

Anyone seeking sun Down Under will need a bigger budget to see them through retirement – as costs tend to be higher than in the UK

…but Down Under will cost more

Anyone seeking sun Down Under will need a bigger budget to see them through retirement – as costs tend to be higher than in the UK.

Food, healthcare, furnishing your home, eating out and car hire cost more in Australia and New Zealand, according to Property Guides.

The average shopping basket costs an extra £13.14 a week in Australia, while treating yourself to a three-course meal in a local mid-range restaurant (not including drinks) will set you back an extra £6.40, at £31.35, compared with the UK.

You would make savings on your fuel – with 50 litres of unleaded petrol costing 40 per cent less in Australia than in the UK at £46.50 versus £77.

However, these savings are not enough to outweigh other higher costs, the report finds. It would cost you an additional £166 per year to fund your lifestyle in Australia.

And that’s before you factor in the state pension penalty. Anyone hoping to move there must be aware that their British state pension would be frozen from the time they arrive in Australia.

The state pension increases every year in the UK by the higher of wage growth, inflation or 2.5 per cent, under a policy called the triple lock. But, unlike many European countries, this does not apply to those overseas in Australia.

British retirees’ state pensions are also frozen for those living in New Zealand, Canada and South Africa.

More than 480,000 pensioners living overseas did not receive any increases in the state pension each year as of March 2022, according to official figures. In total, 84 per cent of those lived in Australia, Canada and New Zealand.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.