Core inflation in the US “fell to 1.5% on a three-month basis and 1.9% on a six-month basis. This marks the second consecutive month where core inflation has been below 2% on a six-month basis,” said Brainard.

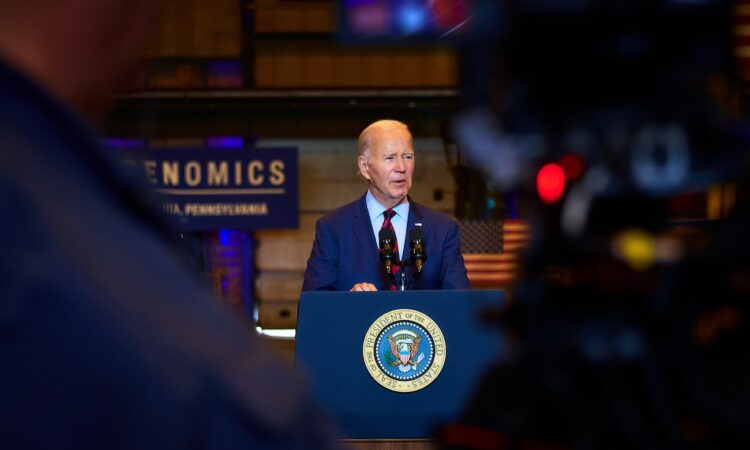

Brainard delivered her summary on the US economy on January 26th, 2024. Contrary to forecasts made a year ago predicting a contraction in the US economy in 2023 and a surge in unemployment, the actual outcome proved otherwise. The economy experienced growth exceeding 3%, and the unemployment rate remained below 4% throughout the entire year, all while inflation decreased.

The overall personal consumption expenditures price index rose by 2% for the month, mirroring the increase in the core index that excludes food and energy costs. Both figures aligned with the estimated values. On an annual basis, the overall index remained steady at 2.6%, while the core index decreased from 3.2% in November to 2.9%.

The uptick in the core index marked the slowest rate of increase since the spring of 2021. Fed officials frequently refer to the core index as their primary gauge for inflation.

Meanwhile, personal income experienced a modest growth of 0.3% in December, accompanied by a robust 0.7% increase in spending.

Notably, economic growth has outpaced the Congressional Budget Office’s (CBO) February 2021 forecast, which predates the American Rescue Plan. The GDP is now more than 8.2% higher than pre-pandemic levels, surpassing the growth of any other G-7 economies.

One of the reasons the economy has outperformed forecasts is the unexpected expansion of the labor supply. In comparison to the pre-American Rescue Plan CBO forecast, the workforce has grown to 167.8 million, with nearly 3 million more Americans now participating in the labor force.

Since the start of the Biden administration, household wages and salaries have outpaced price growth by $3,500, according to the latest Survey of Consumer Finances. The survey highlights historic increases in wealth alongside decreases in credit card debt and student loan balances.”

Brainard concluded that the US economy ended the year in a “healthy position” and headed into 2024 “stronger than forecast.”