Quarterly non-financial accounts for general government

Government revenue and expenditure

Both total revenue and expenditure exhibit a clear seasonality. In order to interpret trends for the most recent quarters, seasonally adjusted data is presented in addition to the non-seasonally adjusted data transmitted by EU Member States (see explanation below).

In the third quarter of 2023, seasonally adjusted general government total revenue in the euro area (EA20) amounted to 46.5 % of GDP. An increase compared with 46.1 % in the second quarter of 2023 was due to an increase of seasonally adjusted government total revenue in absolute terms as well as a comparatively lower growth in nominal GDP. In absolute terms, seasonally adjusted total revenue in the euro area increased by around €23 billion compared with the second quarter of 2023. Total government expenditure in the euro area stood at 49.3 % of GDP, an increase in the ratio compared with 49.1 % of GDP in the previous quarter, due to an increase in seasonally adjusted total government expenditure by around €15 billion as well as a comparatively lower increase in nominal GDP.

In the EU, government total revenue was 46.0 % of GDP in the third quarter of 2023, an increase compared to 45.7 % in the second quarter of 2023. Seasonally adjusted total revenue in the EU increased by around €24 billion compared with the second quarter of 2023. Total government expenditure in the EU was 48.8 % of GDP, an increase compared with 48.7 % of GDP in the previous quarter. Seasonally adjusted total expenditure increased by around €16 billion compared with the previous quarter.

Source: Eurostat (gov_10q_ggnfa)

Source: Eurostat (gov_10q_ggnfa)

From the third quarter of 2010 onwards, a decreasing trend in the level of the total expenditure-to-GDP ratio was visible, reflecting an absolute decrease in total expenditure in some quarters as well as the effects of renewed economic growth in the EU and the euro area (all seasonally adjusted). In the fourth quarter of 2012 and in the second quarter of 2013, total expenditure increased slightly in both areas, influenced by interventions to support the banking sector in several EU Member States, notably in Spain in the fourth quarter of 2012 and in Greece in the second quarter of 2013. Supports for the banking sector in several EU Member States are also the main reason for the increase in the fourth quarter of 2015.

At the level of the euro area and EU, the lowest deficits in the time series available are observed in the first and second quarter of 2018, amounting to -0.2 % and -0.1 % of quarterly GDP respectively.

The decreasing trend in general government deficits was broken in the first quarter of 2020, when EU Member States began to introduce expenditure measures to mitigate the economic and social impact of the COVID-19 pandemic. Strong decreases in total revenue mainly due to declines in economic activity and tax cuts introduced by governments and increases in total expenditure have been observed since this period. This change in trend was accelerated in the second quarter of 2020 when the measures fully came into effect in most EU Member States – in the second quarter of 2020, at the level of the EU and euro area, the highest deficit-to-GDP ratios in the time series were observed (-11.7 % of GDP in the EU, -12.0 % of GDP in the euro area). In the third quarter of 2020, government revenue and expenditure continued to be influenced by policy responses to the COVID-19 pandemic but less severely than in the previous quarter. In many EU Member States the economies opened up in the third quarter after having been in lock down. In the fourth quarter of 2020, the reduction was reversed as the COVID-19 pandemic worsened and government measures to mitigate the impact of the pandemic had a stronger influence on total expenditure.

In the first and second quarters of 2021, the deficits remained at a high level although generally lower than the fourth quarter of 2020, this was mainly driven by lower expenditure as percentage of GDP as well as renewed growth in nominal GDP. In the third and fourth quarters of 2021 as well as in the first quarter of 2022, the deficit-to-GDP ratio continued to decline supported by higher revenue, a decrease in expenditure as well as due to a higher GDP, but remained at a high level compared with the pre-pandemic period.

In the second quarter of 2022, the seasonally adjusted deficit in the EU declined further to -2.3 % of GDP, its lowest level since the start of the COVID-19 pandemic. In the third quarter of 2022, the seasonally adjusted deficit in the EU grew again, mainly due to the impact of measures to alleviate the impact of high energy prices and continued to increase in the fourth quarter of 2022 to stand at -4.9 % of GDP. In many EU Member States, measures were taken to temporarily lower taxes on energy products and expenditure was increased by measures to subsidise energy products and support household income. Measures to alleviate the impact of high energy prices continued to impact the first three quarters of 2023, although in the first quarter of 2023, the deficit declined to -2.8 % of GDP in the EU and -3.0 % of GDP in the euro area, respectively. This stronger decrease in deficit in the first quarter of 2023 from -4.9 % in the previous quarter is due to decreases in total expenditure as well as increases in nominal GDP. In the second quarter of 2023, the growth in seasonally adjusted total expenditure outpaced the growth of seasonally adjusted total revenue in the EU and euro area, while in the third quarter of 2023, the seasonally adjusted total revenue increased more than the seasonally adjusted total expenditure in the EU and euro area, leaving the seasonally adjusted general government deficit to stand at -2.8 % of GDP in the EU and euro area.

_net_borrowing_(-),_total_expenditure_an.png)

Source: Eurostat (gov_10q_ggnfa), seasonally adjusted data: Eurostat and National Statistical Institutes estimates

Source: Eurostat (gov_10q_ggnfa), seasonally adjusted data: National Statistical Institute estimates

Source: Eurostat (gov_10q_ggnfa)

General government deficit

The difference between general government total revenue and total expenditure is known in ESA 2010 terminology as general government net lending (+) / net borrowing (-) (ESA 2010 category B.9) and is usually referred to as government deficit (or surplus). This figure is an important indicator of the overall situation of government finances. It is usually expressed as a percentage of GDP.

Government deficits were more volatile during the COVID-19 pandemic as a result of the varying responses to mitigate its effects such as active policy measures as well as the economic effects of lock-downs. In the second quarter of 2020, the highest deficit in the euro area (-12.0 %) and the EU (-11.7 %) since the start of the time series was recorded.

By contrast, the lowest deficit-to-GDP ratio in the available time series occurred in the first quarter of 2018 for the euro area (-0.2 % of GDP) and the second quarter of 2018 in the EU (-0.1 % of GDP).

_net_borrowing_(-),_seasonally_and_non-adjusted_data,_%.png)

Source: Eurostat (gov_10q_ggnfa)

The main part of government revenue are taxes and social contributions. During economic downturns, tax revenue and social contribution revenue decrease even in the absence of fiscal policy changes as an automatic stabiliser. This is because the underlying tax bases decrease. In the second quarter of 2020, large decreases in the seasonally adjusted total government revenue were observed, amounting to €-123 billion in the euro area and €-131 billion for the EU compared with the first quarter of 2020. However, in the third quarter of 2020, seasonally adjusted government total revenue grew by €92 billion in the euro area (€107 billion for the EU) compared with the second quarter of 2020. From the fourth quarter of 2020 onwards, total seasonally adjusted revenue in the euro area and EU continued to increase up until the second quarter of 2023. The increases constitutes a sharp rebound compared with the second quarter of 2020 and as result the euro area seasonally adjusted total revenue reached the levels observed prior to the pandemic already in the first quarter of 2021. The seasonally adjusted revenue in both the euro area and in the EU expressed in € billion increased further in all quarters of 2022, the first quarter of 2023, the second quarter of 2023 as well as in in the third quarter of 2023 when seasonally adjusted general government total revenue increased by €23 billion in the euro area and €24 billion in the EU. A relatively lower pace of growth in recent quarters can partly be attributed to temporary tax cuts in many Member States in response to the high energy prices.

Source: Eurostat (gov_10q_ggnfa)

In the second quarter of 2020, all countries set up or expanded specific (expenditure) measures in order to mitigate the economic downturn caused by the COVID-19 pandemic. This, as well as an increased use of existing (social security) schemes, explains the increase in seasonally adjusted total expenditure by around €112 billion in the euro area (€138 billion for the EU) compared with the first quarter of 2020. In the third quarter of 2020, seasonally adjusted total government expenditure decreased by €-35 billion (€-46 billion for the EU) compared with the second quarter of 2020 due to a lesser impact of COVID-19 policy measures as economies started opening up. This was however reversed in the fourth quarter of 2020 as expenditure increased again by €47 billion for the euro area and €54 billion for the EU compared with the third quarter of 2020. Lower increases followed in the first and second quarters of 2021 before reversing to a decline in the third quarter of 2021. In the fourth quarter of 2021, expenditure increased again by €36 billion for the euro area and €51 billion for the EU.

In the first quarter of 2022, the seasonal adjusted expenditure decreased by -€17 billion for the euro area and €19 billion for the EU, compared with the fourth quarter of 2021. This decline occurred despite government support to households and businesses to alleviate the impact of increasing energy prices. In the second quarter of 2022, the growth path of the seasonally adjusted expenditure reversed to an increase, by €27 billion for the euro area and €34 billion for the EU, followed by a more rapid increase in the third quarter of 2022 of €68 billion for the euro area and €76 billion for the EU. In the fourth quarter of 2022, the increase was relative high, €60 billion for the euro area and €74 billion for the EU.

In the first quarter of 2023, the sharpest decline in seasonally adjusted total expenditure in the available time series is observed: -€51 billion for the euro area and -€59 billion for the EU. This decline of seasonally adjusted total expenditure observed for the first quarter of 2023 is despite inflationary pressures. The decline however reversed to an increase in the second quarter of 2023 when seasonally adjusted total expenditure grew by €17 billion for the euro area and €37 billion for the EU. The seasonally adjusted total expenditure grew on a slower pace in the third quarter of 2023, by €15 billion for the euro area and €16 billion for the EU.

In Eurostat’s public database, seasonally adjusted and calendar day adjusted total revenue and total expenditure data of EU Member States and EFTA countries, which provide seasonally adjusted and calendar day adjusted data for total revenue, total expenditure and net lending (+) / net borrowing (-) in addition to the non-seasonally adjusted data, is presented in full detail. This data is provided on a voluntary basis by the EU Member States’ statistical authorities.

Source: Eurostat (gov_10q_ggnfa)

Quarterly financial accounts for general government

Financial transactions – assets, liabilities and net financial transactions

The government financial accounts notably allow for an analysis of how governments finance their deficits or use their surpluses to either reduce their liabilities or acquire financial assets. They include data on financial transactions (net acquisition of financial assets and the net incurrence of financial liabilities) and balance sheet items (stocks of financial assets and liabilities outstanding at the end of each quarter) for general government and its subsectors. Variations in stocks are explained both by the transactions and by other factors such as holding gains and losses and other changes in volume. The aim of this section is to present the main characteristics of the general government financial accounts.

From the fourth quarter of 2008 onwards, the fluctuation of transactions in both assets and liabilities increased sharply due to the economic and financial crisis, resulting in increasing negative figures in net financial transactions (ESA 2010 category B.9f). This is interpreted as the government deficit/surplus derived from financial accounts. It shows how the deficit is financed by incurring liabilities or the disposal of financial assets. Contrary to the government deficit/surplus, net financial transactions are not seasonally adjusted. The increase and peaks in transactions in financial assets can be explained by governments having acquired such assets to support financial institutions, for example acquiring an equity stake or providing a loan. The worsening economic climate also led to an increase in government total expenditure, while revenue decreased. For these reasons, governments also needed to incur liabilities.

Source: Eurostat (gov_10q_ggfa)

Net financial transactions continued to deteriorate steadily from the second quarter of 2008 to the first quarter of 2010 for the euro area and the EU. From the first quarter of 2010 until the second quarter of 2018 onwards gradual improvements were visible.

In the first quarter of 2020, net financial transactions started to worsen due to higher growth of liabilities compared with assets. In the second quarter of 2020, the net financial transactions continued to sharply decrease. The policy responses to the containment measures increased the financing needs for governments. Part of the financing was used for the accumulation of assets, notably in deposits, but also in other accounts receivable as a consequence of deferral of tax and social contribution payment deadlines widely introduced in EU Member States. In the third quarter of 2020, net financial transactions mainly reflected the financing of the deficit. In the fourth quarter of 2020, the governments disposed of some of their accumulated deposits to finance the deficit. In the first quarter of 2021, net financial transactions in liabilities mainly reflected the financing of the deficit as well as the accumulation of assets (notably deposits), itself driven by net issuances of debt liabilities. For the periods between the second quarter of 2021 and the second quarter of 2022, net financial transactions in liabilities again reflected the need to finance the deficit as well as the acquisition of assets. For the third and the fourth quarter of 2022, the main contributor to the change in debt was the financing of the deficit, while a net disposal of financial assets was also recorded (relating mainly to deposits as well as other accounts receivable). In the first and the second quarter of 2023, the debt increased mainly due to the need to finance the deficit as well as due to a net acquisition of financial assets. In the third quarter of 2023, the financing of the deficit explained the main part of the change in debt of the euro area.

Source: Eurostat (gov_10q_ggfa)

Government financial balance sheet

At the level of the EU and the euro area, a significant rise in the stocks of liabilities was observed since the fourth quarter of 2008, together with an increase in assets which was less pronounced. The rise in the stock of liabilities was mainly due to debt securities, which are by far the most important financial instrument on the government liability side. The stock of loan liabilities also increased substantially. The remainder of financial liabilities are mainly ‘other accounts, payable’.

In the second and third quarters of 2020, the stock of financial assets increased due to the policy responses to the pandemic both in the EU and the euro area. Notably, increases in deposits as well as other accounts receivable, the latter mainly relating to the deferral of taxes and social contributions that were accrued as revenue but not yet paid, were observed.

The stock of liabilities increased as a percentage of GDP between the first quarter of 2020 and the first quarter of 2021 mainly due to the issuance of debt securities. This increase was sharper and far more pronounced than the one observed in the financial crisis. The stock of liabilities reversed to a decrease in the second quarter of 2021, with stronger decreases observed in the first three quarters of 2022, the latter mainly being due to negative revaluations of government debt securities reflecting rising interest rates which outpaced the issuance of debt securities. Although on a slower pace, the stock of liabilities continued to decrease in the fourth quarter of 2022 again mainly due to negative revaluations. In the first quarter of 2023, the stock of liabilities increased slightly due to net issuances of debt securities (6 % of GDP) partly offset by a negative revaluation (-4.8 % of GDP). In the second quarter of 2023, the stock of liabilities decreased due to negative revaluation of debt securities (-4.0 % of GDP) which were partly offset by the net issuance (3.8 % of GDP). In the third quarter of 2023, the stock of liabilities decreased further, again due to negative revaluation of debt securities (-4.5 % of GDP) which were only partly offset by the net issuance (2.8 % of GDP).

Source: Eurostat (gov_10q_ggfa)

Source: Eurostat (gov_10q_ggfa)

At the level of the EU, the major part of the stock of financial assets is held in equity and investment fund shares (for example stakes in public corporations), with currency and deposits (these exhibit a strong seasonality), other accounts receivable, loans and debt securities also making up important parts. In the second quarter of 2020, the stock of currency and deposits increased the most of all financial instruments. Between the second and the fourth quarter of 2021, the stocks of financial assets remained relatively stable as a percentage of GDP, while in declining trend is observed for the quarters of 2022. In the first quarter of 2023, the stock of total assets increased due to more currency and deposits and a higher stock of equity, while decreases were observed in loans and other accounts receivable. In the first quarter of 2023, the stock of total assets decreased or remained unchanged for all financial instruments, with the most pronounced decline visible for the stock of equity. In the third quarter of 2023, the stock of total assets decreased mainly due to lower stock of equity, as well as decline in currency and deposits, loans and other accounts receivable.

In all quarters of 2022, the stock of equity and investment fund shares declined as a percentage of GDP. In the first, second and third quarter of 2022, this was the main driver behind the decrease in the stock of total assets as a percentage of GDP. Equity includes the shares held in the National Central Bank, the value of which is influenced by the revaluation of the monetary reserves. In the fourth quarter of 2022, the overall decline in financial assets was mainly due to a decrease in deposits. It is not uncommon that governments decrease their deposits during the fourth quarter of a year, while increasing their deposits in the first quarter. Indeed, in the first quarter of 2023, the stock of currency and deposits increased in the EU and euro area followed again by decline in the second quarter of 2023. In the second and the third quarters of 2023, at the level of the EU, the stock of financial assets also declined due to decreases in the stock of equity and the stock of loan assets.

Source: Eurostat (gov_10q_ggfa)

Source: Eurostat (gov_10q_ggfa)

The difference between the stock of financial assets and liabilities is the balancing item net financial worth.

Source: Eurostat (gov_10q_ggfa)

Compared with the fourth quarter of 2020, when the balancing item net financial worth for the EU stood at -66.5 % of GDP, the net financial worth continued to improve in all quarters up to the fourth quarter of 2022 where it stood at -48.9 % of GDP. This improvement was influenced by negative revaluations of government debt security liabilities. In the first quarter of 2023, the net financial worth for the EU declined to -49.2 % of GDP while improvement to -48.9 % of GDP and to -47.8 % of GDP is observed in the second and the third quarter of 2023, respectively.

In the EU, the stock of financial assets stood at 39.1 % of GDP at the end of the third quarter of 2023 (a decrease compared with 41.8 % of GDP at the end of the third quarter of 2022) and the stock of liabilities also declined from 91.6 % of GDP at the end of the third quarter of 2022 to 86.9 % of GDP at the end of the third quarter of 2023. The stock of financial assets and liabilities changes due to financial transactions as well to ‘other flows’ such as revaluations. Between the first quarter of 2020 and the first quarter of 2021, the stock of debt securities increased substantially due to transactions because of increased financing needs of governments, with the one exception in the fourth quarter of 2020, when there was a small net repurchase. Starting from the second quarter of 2021, the stock of debt securities at market value decreased as positive net transactions were offset by larger negative revaluations. In the third quarter of 2023, the stock of liabilities decreased as the positive net transactions were offset by negative revaluations.

Source: Eurostat (gov_10q_ggfa)

Source: Eurostat (gov_10q_ggfa)

Quarterly gross debt for general government

At the end of the third quarter of 2023, the general government gross debt-to-GDP ratio in the euro area (EA20) stood at 89.9 %, compared with 90.3 % at the end of the second quarter of 2023. In the EU, the ratio also decreased from 83.0 % to 82.6 %. Compared with the third quarter of 2022, the government debt-to-GDP ratio also decreased in both the euro area (from 92.2 % to 89.9 %) and the EU (from 84.6 % to 82.6 %).

At the end of the third quarter of 2023, debt securities accounted for 83.6 % of euro area and for 83.1 % of EU general government debt. Loans made up 13.6 % and 14.1 % respectively and currency and deposits represented 2.8 % of both euro area and EU government debt. Due to the involvement of EU Member States’ governments in lending to certain Member States, quarterly data on intergovernmental lending (IGL) are also published. The IGL as percentage of GDP at the end of the third quarter of 2023 stood at 1.5 % in the euro area and at 1.3 % in the EU.

The highest ratios of government debt to GDP at the end of the third quarter of 2023 were recorded in Greece (165.5 %), Italy (140.6 %), France (111.9 %), Spain (109.8 %), Belgium (108.0 %) and Portugal (107.5 %), and the lowest in Estonia (18.2 %), Bulgaria (21.0 %), Luxembourg (25.7 %), Sweden (29.7 %) and Denmark (30.1 %).

Source: Eurostat (gov_10q_ggdebt)

Compared with the second quarter of 2023, nine Member States registered an increase in their debt to GDP ratio at the end of the third quarter of 2023 and eighteen a decrease. The largest increases in the ratio were observed in Belgium (+2.1 percentage points (pp)), Latvia (+1.9 pp), Slovenia (+1.0 pp) and Romania (+0.8 pp), while the largest decreases were recorded in Cyprus (-5.6 pp), Luxembourg (-2.6 pp), Portugal (-2.5 pp), Croatia (-2.2 pp), Italy (-1.8 pp), Greece (-1.6 pp), Spain (-1.4 pp), the Netherlands and Slovakia (both -1.0 pp).

Source: Eurostat (gov_10q_ggdebt)

Compared with the third quarter of 2022, eight Member States registered an increase in their debt to GDP ratio at the end of the third quarter of 2023 and nineteen Member States a decrease. Increases in the ratio were recorded in Belgium (+2.5 pp), Estonia (+2.3 pp), Finland (+2.0 pp), Latvia (+1.3 pp), Slovakia, Romania and Luxembourg, (all three +1.0 pp) as well as Lithuania (+0.4 pp). The largest decreases were observed in Greece (-12.0 pp), Portugal (-10.9 pp), Cyprus (-10.3 pp), Croatia (-5.5 pp), Ireland (-4.9 pp), Spain (-4.2 pp), Sweden (-4.0 pp), Austria (-3.1 pp) and Slovenia (-3.0 pp).

Source: Eurostat (gov_10q_ggdebt)

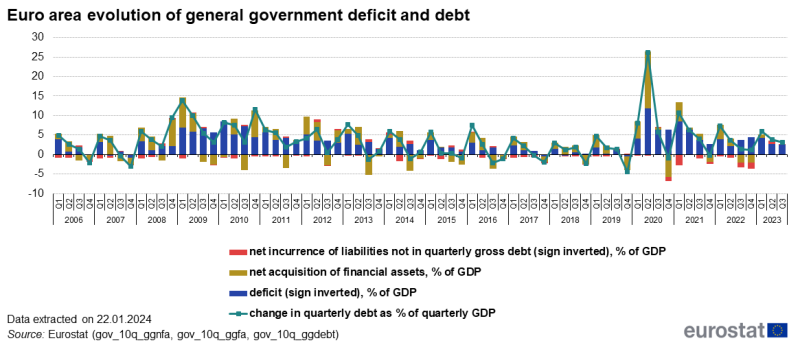

Evolution of deficit and debt

The figure below shows some of the most important links between the quarterly deficit and the quarterly debt for the euro area. Generally, the movement in government debt can be linked with the government balance: in case a deficit is observed, one would expect to see an increase in debt, in case of a surplus, some of it could be used to repay debt. However, this is not necessarily the case. Deficits can also be financed by the sale of financial assets, or alternatively, debt can be raised to finance the acquisition of financial assets. Therefore, in addition to the surplus/deficit, a strong co-movement of the net acquisition of financial assets with the evolution of quarterly debt exists. The incurrence of liabilities not covered in the definition of the general government gross debt (mainly ‘other accounts, payable’), as well as valuation differences and discrepancies, also play a role in explaining the change in debt.

Source: Eurostat (gov_10q_ggdebt)

Since the first quarter of 2020, at the level of the euro area, deficits (non-seasonally adjusted) started increasing because of the COVID-19 containment measures and policy responses to mitigate the economic and social impact of those containment measures. This was in particular the case in the second quarter of 2020, where the highest deficit since the start of the series was recorded (-12.0 % of quarterly GDP). The financing of the deficit explained around half of the increase in gross debt for the first and second quarters of 2020. The net acquisition of financial assets explains further the debt increases in the first and second quarters of 2020, implying that the increase in debt was a lot higher than the deficit. Notably, increases in deposits as well as other accounts receivable, the latter relating to the deferral of taxes and social contributions that were accrued as revenue but not yet paid, are observed in the first two quarters of 2020. In the third quarter of 2020, the financing of the deficit explained the main part of the increase in debt. In the fourth quarter of 2020, at the level of the euro area, the deficit was financed for the major part by the disposal of assets (including reductions in deposits accumulated with major debt issuances in the first and second quarters) rather than by incurring additional debt. An increase in liabilities not part of Maastricht debt (notably other accounts payable) also contributed.

In the first three quarters of 2021, the change in debt was mainly attributable to the financing of the deficit, although the net acquisition of financial assets contributed positively in the first quarter of 2021, while the incurrence of liabilities not in the Maastricht debt contributed negatively. In the fourth quarter of 2021, at the level of the euro area, the deficit was financed mainly by the disposal of assets rather than by incurring additional debt. An increase in liabilities not part of Maastricht debt (notably other accounts payable) also contributed.

In the first and second quarter of 2022, the change in euro area debt was due to the financing of the deficit as well as a net acquisition of financial assets. In the third and the fourth quarter of 2022, the change in debt related in part to the financing of the deficit, while part of the deficit was also financed through a net disposal of financial assets (again, mainly related to deposits). In all quarters of 2022, particularly in the fourth quarter, an increase in liabilities not part of Maastricht debt (mainly other accounts payable) also contributed.

In the first three quarters of 2023, the main reason for the increase in debt was the financing of the deficit, with the net acquisition of financial assets contributing to a lesser extent. Notably, in the third quarter of 2023, the financing of the deficit (2.5 % of GDP), explained the main part of the change in gross debt (3.1 % of quarterly GDP) of the euro area. At the same time, the effects of the net acquisitions of financial assets (-0.2 % of GDP) were fully offset with the effects of net incurrences of liabilities not included in Maastricht debt (0.2 % of GDP). Other adjustments comprise notably certain revaluations of debt, adjustments between transactions and the change in stock at face value as well as discrepancies (0.6 % of GDP).

Data sources

Please refer to the country notes on Eurostat’s metadata (ESMS) for more important information at country level.

Since the first quarter of 2020, Member States have implemented COVID-19 containment measures. In all quarters of 2022 and the first three quarters of 2023, the impact of the measures to mitigate the economic and social impact of the COVID-19 pandemic had a significantly lower impact than in quarters of 2020 and 2021. However, government revenue and expenditure continued to be impacted by the measures undertaken by most Member States to alleviate the impact of increasing energy prices. Country specific explanatory metadata are published.

A full harmonisation of recording practices for measures to alleviate the impact of increasing energy prices was not yet achieved. Revisions in the coming quarters are thus expected to be larger than usual. Data for the first and second quarters were significantly revised compared to the previous release.

All quarterly government finance statistics data for the first three quarters of 2023 have been labelled provisional, due to the likelihood of future revisions.

Gross domestic product

Throughout this publication, gross domestic product (GDP) at current prices (nominal) is used, either using the non-seasonally adjusted or the seasonally and calendar adjusted forms as appropriate.

Context

Quarterly accounts of general government

Eurostat releases quarterly flow and stock data for the general government sector, using an integrated structure which combines the data from quarterly non-financial accounts for general government, quarterly financial accounts for general government and quarterly government debt. An integrated publication combining data from all three tables is released quarterly on the dedicated Government Finance Statistics (GFS) section of the Eurostat web site.

Data is transmitted according to the ESA 2010 transmission programme for quarterly financial accounts and quarterly government debt. Non-financial accounts data is transmitted under gentlemen’s agreement.

ESA 2010

Eurostat publishes quarterly government finance statistics figures based on the European System of Accounts 2010 (ESA 2010) methodology.

General government

Government finance statistics cover data for general government as defined in ESA2010, paragraph 2.111.

Seasonal adjustment of selected data series

Quarterly government finance statistics are reported to Eurostat in the form of non-seasonally adjusted (raw) figures. However, a certain number of the reported series contain seasonal patterns (explained by the link with the seasonality of economic activity and by the budgetary planning and accounting practices of national governments), which make it difficult to carry out a direct meaningful cross-country and time series analysis using non-adjusted data. The same is true for GDP, which reflects the seasonal pattern of all economic activities in the economy.

To overcome this difficulty and thus to gain a better understanding of trends in addition to the non-seasonally adjusted data, seasonally adjusted data is presented for the EU and euro area in this article. The seasonal adjustment aims to remove the seasonality linked to this quarterly data.

It should be noted that annualised seasonally adjusted data is not in general equal to annualised non-adjusted data. When using annualised figures, it is more appropriate to use non-seasonally adjusted data. Using seasonally adjusted data is more appropriate when looking at quarter-on-quarter growth rates.

The seasonal adjustment for total revenue and total expenditure is done using an indirect procedure (at country level) using Tramo-Seats on Demetra+. Where available, National Statistical Institutes own estimates are used as input for the aggregates, which are supplied to Eurostat on a gentlemen’s agreement basis. Most country level estimates as well as data for the EU aggregates are published on Eurostat’s free dissemination database. These estimates are supplemented by Eurostat’s own estimates for those countries, which do not supply their own estimate – such data is labelled confidential and not published.

Net lending (+) / net borrowing (-) is derived indirectly from the accounting identity: Net lending (+) / net borrowing (-) = total revenue – total expenditure.

Geographical composition

Up to 31 December 2022, the euro area (EA19) included Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland.

From 1 January 2023 the euro area (EA20) also includes Croatia.

European Union (EU27): Belgium, Bulgaria, Czechia, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland and Sweden.

The aggregate data series commented on in this article refer to the official composition of the euro area at the end of the most recent quarter for which data is available. Thus, releases with data for first quarter of 2023 onwards comment on EA20 series.

Croatian data in millions of national currency is expressed in euro-fixed for periods up to the fourth quarter of 2022, i.e. HRK divided by the irrevocable exchange rate.