Image © Pound Sterling Live

Lloyds Bank is the latest big institution to predict UK inflation will fall to the Bank of England’s 2.0% target by April.

The high-street bank says the upside surprise in the December inflation print reported Wednesday won’t knock the disinflationary process off course, as economists take the scalp to their inflation forecasts.

UK headline CPI inflation rose to 4.0% in December, prompting investors to push back the expected timing of the first rate cut, with the odds of a May cut falling to below 70% from being fully priced ahead of the inflation release.

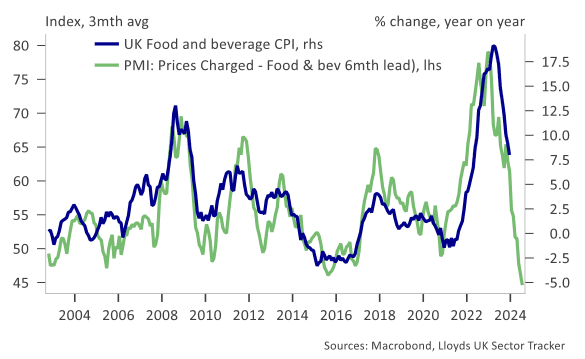

Above: “Our UK Sector Tracker suggests that food price inflation will moderate sharply further in the coming months” – Lloyds Bank.

Lloyds Bank economist Nikesh Sawjani says the figures confirm the ride down will be bumpy.

“With much of the upside surprise, particularly relative to our own forecast, largely due to movements in volatile components, our view that inflation will fall back materially in the first half of the year remains unwavered,” says Sawjani.

He explains that the December figures confirm underlying momentum in terms of price growth remains largely unchanged and points to a firm deceleration of inflation in the coming months

Like other forecasters, Sawjani notes the big development in terms of the inflation is the recent fall in wholesale gas prices, which will drag household bills lower in April.

- UK Inflation To Plummet Below 2.0 As Early As May Says ING

- UK Inflation Predicted Below 2.0% As Soon As April By Deutsche Bank

Lloyds Bank’s latest forecasts now include a cumulative decline in the household energy prices of around 18% across the April

and July reset dates.

“This effect will still pull the headline rate of inflation down quicker than envisaged in our previous set of forecasts,” says Sawjani.

This led the high-street bank to slash the April inflation forecast from 2.6% to 2.0%, hitting the Bank of England’s target in the process.

Food price inflation is meanwhile expected to decline sharply in the coming months as food and beverage manufacturers have been consistently reporting reductions in input costs since May.

Although headline inflation will fall to the Bank’s 2.0% target, Lloyds warns the core inflation rate – which the Bank of England watches closely – won’t fall to the 2.0% target until year-end:

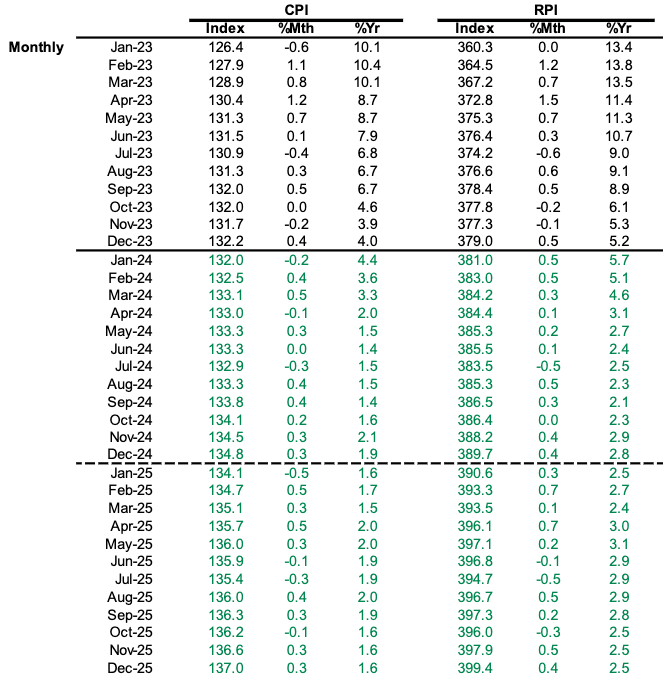

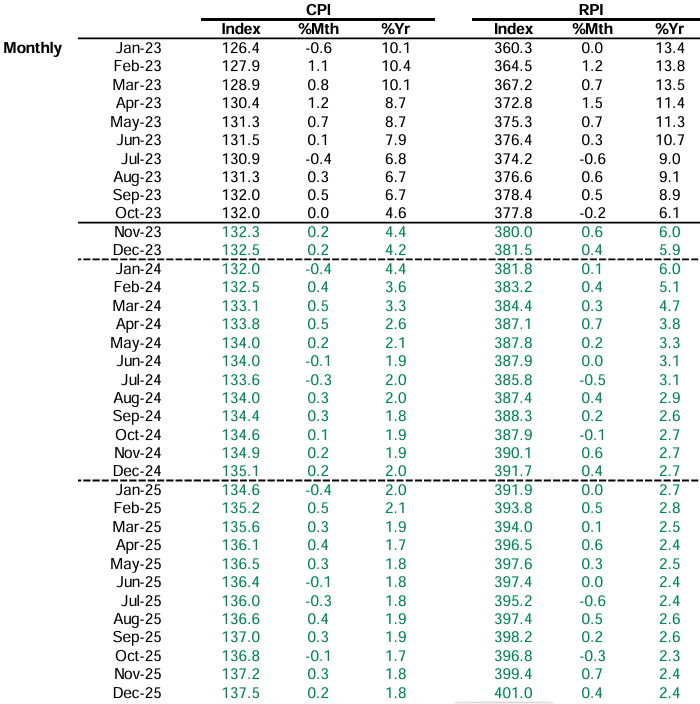

Lloyds Bank revised inflation forecasts:

Previous forecast: