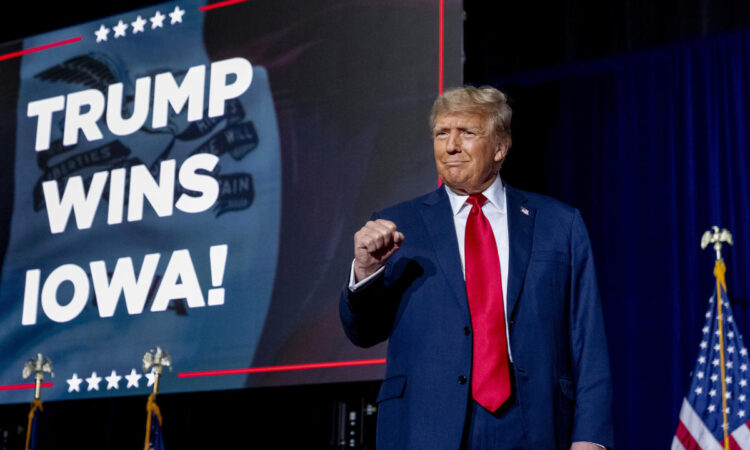

The FTSE and European stocks fell at the opening bell on Tuesday, following a landslide victory for former president Donald Trump in the Iowa caucuses.

The FTSE 100 (^FTSE) fell 0.6%. Meanwhile, the DAX (^GDAXI) in Germany and the CAC (^FCHI) in Paris were down 0.8% and 0.7% respectively. The pan-European Stoxx 600 (^STOXX) was also 0.7% lower.

After a dramatic night, Trump entrenched his status as the frontrunner for the 2024 Republican presidential nomination, as Ron DeSantis edged out former UN Ambassador Nikki Haley to take a distant second place.

In his victory speech the former president said he wanted to “straighten up the problems of the world.”

Meanwhile in the UK, labour market data showed that wage growth is cooling. The number of vacancies posted declined by 49,000 on the quarter, while the unemployment rate remained largely flat at 4.2%.

“With inflation currently on track to reach the 2% target as early as April, there is a significant possibility that we could see meaningful real pay growth throughout this year,” said Jake Finney, economist at PwC UK.

Read more: Bitcoin ETF boom won’t mimic previous rallies, says VC founder

Financial markets are currently expecting over 100 basis points of cuts to the Bank of England base rate over the course of 2024. The signs that the labour market is gradually normalising will reinforce the view that rate cuts could come as early as May, added Finney.

“It has been tough for many families recently, but with inflation now falling and the economy gradually returning to growth today’s continuing rise in real wages will offer further relief,” said Chancellor Jeremy Hunt. “On top of this the cut in National Insurance contributions will get more people back into the jobs market, not just supporting economic growth but saving a typical two earner household around £1,000 this year.”

Follow along with us live:

Live2 updates

Watch: Economy grew by 0.3% in November but recession remains a threat

Download the Yahoo Finance app, available for Apple and Android.