(Bloomberg) — The UK economy saw a modest rebound in November, although not by enough to rule out the prospect of a technical recession for the second half of 2023.

Most Read from Bloomberg

Gross domestic product rose 0.3%, bouncing back from a drop of the same scale in October, the Office for National Statistics said Friday. Economists had expected a 0.2% increase.

The figures mean the UK would require a flat December to avoid a contraction for the full quarter, and that month was held back by wet weather and strikes by doctors. It leaves the economy sputtering with a chance for a small pickup later this year. Prime Minister Rishi Sunak is hoping for sunnier news ahead of a general election in the autumn.

“The economic outlook currently remains gloomy, with a technical recession still potentially on the cards in the second half of 2023, especially given the expected impact from the industrial action in December,” said Yael Selfin, chief economist at KPMG UK. “Even if the economy manages to avoid a recession, it is expected to remain in stagnation territory.”

All else being equal, the economy will shrink 0.1% in the fourth quarter if GDP falls by 0.02% or more in December, the ONS said. Zero growth in December would leave the fourth quarter unchanged. Output slipped 0.1% in the third quarter.

What Bloomberg Economics Says …

“The economy is likely to continue to tread the line between stagnation and contraction in the first three months of 2024, but the outlook will brighten from the spring. Falling inflation should open the door to rate cuts in the second quarter and, with a drop in energy prices set to boost real incomes, growth is poised to pick up speed.”

—Ana Andrade and Dan Hanson, Bloomberg Economics. Click for the REACT.

Money markets added to bets on the scope for interest-rate cuts this year, fully pricing five quarter-point reductions, although this is still less than the six such decreases traders were anticipating as recently as last month.

“This morning’s figure shows just how precarious the situation is for the UK economy and piles yet more pressure onto the Bank of England to cut interest rates,” said Richard Carter, head of fixed interest research at Quilter Cheviot. “The UK faces a real challenge when it comes to avoiding recession as we move further into the winter months.”

Sunak has overseen a sluggish economy since taking office in 2022, despite making growth one of his key pledges. His Conservative Party is trailing the Labour opposition and has signaled a vote will take place in the second half of the year. Chancellor of the Exchequer Jeremy Hunt said what’s more important is getting inflation under control.

“While growth in November is welcome news, it will be slower as we bring inflation back to its 2% target,” Hunt said. “But we have seen that advanced economies with lower taxes have grown more rapidly, so our tax cuts for businesses and workers put the UK in a strong position for growth into the future.”

A stronger-than-expected performance by the services sector helped to drive the rebound in November with retail, car leasing and computer games companies enjoying a “buoyant month,” the ONS said. Services output jumped 0.4% compared to the previous month.

There was a mixed performance outside of the services sector, the largest part of the UK economy. The manufacturing sector snapped four months of month-on-month declines with production growing 0.4%. However, construction output unexpectedly fell for a second straight month with storms leading to delays in planned work.

While the economy gained some momentum in November, the longer term picture was more gloomy. The GDP contracted 0.2% in the three months through November compared to the previous three month period.

“The longer-term picture remains one of an economy that has shown little growth over the last year,” said Grant Fitzner, chief economist at the ONS. “The economy contracted a little over the three months to November, with widespread falls across manufacturing industries, which were partially offset by increases in public services, which saw less impact from strike action.”

The ONS said November was helped by a lack of industrial action in the National Health Service and the transport sector plus the end of the actors’ strikes in the US, which had spillover effects for TV and film production in the UK. However, the return of widespread industrial strife in December and January is likely to weigh on the economy again, leaving an uphill struggle to stop another contraction at the end of 2023.

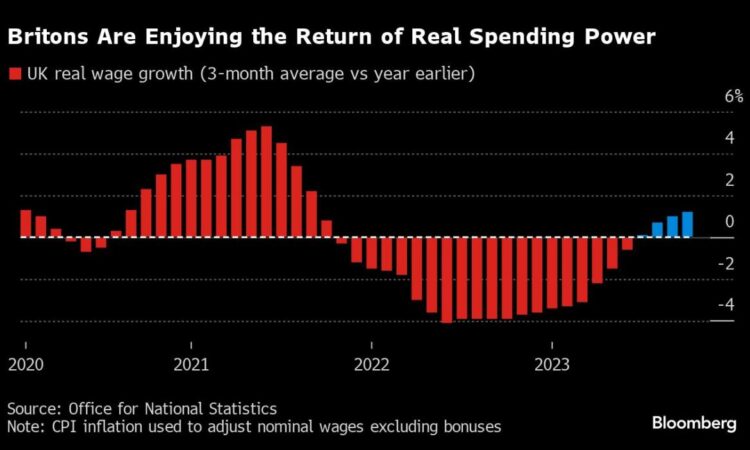

While persistent inflation and high interest rates weighed on the economy last year, the outlook for 2024 is brightening. Some economists have upgraded their growth forecasts off the back of lower-than-expected inflation figures, gains in real wages and expectations that the Bank of England start cutting interest rate this Spring. Survey data has also pointed to some pick up in economic momentum in recent months.

Britain saw its goods trade deficit narrow slightly to £16.2 billion ($20.7 billion) in November. Imports fell by 3.3%, driven by decreased shipments of machinery and transport equipment from both European Union and non-EU countries. Exports fell 2%, due to lower demand from non-EU nations.

The figures exclude non-monetary gold and other precious metals, flows of which can be volatile.

While persistent inflation and high interest rates weighed on the economy last year, the outlook for 2024 is brightening. Some economists have upgraded their growth forecasts off the back of lower-than-expected inflation figures, growth in real wages and expectations that the Bank of England will pivot to interest rate cuts as soon as the Spring. Survey data has also pointed to some pick up in economic momentum in recent months.

Markets are leaning toward the first rate reduction arriving in May as the BOE shifts its attention away from high inflation to propping up a stagnant economy. Investors are betting on around four more cuts by the end of 2024.

The BOE has stuck by its higher for longer messaging despite market bets on a cut being boosted by inflation slipping below 4% in the latest data for November. In recent days, economists at Deutsche Bank and Oxford Economics have said that inflation could be back at the BOE’s 2% target by the Spring.

“Over a longer time horizon, the economy is not going anywhere,” said Roger Barker, director of policy at the Institute of Directors. “November’s increase merely clawed back the ground lost in October. We will still need to wait for December’s GDP figure to find out if the UK avoided a technical recession in 2023.”

–With assistance from Harumi Ichikura, Andrew Atkinson, Irina Anghel, Zoe Schneeweiss and Alice Atkins.

(Updates with details from the report and market reaction.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.