exceptional, temporary and far less than the €6 trillion bank bailout to be paid by the state budget

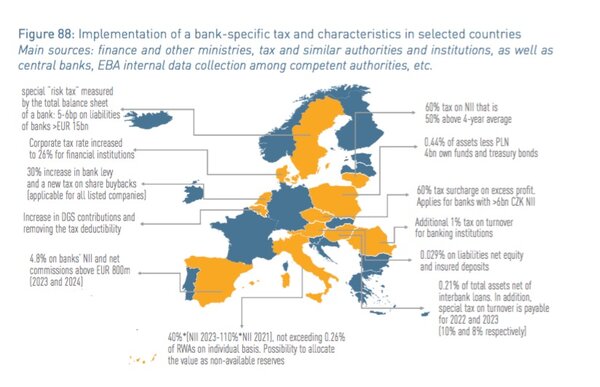

At least twelve European countries apply some form of special levy on banks. The European Banking Authority

EBA

European Banking Authority

The body charged with supervising the European banking system and, along with two other authorities, the European Securities and Markets Authority (ESMA) and the European Insurance and Occupational Pensions Authority (EIOPA), form part of the European System of Financial Supervision.

EBA : https://www.esma.europa.eu/

mentions in its report on risk assessment dated December 2023 [1] that revenues from bank taxes in Europe recorded a 30% increase from June 2022 to June 2023. This concerns Austria, Belgium, The Czech Republic, Denmark, Italy, Hungary, Lithuania, the Netherlands, Poland, Romania, Spain and Sweden. Rates for each country are as follows:

Spain imposed a 4.8% temporary levy on net interest

Interest

An amount paid in remuneration of an investment or received by a lender. Interest is calculated on the amount of the capital invested or borrowed, the duration of the operation and the rate that has been set.

income and net commissions to banks, which charged more than €800 million in 2019, the year before the pandemic. This extraordinary tax on banks, along with that on energy companies, was introduced in mid-2022 to finance part of the anti-crisis buffer. This tax on financial institutions brought in €1,263 million in 2022 and we can expect the same amount in 2023. We do not have any prognosis yet for 2024. Partners in the government coalition, the PSOE and Sumar, committed to turn the currently extraordinary taxes into permanent taxes by 2025 [2].

- Figura 1. Mapa de los países europeos que aplican tasas específicas a la banca y sus características. Fuente: EBA

Italy applies a 40% tax on the difference in interest margins between 2021 and 2023, with which it hopes to raise around 3 billion euros. Announced in August 2023, it was modified a month later, offering banks a loophole: they could avoid paying the tax if they increased their capital levels, provided that these reserves were not used to remunerate shareholders through dividend distributions or share

Share

A unit of ownership interest in a corporation or financial asset, representing one part of the total capital stock. Its owner (a shareholder) is entitled to receive an equal distribution of any profits distributed (a dividend) and to attend shareholder meetings.

buyback programmes. [3]

Belgium increased contributions to the Deposit Guarantee Scheme and removed tax deductibility of the bank levy, thus aiming to levy 150 million euros [4]. The Netherlands increased by 30% a special tax on banks and created a new tax on share buybacks for all listed companies. Austria levies 0.029 % on liabilities

Liabilities

The part of the balance-sheet that comprises the resources available to a company (equity provided by the partners, provisions for risks and charges, debts).

net equity

Equity

The capital put into an enterprise by the shareholders. Not to be confused with ’hard capital’ or ’unsecured debt’.

and on insured deposits. Denmark increased the corporate tax rate on banks to 26%. Sweden levies a 5 to 6 base points tax on liabilities of banks above 15 billion euros in assets.

Hungary levies 0.21% on total assets net of interbank loans, and introduced a new tax on turnover (10% in 2022 and 8% in 2023). Lithuania applies a 60% tax on net interest income, i.e. 50% above the average tax over the past four years. Poland levies 0.44% on assets, non-performing assets, own funds and treasury bonds. The Czech Republic applies a 60% tax surcharge on excess profit

Profit

The positive gain yielded from a company’s activity. Net profit is profit after tax. Distributable profit is the part of the net profit which can be distributed to the shareholders.

. Romania imposes an additional 1% tax on turnover for banking institutions.

Though not mentioned in the EBA report, Ireland should be added; in 2024 its government will increase the tax it has levied since 2014 on institutions that benefited from public bailout during the financial crisis. This increase will more than double this year’s revenues (from 87 to 200 million euros). Concerned banks are AIB, Bank of Ireland and Permanent TSB [5].

According to the special report 21/2020 of the European Court of Auditors, the public bailout of EU banks from the 2008 crisis to 2017 was more than six thousand billion euros.

It was this very bailout that was put forward by Pedro Sánchez’ government to vindicate the ‘exceptional and temporary’ tax of July 2022: “During the financial crisis the State bailed out the banking sector, which according to the court of auditors cost 66,567 million euros,” the president recalled. The finance minister, María Jesús Montero, added: “We are well aware that this country, while at a complicated juncture and with the help of conservative governments, bailed banks out. At the time when we stood in the opposition and now when we are in the government, we have kept saying that it was indeed essential to save all citizens. These companies are making the biggest profit, are inflating their profit and loss accounts, and it therefore seems fair to ask them to pay an additional and temporary tax for the years 2022 and 2023” [6].

It has to be recalled that the public bailout of EU banks from the 2008 crisis to 2017 cost over six thousand billion euros, considering capital support instruments (1.12 thousand billion euros) and liquidity

Liquidity

The facility with which a financial instrument can be bought or sold without a significant change in price.

support instruments (5.03 thousand billion euros), according to the special report 21/2020 of the European Court of Auditors [7]. As stated by Mihails Kozlovs, a member of the European Court of Auditors in charge of the audit, “Since the 2008 crisis until today, the financial service sector has received much more state support than any other sector in the economy.” He added, “Proper and thorough control of such State aid is essential to protect competition in the internal market and to shield EU taxpayers from the burden of bank bailouts.”

Ayudas estatales aprobadas entre 2008 y 2017 : Public aid approved from 2008 to 2017

Instrumentos de ayuda de capital : Capital support instruments

Instrumentos de ayuda de liquidez : Liquidity support instruments

Strangely, the same people who subscribed to the bank bailout under the fallacious pretext that it would not cost one single euro to the public treasury are those who now criticize taxing financial institutions. This is the case of Luis de Guindos, who as economy minister in 2012 signed a memorandum of understanding for 100 billion euros to bail out Spanish private banks. In 2023, as vice-president of the ECB

ECB

European Central Bank

The European Central Bank is a European institution based in Frankfurt, founded in 1998, to which the countries of the Eurozone have transferred their monetary powers. Its official role is to ensure price stability by combating inflation within that Zone. Its three decision-making organs (the Executive Board, the Governing Council and the General Council) are composed of governors of the central banks of the member states and/or recognized specialists. According to its statutes, it is politically ‘independent’ but it is directly influenced by the world of finance.

https://www.ecb.europa.eu/ecb/html/index.en.html

, he wants the bank tax not to affect ‘either the liquidity or the solvability’ of institutions. [8] In November 2022, the European Central Bank

Central Bank

The establishment which in a given State is in charge of issuing bank notes and controlling the volume of currency and credit. In France, it is the Banque de France which assumes this role under the auspices of the European Central Bank (see ECB) while in the UK it is the Bank of England.

ECB : http://www.bankofengland.co.uk/Pages/home.aspx

(ECB) published an opinion recommending an analysis of the negative consequences of the bank tax. In this regard, Spanish Prime Minister Pedro Sánchez ironically thanked Mr De Guindos for his “help”, but reaffirmed that the government would continue with its roadmap. [9]

In the same vein, the European Banking Authority, in its aforementioned risk assessment report, defended the interests of the banks, stating that the new measures could mean “greater uncertainty for the banking sector”. Such warnings were not heeded when European banks accumulated imbalances and had to be bailed out with public money.

Translated by Christine Pagnoulle