Image © Adobe Images

UK inflation is on course to record a swift decline to the Bank of England’s 2.0% target thanks to plummeting costs facing producers and outright energy deflation.

In fact, a drop in energy bills in April could result in headline CPI inflation dropping below 2.0% before rebounding to approximately 2.5% for the remainder of the year.

“While it will be bumpy, we think the annual CPI rate will fall below 2% by April-24, driven in large part by a substantial drop in energy bills,” says Sanjay Raja, Senior Economist at Deutsche Bank.

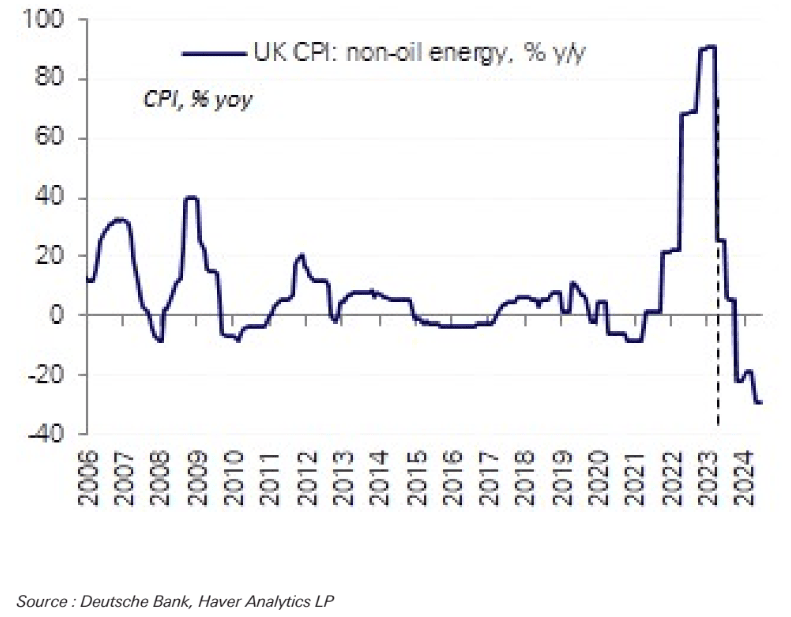

Above: “Non-oil inflation a big reason for our downward revision to 2024 CPI” – Deutsche Bank.

In an inflation forecast update, Deutsche Bank’s researchers say the biggest shift they have had to contend with is the fall in energy inflation.

They say that after two consecutive monthly declines in oil prices, overall energy prices (CPI) will likely end 2023 at around -17.5% year-on-year, helped by a sharp 5.5% month-on-month decline in motor fuel prices in December.

However, household dual fuel bills will rise by around 5% m/m in January, tempering some recent good news.

Global natural gas prices have nevertheless declined over recent weeks, leading economists to pencil in a meaningful reduction in energy bills in April.

“The good news? We’re due a bigger drop in dual fuel bills in April. Our Ofgem Price Cap model points to a near 14% drop in gas and electricity prices come April,” says Raja.

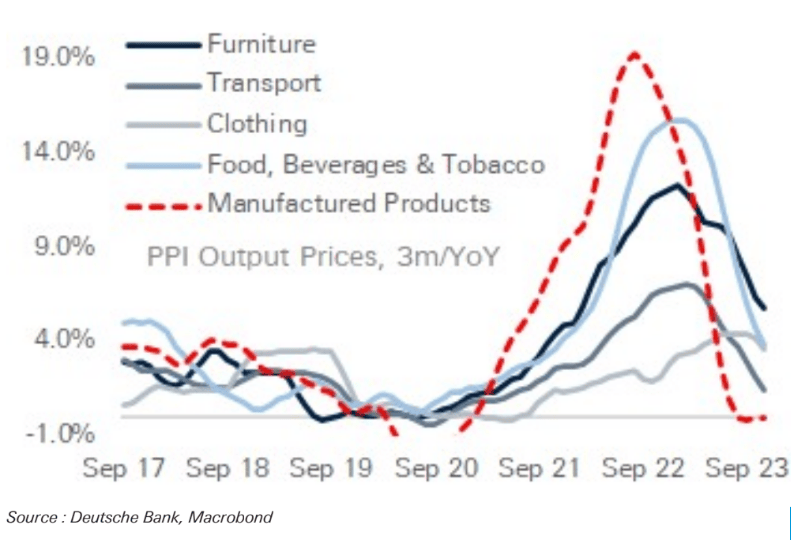

Above: “PPI pressures are falling like a stone” – Deutsche Bank.

That alone will take energy deflation closer to -20% y/y to start Q2-24, and Deutsche Bank expects energy prices to remain broadly steady thereafter, ending the year at around -7% y/y.

“Overall, energy CPI inflation, we think, will now contract by 14% in 2024, following a 5% rise in 2023,” says Raja.

Elsewhere, the prices paid by producers are collapsing, signalling further declines in the inflation rates of manufactured goods and food.

Inflation in the services sector will remain well above 2.0% as wages are expected to stay at historically elevated levels, but Deutsche Bank doesn’t see this as being enough to dislodge the disinflationary trends underway in the UK.

“Despite stickier services CPI – we see headline CPI falling back to the Bank’s 2% target by spring – almost ten quarters earlier, relative to the Bank’s November Monetary Policy Report forecasts,” says Raja.

“After a swift ascent to its peak, we now see as swift of a descent back to the Bank’s 2% mandate,” he adds.

Deutsche Bank sees 2024 CPI inflation running around 100bps below the Bank’s November mean CPI forecast. And in 2025, CPI will drop below 2% y/y, averaging 1.8%, which is below the Bank’s forecast for 2.5%.

If Deutsche Bank is correct, market bets for several interest rate cuts at the Bank of England in 2024 could be justified. Market implied pricing shows investors are positioned for as many as five 25 basis point cuts.