Are you eligible for the zero-down USDA home loan?

What if you could secure a USDA home loan that allows you to buy a house with no down payment, competitive mortgage rates, and reduced mortgage insurance costs?

It might sound like a dream, but it’s entirely possible with the USDA mortgage program. Designed to assist low- and moderate-income Americans in becoming homeowners, USDA loans provide incredibly affordable financing options for eligible buyers.

Essentially, USDA home loans empower individuals to transition from renting to owning, even when they thought homeownership was out of reach.

Verify your USDA loan eligibility. Start here

In this article (Skip to…)

>Related: How to buy a house with $0 down: First-time home buyer

What is a USDA home loan?

USDA loans are mortgages backed by the U.S. Department of Agriculture as part of its Rural Development Guaranteed Housing Loan program. USDA offers financing with no down payment, reduced mortgage insurance, and below-market mortgage rates.

Verify your USDA loan eligibility. Start here

The USDA mortgage program is intended for home buyers with low-to-average household incomes. In addition, you must buy a home in a “rural area” (as defined by the USDA) to qualify. Those who are eligible can use a USDA mortgage to buy a home or refinance one they already own.

USDA loans offer nearly unbeatable benefits for qualified borrowers. So if this program sounds like a good fit for you, it’s worth getting in touch with a lender to find out if you’re eligible.

How do USDA home loans work?

USDA loans are insured by the U.S. Department of Agriculture. Thanks to this government guarantee, lenders can offer 100% financing and below-market interest rates without taking on too much risk.

Verify your USDA loan eligibility. Start here

Although the USDA backs this program, it typically isn’t the one lending money. Instead, private lenders are authorized to offer USDA loans. That means you can get a USDA mortgage from many mainstream banks, mortgage lenders, and credit unions.

The application process for a USDA mortgage works just like any other home loan. You’ll compare rates and choose a lender, complete an application (often online), provide financial documents, wait for the lender’s approval, and then set a closing day.

The only exception is for very-low-income borrowers, who may qualify for a USDA Direct home loan. In this case, you’d go straight to the Department of Agriculture to apply rather than to a private lender.

Types of USDA home loans

For eligible individuals and families looking to buy, build, or renovate a home in a rural area, the USDA offers three main types of mortgage loans. These loan programs are as follows.

Verify your USDA loan eligibility. Start here

USDA Guaranteed Loans

USDA Loan Guarantees are provided to qualified borrowers by approved private lenders, such as banks and mortgage firms. A USDA guaranteed loan is one in which the government backs a portion of the loan, lowering the lender’s risk and allowing them to offer more favorable terms to the borrower. These loans frequently have low interest rates, no down payment, and more lenient credit requirements. Borrowers must meet household income limits, which vary depending on location and household size, and the property must be in an eligible rural area as defined by the USDA.

USDA Direct Loans

The USDA also offers the Single Family Housing Direct loan through the Section 502 Direct Loan Program. These loans are meant to help low income families to buy, build, or fix up small homes in rural areas. Direct loans, as opposed to guaranteed loans, are funded by the USDA rather than private lenders. These loans have favorable terms, such as low interest rates (as low as 1% with payment assistance) and long repayment periods (up to 38 years for eligible applicants). Income, creditworthiness, and the property’s location in an eligible rural area determine eligibility for direct loans.

USDA Home Improvement Loan

The USDA’s Single Family Housing Repair Loans and Grants program, also known as the Section 504 program, provides financing for home improvements. This program provides low-interest, fixed-rate loans and grants to low-income rural homeowners for necessary home repairs, improvements, and modifications that make their homes safer, more energy-efficient, and more accessible. However, if you’re looking for one, you might have a difficult time finding this type of USDA home loan. They are not widely available from lenders.

USDA home loan requirements

To be eligible for a USDA home loan, you’ll need to meet a number of requirements that vary depending on whether you are applying for a USDA loan guarantee or a USDA direct loan.

Verify your USDA loan eligibility. Start here

Some general requirements, however, apply to all USDA loans, specifically those based on both buyer and property eligibility.

- Your home must be located in an eligible rural area. The USDA typically defines it as a population of less than 20,000. To find out if the property you’re buying is in a USDA-eligible area, and whether or not you meet local income limits, you can use the USDA’s eligibility site

- You must meet USDA monthly income caps. To be eligible, you can’t make more than 115% of the area median income

- Your income should be stable. Applicants must demonstrate a stable and dependable income, typically for at least 24 months prior to applying for the loan

- You’ll need to be creditworthy. Although USDA loans have more flexible credit requirements than conventional loans, borrowers still need to demonstrate creditworthiness. Lenders typically look for a credit score of at least 640 for guaranteed loans, while direct loans may have more lenient credit score requirements

- You can’t have too much existing debt. Generally, your monthly debt (including future mortgage payments) should not exceed 41% of your gross monthly income, although some exceptions may be made based on factors like credit score and cash reserves

- You’ll need to purchase a single-family primary residence. USDA loans are only available for primary residences, not for investment properties or second homes.

- Your property must conform to safety standards. The property must meet USDA’s minimum property requirements, which include safety, structural integrity, and adequate access to utilities and services.

- You need citizenship status. Applicants must be U.S. citizens, U.S. non-citizen nationals, or qualified aliens with a valid Social Security number.

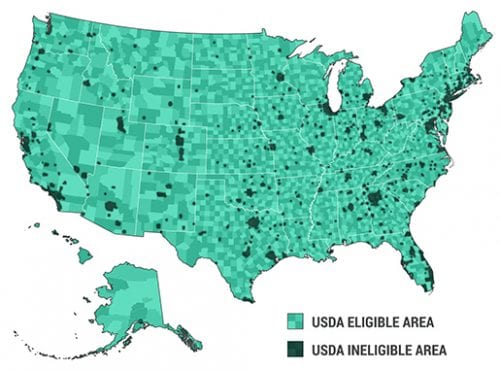

USDA home loan map

The USDA eligibility map is an online tool that assists potential borrowers in determining whether a property is located in a rural area that is eligible for USDA home loans.

Users can enter a specific address or explore areas of the map to see if they qualify for USDA guaranteed loans or direct loans by using this interactive map.

Verify your USDA loan eligibility. Start here

1 Source: USDAloans.com based on Housing Assistance Council data

USDA loan rates

Compared to other home loan programs, USDA mortgage interest rates are some of the lowest available.

Check your USDA loan rates. Start here

USDA rates are typically only matched by the VA loan, which is exclusively for veterans and service members. These two programs (USDA and VA) can offer below-market interest rates because their government guarantee protects lenders against loss.

Other mortgage programs, like the FHA loan and conventional loan, can have rates around 0.5%-0.75% higher than USDA rates on average. That said, mortgage rates are personal. Getting a USDA loan doesn’t necessarily mean your rate will be “below-market” or match the USDA loan rates advertised.

To get the lowest possible rate and monthly payments, you need an excellent credit score and a low debt-to-income ratio. Making a down payment can help, too, although the USDA doesn’t require one.

USDA loan costs

When it comes to financing a home purchase with a USDA loan, it’s not just the mortgage rate that you need to consider. You’ll be responsible for various fees and costs, which can add up over time. Understanding these costs upfront can help you make a more informed decision and plan your budget accordingly. Here’s a breakdown of the expenses you can expect.

USDA mortgage insurance

USDA guarantees its mortgage loans, meaning it offers protection to mortgage lenders in case borrowers default. But the program is partially self-funded. To keep this loan program running, the USDA charges homeowner-paid mortgage insurance premiums.

Verify your USDA loan eligibility. Start here

Upfront guarantee fee

One of the first costs you’ll encounter is the upfront guarantee fee. This fee is a percentage of the loan amount and is required by the USDA to secure the loan. It’s usually around 1% but can vary. You can either pay this fee upfront or roll it into the loan balance.

Annual guarantee fee

Unlike conventional loans that may not require mortgage insurance, USDA loans come with a monthly mortgage insurance premium. You can expect to pay 0.35% annual guarantee fee, based on the remaining principal balance each year.

The annual fee is broken into 12 installments and included in your regular mortgage payment.

As a real-life example: A home buyer with a $100,000 loan size would have a $1,000 upfront mortgage insurance cost, plus a monthly payment of $29.17 for the annual mortgage insurance. USDA upfront mortgage insurance is not paid in cash. It’s added to your loan balance, so you pay it over time.

Inspection fees

Before the loan is approved, the property will need to be inspected to ensure it meets USDA property eligibility requirements. This inspection can cost anywhere from $300 to $500, depending on the location and size of the home.

Closing Costs

Closing costs are a mix of fees that include loan origination fees, appraisal fees, title search fees, and more. These costs can range from 2% to 5% of the home’s purchase price. Some of these costs can be rolled into the loan amount, but it’s best to be prepared to pay some of these out-of-pocket.

How to apply for a USDA home loan

Applying for a USDA home loan can be a great way to finance a home, especially if you’re looking to buy in a rural area. These loans offer attractive benefits like zero down payment and competitive interest rates.

However, the process involves several steps and specific eligibility criteria. Here’s a guide on how to apply for a USDA home loan.

Step 1: Check your eligibility

Before diving into the application process, it’s crucial to determine if you meet the USDA’s eligibility requirements. These typically include:

- A minimum credit score of 640

- A debt-to-income (DTI) ratio of up to 41%

- Income limitations, which vary by location and household size

- The property must be located in a USDA-eligible area

Step 2: Gather necessary documentation

You’ll need to provide various documents to prove your eligibility, including:

- Proof of income (e.g., pay stubs, tax returns)

- Employment verification

- Credit history report

- Personal identification (e.g., driver’s license, passport)

Step 3: Pre-Qualification

Contact a USDA-approved lender to get pre-qualified for a loan. During this process, the lender will review your financial situation to give you an estimate of how much you can borrow.

Check if you’re eligible for a USDA loan. Start here

Both pre-approval and pre-qualification can give you a better idea of your budget and show sellers that you are a serious buyer.

Step 4: Property search

Once pre-qualified, you can start looking for a property that meets USDA guidelines. Keep in mind that the home must be your primary residence and located in an eligible rural area.

Working with a real estate agent who has experience with USDA loans can be a big advantage.

Step 5: USDA home loan application

After finding the right property, you’ll need to fill out the USDA loan application. Your lender will guide you through this process, which will include a more thorough review of your financial situation and the submission of additional documents.

Step 6: Property appraisal and inspection

The lender will arrange for an appraisal to ensure the property meets USDA standards. An inspection may also be required to identify any potential issues with the home.

Step 7: Loan approval and closing

Once the appraisal and inspection are complete, and all documentation is verified, you’ll move to the loan approval stage. If approved, you’ll proceed to closing, where you’ll sign all necessary paperwork and officially secure your USDA home loan.

With the loan secured and the keys in hand, you’re now ready to move into your new home!

By following these steps and working closely with a USDA-approved lender, you can navigate the USDA home loan process with confidence. Always remember to consult with your lender for the most accurate and personalized advice.

How do USDA loans compare to other types of mortgages?

When it comes to choosing the right mortgage, it’s essential to understand the differences between USDA, FHA, VA, and conventional loans.

Each loan type has its own set of requirements, benefits, and drawbacks. Here’s a comparison table to help you get a clearer picture.

| USDA Loans | FHA Loans | VA Loans | Conventional Loans | |

| Credit Score Minimum | 640+ | 580+ | No minimum, but 620+ recommended | 620+ |

| Down Payment Requirement | 0% | 3.5% minimum | 0% | 3% to 20% |

| DTI Ratio | Typically up to 41% | Typically up to 43% | Varies, but often up to 41% | Typically up to 43% |

| Property Requirements | Must be in USDA-eligible area | Must meet FHA guidelines | Must meet VA guidelines | Typically more flexible |

| Mortgage Insurance | Monthly premium | Monthly premium | No mortgage insurance required | Required if down payment is < 20% |

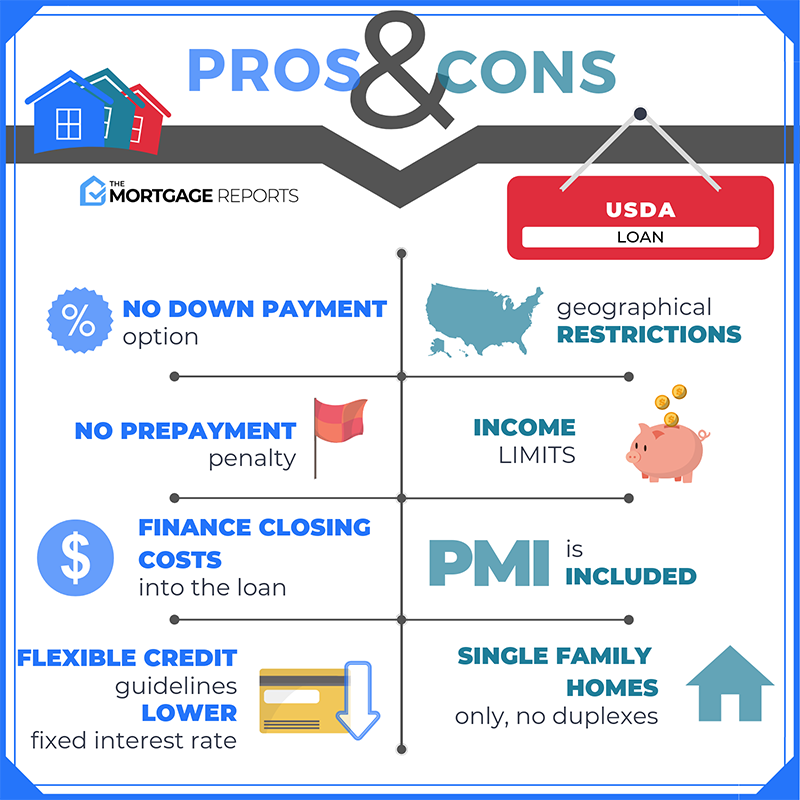

USDA loans have three important features that set them apart from other home loan programs:

- With a USDA loan, you don’t have to make a down payment. This is one of only two major loan programs that allow zero-down financing

- USDA is the only major loan program with geographic restrictions. You have to buy in a qualified “rural area” (though this includes many small towns and suburbs)

- The USDA loan program requires you to take a fixed-rate loan. Adjustable-rate mortgages are not available

Beyond that, the USDA loan isn’t all that different from other mortgage programs. The repayment schedule doesn’t feature a “balloon” or anything non-standard, the closing costs are ordinary, and prepayment penalties never apply.

Rural loans can be used by first-time home buyers and repeat home buyers alike. Homeownership counseling is not required to use the USDA program.

Understanding the USDA Rural Housing Mortgage

The Rural Development loan’s full name is the USDA Single Family Housing Guaranteed Loan Program. However, the program is more commonly known as the “USDA loan.”

Verify your USDA loan eligibility. Start here

The Rural Development loan is sometimes called a “Section 502” loan. This refers to section 502(h) of the Housing Act of 1949, which makes the program possible. This program is designed to help single-family home buyers and stimulate growth in less-populated, “rural,” and low-income areas.

That might sound restrictive. But in fact, 97% of the U.S. map is eligible for USDA loans, including many suburban areas near major cities. Any area with a population of 20,000 or less (or 35,000 or less in special cases) can be an eligible rural area.

Yet most U.S. home buyers, even those with USDA loan eligibility, haven’t heard of this program or instantly think “farmland.” This is because the USDA loan program wasn’t launched until the 1990s. Only recently has it been updated and adjusted to appeal to rural and suburban buyers nationwide.

Many USDA-approved lenders don’t list the USDA loan on their loan application menu. But many offer it. So if you think you’re eligible for a zero-down USDA loan, it’s worth asking your shortlist of lenders whether they offer this program.

USDA home loan FAQ

Verify your USDA loan eligibility. Start here

You might qualify for a USDA loan if you have an average salary for your area and a credit score of 640 or higher. USDA loans only can be used to buy a home in rural or suburban areas. Typically, qualifying regions have a population under 20,000.

The income limit for USDA home loans is based on your area’s median income. To be eligible for a USDA loan, you can’t exceed the median income by more than 15 percent. For example, if the median salary in your city is $65,000 per year, you could qualify for a USDA loan with a salary of $74,750 or less.

A USDA loan is a great option for buyers with moderate or low income. It lets you buy a house with no money down and low mortgage rates — two huge benefits that only one other loan program (the VA loan) offers. If your home is in an eligible area, it’s worth exploring a USDA-guaranteed loan. The main drawback is that USDA rural development loans require mortgage insurance for the life of the loan. So if you can make a 20 percent down payment, you might prefer a conventional loan with no mortgage insurance payment.

Both programs let you buy with a low down payment and require mortgage insurance. USDA can be used with zero down, but the home has to be in a qualified rural area, and the buyer has to meet income eligibility caps. FHA requires 3.5 percent down but no location or income restrictions exist. FHA also has more lenient credit requirements: You need a 580 credit score for FHA versus 640 for USDA. The right loan type for you depends on where you’re buying and your financial situation.

USDA lenders have to send each loan file to the Department of Agriculture for approval before underwriting. This can add around two to three weeks to your loan processing time.

Most mortgage lenders require a minimum credit score of 640 to qualify for the program.

The USDA has no down payment requirement. You can finance 100 percent of the home price with a USDA loan. However, if you decide to make a down payment, you can lower your monthly mortgage payments and potentially afford a more expensive home.

USDA loan rates are often lower than conventional 30-year fixed mortgage rates. Plus, mortgage insurance rates are lower. This means a USDA loan is often more affordable overall than a comparable FHA or conventional loan.

No, cash-out refinancing is not allowed in the USDA Rural Housing Program. Its loans are for home buying and rate-and-term refinances only.

USDA loans require mortgage insurance (MI), which includes a 1.00 percent upfront guarantee fee added to your loan balance at closing and an annual fee of 0.35 percent divided into 12 installments and included in your monthly mortgage payments. You can finance your Upfront Mortgage Insurance by adding it to your loan amount. For example, if you purchased a new home for $100,000 and borrowed the full amount, your Upfront Mortgage Insurance would be $1,000, allowing you to increase your loan size to $101,000.

The USDA sets no loan limits, but the amount you can borrow is limited by your household income and debt-to-income ratio. The USDA typically caps debt-to-income ratios to 41 percent. However, the program may be more lenient for borrowers with a credit score over 660 and stable employment, or who show a demonstrated ability to save.

You can find a USDA loan lender by visiting the U.S. Department of Agriculture’s website, which maintains a list of approved lenders for the Rural Housing Program. The USDA Rural Housing loan offers a 30-year fixed-rate mortgage only, with no 15-year fixed option or adjustable-rate mortgage (ARM) program available.

Yes, USDA rural development loans allow both gifts from family members and non-family members for closing costs. Inform your loan officer as soon as possible if you’ll be using gifted funds, as it requires extra documentation and verification from the lender. Additionally, the USDA Rural Housing Program permits sellers to pay closing costs for buyers through seller concessions. These concessions may cover all or part of a purchase’s state and local government fees, lender costs, title charges, and various home and pest inspections.

No, the USDA loan program is designed specifically for primary residences and cannot be used for vacation homes, investment properties, or working farms. The Rural Housing Program focuses on residential property financing.

If you are a W-2 employee, you are eligible for USDA financing immediately, as there’s no job history requirement. However, if you have less than two years in a job, you may not be able to use your bonus income for qualification purposes. Self-employed individuals can also use the USDA Rural Housing Program. To verify your self-employment income, you will need to provide two years of federal tax returns, similar to the requirements for FHA and conventional financing.

Yes, the USDA loan program can be used for various purposes, including making eligible repairs and improvements to a home (such as replacing windows or appliances, preparing a site with trees, walks, and driveways, drawing fixed broadband service, and connecting utilities), permanently installing equipment to assist household members with physical disabilities, and purchasing and installing materials to improve a home’s energy efficiency (including windows, roofing, and solar panels).

Yes, along with U.S. citizens, legal permanent residents of the United States can also apply for a USDA loan.

Today’s USDA mortgage rates

USDA mortgage interest rates consistently rank among the lowest in the market, next to VA loans.

USDA loans can be particularly attractive to borrowers seeking optimal financial terms, especially in an environment with elevated interest rates. Prospective homebuyers who meet the criteria for a USDA loan may be able to secure a great deal right now.

To find out whether you qualify for one — and what your rate is — consult with a trusted lender below.

Time to make a move? Let us find the right mortgage for you

1 Source: USDAloans.com based on Housing Assistance Council data