Chase Bank Warns UK Customers: Crypto Purchases May Lead to Account Closure

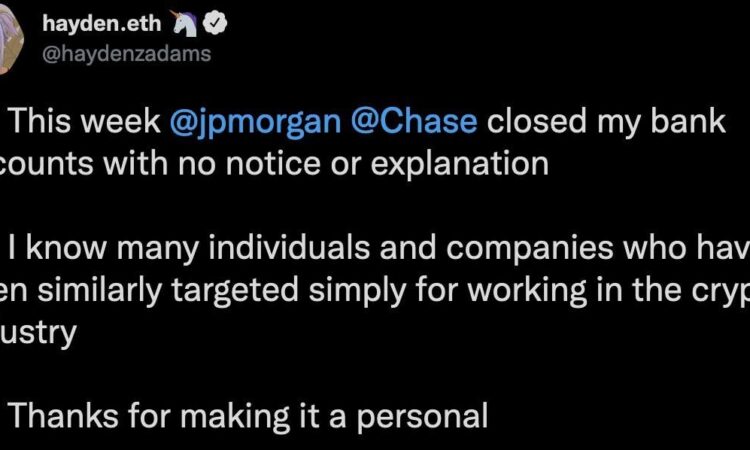

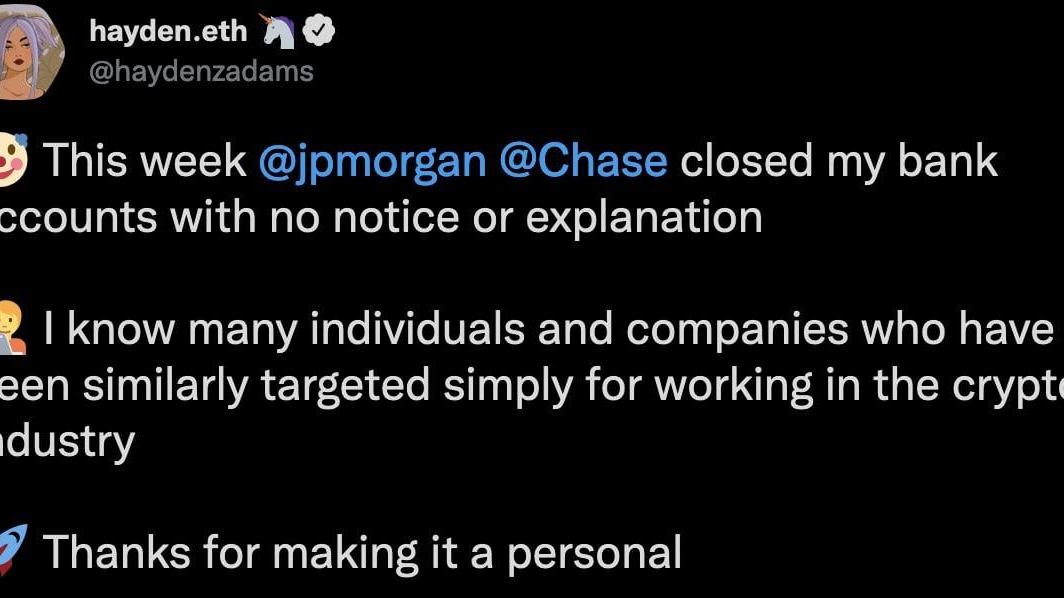

In an unprecedented move, Chase Bank in the UK has begun sending notifications to its customers, warning them that their bank accounts could be closed if used for purchasing crypto assets. This decision has sparked significant concern, especially amidst speculation that a similar policy might soon be implemented for US customers as well.

CBDCs versus Cryptocurrencies

A popular finance influencer on TikTok, known as _cryptonwendyo, has suggested a possible motive behind this action. With the rising emergence of central bank digital currencies (CBDCs), which could be viewed as direct competitors to cryptocurrencies like Bitcoin, banks may be attempting to stymie the growth of these decentralized currencies.

Preventing Unexpected Account Closures

It’s common practice for banks to close accounts without prior warning if they suspect any fraudulent activity. However, this can lead to distress for those who find themselves mistakenly flagged. To circumvent potential issues, customers are advised to spread their funds across multiple accounts and to make immediate contact with the bank if an account is suddenly closed.

Proactive Measures Against Account Suspension

Keeping the account active, maintaining a positive balance, and setting up low-balance alerts can also serve as effective measures against unexpected account closures. However, if an account is closed due to inactivity or negative balances, customers may need to open a new account or recover their funds from their state’s unclaimed property office.