UK house prices have dipped 1.8% compared with this time last year, according to a monthly monitor by Nationwide, reflecting weak activity in the sector throughout the year.

The average price of a home was £257,443 in December, according to the lender, which showed no change from the previous month.

Despite some favourable economic factors for consumers, such as rises in income in cash terms, these weren’t enough to offset the impact of higher mortgage rates, which have been consistently hot as the Bank of England has tried to tame inflation.

In recent months mortgage rates were still more than three times the record lows prevailing in 2021 in the wake of the pandemic.

A borrower earning the average UK income and buying a typical first-time buyer property with a 20% deposit would have a monthly mortgage payment equivalent to 38% of take-home pay — well above the long run average of 30%, Nationwide said.

Read more: New Year’s Resolutions that will make you richer

This has led to a dip in the number of transactions.

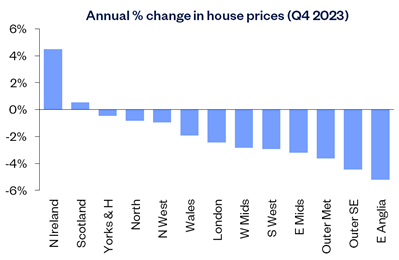

The region with the biggest pullback was East Anglia, which fell 5.2% since last year, while Northern Ireland and Scotland were the only regions to see an average increase across 2023.

Across England overall, prices were down 2.9% compared with Q4 2022, while Wales saw a 1.9% decline.

In terms of housing type, there were signs that more buyers were looking towards smaller, less expensive properties, with transaction volumes for flats holding up better, Nationwide said.

“The total number of transactions has been running at c10% below pre-pandemic levels over the past six months, with those involving a mortgage down even more (c20%), reflecting the impact of higher borrowing costs,” said Robert Gardner, Nationwide’s chief economist.

“On the flip side, the volume of cash transactions has continued to run above pre-Covid levels.”

The data comes alongside a prediction that house prices will fall further in 2024. Housing platform Rightmove said it expects asking prices to track around 1% lower nationally by the end of next year, as the market continues to normalise after post-Covid freneticism.

Read more: Property: 12 of 2023’s most stunning properties

Sellers will likely have to price more competitively to secure a buyer next year and agents will have to work harder especially when it comes to first-time buyers as affordability remains stretched.

Zoopla also recently published its house price index for November showing houses were being sold at steep discount. In London properties are selling for £25,000 less than the asking prices, while in the rest of the country sellers were lowering prices by £18,000.

Watch: How much money do I need to buy a house?

Download the Yahoo Finance app, available for Apple and Android.