ma li/iStock via Getty Images

Introduction

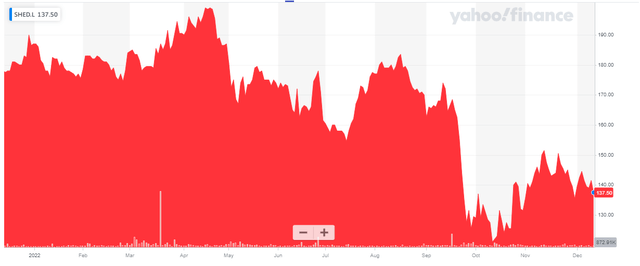

While I like real estate, some of the valuations in Europe have been pricing assets for perfection and the only logical consequence was a reality check for some REITs. Urban Logistics REIT (OTCPK:PCILF) reached a high of 200 pence earlier this year but has lost in excess of 30% of its share price. In this article, I’ll have a closer look at the REIT’s performance while I will also play around with the capitalization rate to see how the fair value per share holds up using more conservative parameters.

Urban Logistics has its primary listing in London, where it is trading with SHED as its ticker symbol. The average daily volume is approximately 1.7 million shares per day, which clearly makes it the best market to trade in the REIT’s shares. The current market cap is approximately 650M GBP. I will use the GBP as base currency throughout this article.

The first half of the year confirms the REIT is on the right track

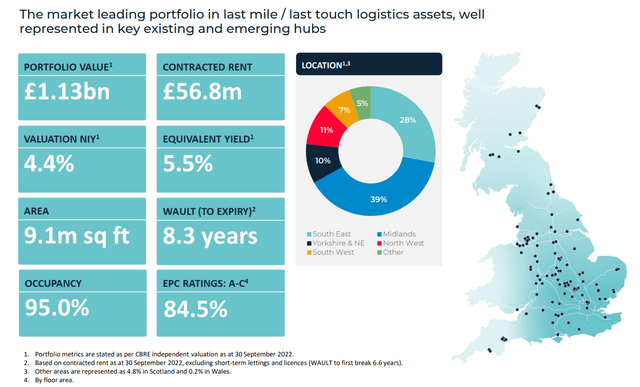

The REIT’s name gives it away: Urban Logistics invests in logistics properties in Great Britain, with about 95% of its assets in England.

Urban Logistics Investor Relations

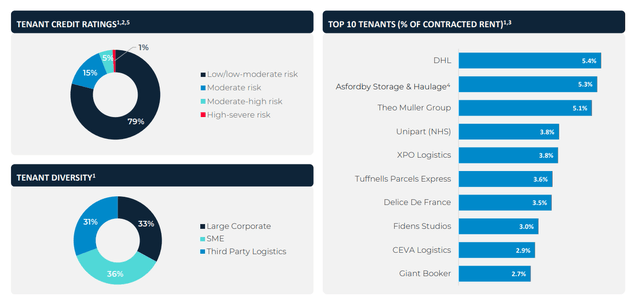

Most of the tenants are large counterparties with low to a low-moderate risk profile, with the German DHL Group (a subsidiary of Deutsche Post) as Urban’s largest tenant.

Urban Logistics Investor Relations

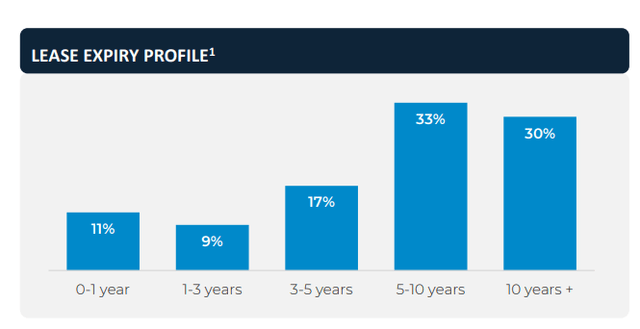

One of the elements I like most about Urban Logistics is its relatively long WAULT of 8.3 years, with about 30% of its leases lasting for much longer than 10 years.

Urban Logistics Investor Relations

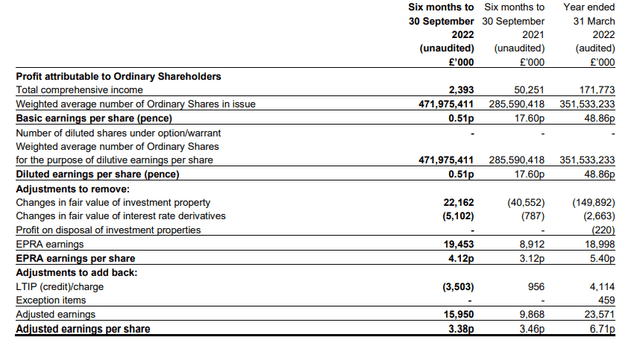

During the first half of the year (which ended on September 30, as Urban Logistics’ financial year runs from April 1 to March 31), the REIT reported a net rental income of 25.4M GBP. After deducting the 5M GBP in administrative expenses and the 4.6M GBP in finance expenses, the net cash earnings provided by the properties were approximately 16M GBP, resulting in adjusted earnings per share result of 3.38 pence based on the current share count of 472 million shares.

Urban Logistics Investor Relations

This means the current distribution of 3.25 pence for the first half of the current financial year is still fully covered by the adjusted earnings and the EPRA earnings. Based on the current share price of 137.50 pence, the current yield is approximately 5.5% as the interim dividend was followed by a final dividend of 4.35 pence for a total of 7.6 pence per share in the past few years. Not bad at all, but keep in mind the vast majority of the earnings is spent on the distribution. Distributions from REITs are subject to a 20% withholding tax in the UK, so you should consult with a tax advisor to see if it is possible to reclaim a portion of those foreign taxes.

I’m not convinced about the book value of the properties – but the LTV ratio holds up anyway

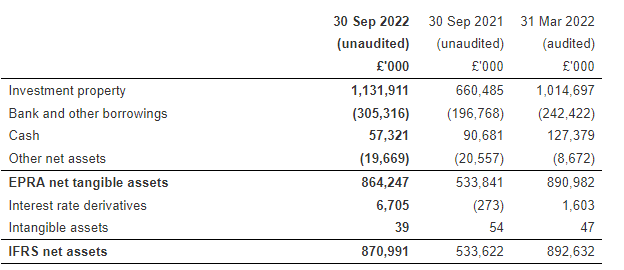

As of the end of September, the official Net Asset Value per share was estimated at 185.54 pence per share, based on the book value of the properties of approximately 1.13B GBP. The EPRA Net Tangible Assets came in at 183.11 pence per share, and this is a metric I’d like to use going forward.

Urban Logistics Investor Relations

My first question obviously is ‘how reliable is the 1.13B GBP book value of the properties?’ We saw in the income statement the REIT already had to record a negative impact of in excess of 20M GBP, so I wanted to dig a bit deeper into this.

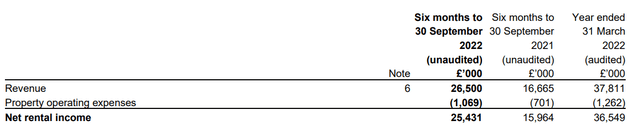

We know the net rental income in the first half of this year was 25.4M GBP (see below). On an annualized basis, we can realistically expect 51M GBP.

Urban Logistics Investor Relations

However, simply annualizing the H1 result would not be the smartest idea as the REIT has been able to hike the rent at a bunch of properties while it also closed a few additional acquisitions. The current run rate of the net rental income is estimated at 57M GBP.

Urban Logistics Investor Relations

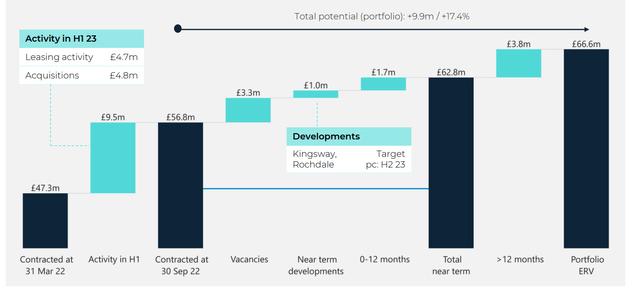

I won’t get as far as using the REIT’s near-term guidance of 62.8M GBP as this assumes the vacancy will drop to zero, but I will include the 1M GBP addition from development projects and 1.7M GBP in anticipated rent hikes to end up at 59.5M GBP as run-rate for the net rental income.

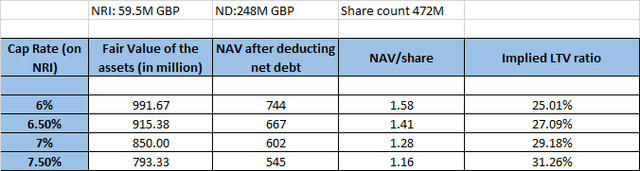

This means the current book value of 1.15B GBP for the rent-generating properties and the properties under development represent a net rental income yield of 5.18%. That’s not very high, but I have seen much worse on the European continent lately, where some logistics REITs valued their assets at a 4-4.5% net rental income yield. In the table below, I calculated an updated fair value for the assets as well as the impact on the NAV/share and the LTV ratio. I used the current share count of 472 million shares and a net financial debt of 248M GBP.

Based on the table above, the market is already using a 6.5% Net Rental yield, so there is some leeway here. Using 6% would still result in a NAV/share of 158 pence per share (+14% above the current share price) while the LTV ratio would still be low at approximately 25%. Even in a more conservative scenario using a 7% rental yield, the downside would be limited to just around 7% while the LTV ratio will stay below 30%.

Investment thesis

I was pleasantly surprised after digging into Urban Logistics. I like the low LTV ratio as this will shield the company from interest rate increases (a 200 basis point increase to an average cost of debt of 5% would reduce the EPRA earnings by just 6M GBP per year. That’s very manageable and considering the 5-year UK bond yield is just around 3.2%, I don’t think we’ll see 5% anytime soon.

The current share price is also relatively attractive compared to the official NAV/share, but even if I apply more conservative parameters, Urban Logistics is still trading at a discount to its fair value based on both a 6% and 6.5% capitalization rate based on the net rental income.

I currently have no position in Urban Logistics, but the REIT is actually pretty attractively priced right now.