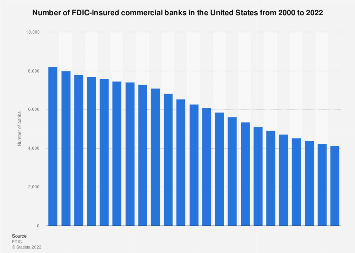

In 2022, there were 4,135 FDIC-insured commercial banks in the United States. The FDIC, Federal Deposit Insurance Corporation, is an agency that insures the banking system in the U.S. Between 2000 and 2022, the number of FDIC-insured commercial banks decreased sharply. In spite of the dropping number of banks, the number of employees in the banking industry increased in the last two decades.

Why do banks need insurance?

The number of banks is shrinking, but the value of deposits in these banks is growing, amounting to trillions of U.S. dollars. The primary function of the FDIC is to insure these deposits up to 250,000 U.S. dollars. Under stable economic conditions, this task can be performed without particular difficulties. However, during economic uncertainties and recessions, it can be challenging. During the Global Financial Crisis, hundreds of FDIC-insured banks declared insolvency. Account holders were then eligible for compensation for the portion of their accounts that the FDIC insured.

Financial figures of the FDIC-insured banks

Except in times of deep recession, U.S. banks have a positive net operating income. It amounted to over 317 billion U.S. dollars in 2022. The value of funds borrowed by the U.S. FDIC-insured banks reached one trillion U.S. dollars that year.