ECB publishes supervisory banking statistics on significant institutions for the second quarter of 2023

9 October 2023

- Aggregate Common Equity Tier 1 ratio up to 15.72% in second quarter of 2023 (compared with 15.53% in previous quarter and 14.96% in second quarter of 2022)

- Aggregated annualised return on equity up to 10.04% in second quarter of 2023 (compared with 7.59% in second quarter of 2022)

- Aggregate non-performing loans ratio (excluding cash balances) remained stable at 2.26% (compared with 2.24% in previous quarter)

- Share of loans showing significant increase in credit risk (stage 2 loans) decreased slightly to 9.19% (down from 9.31% in previous quarter)

- Statistics include breakdowns of debt securities by counterparty for first time

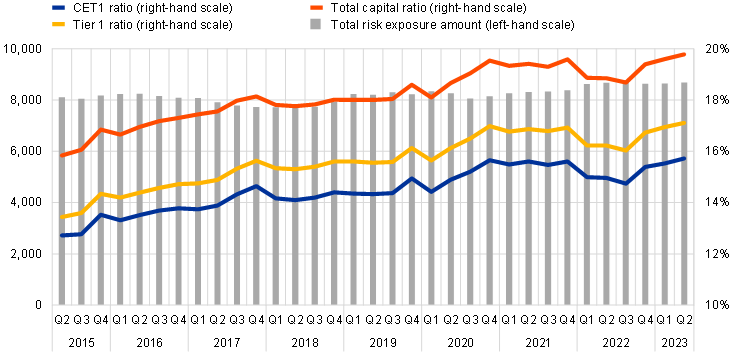

Capital adequacy

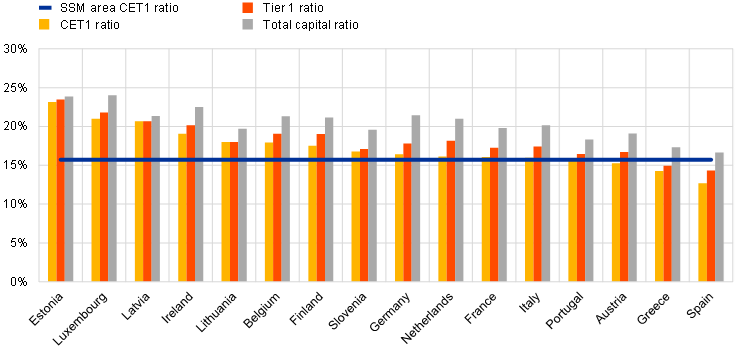

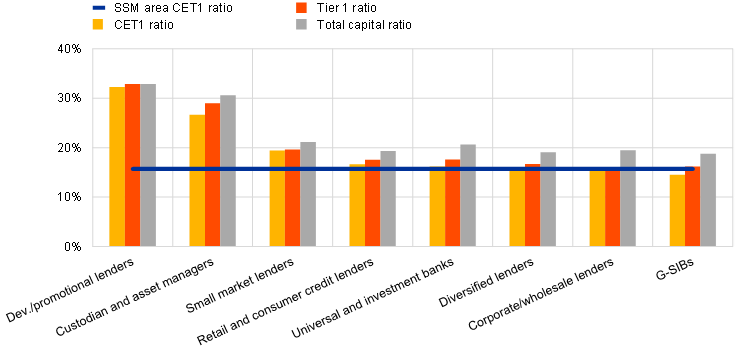

The aggregate capital ratios of significant institutions (i.e. those banks that are supervised directly by the ECB) increased in the second quarter of 2023. The aggregate Common Equity Tier 1 (CET1) ratio stood at 15.72%, the aggregate Tier 1 ratio stood at 17.11% and the aggregate total capital ratio stood at 19.78%. Aggregate CET1 ratios at country level ranged from 12.70% in Spain to 23.16% in Estonia. Across Single Supervisory Mechanism business model categories, global systemically important banks (G-SIBs) reported the lowest aggregate CET1 ratio (14.54%).

Chart 1

Capital ratios and their components

(EUR billions; percentages)

Source: ECB.

Chart 2

Capital ratios by country for the second quarter of 2023

(percentages)

Source: ECB.

Note: Some countries participating in European banking supervision are not included in this chart, either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation in that country.

Chart 3

Capital ratios by business model for the second quarter of 2023

(percentages)

Source: ECB. Notes: “G-SIBs” stands for “global systemically important banks”. “Dev./promotional lenders” stands for “development/promotional lenders”. SSM stands for “Single Supervisory Mechanism”.

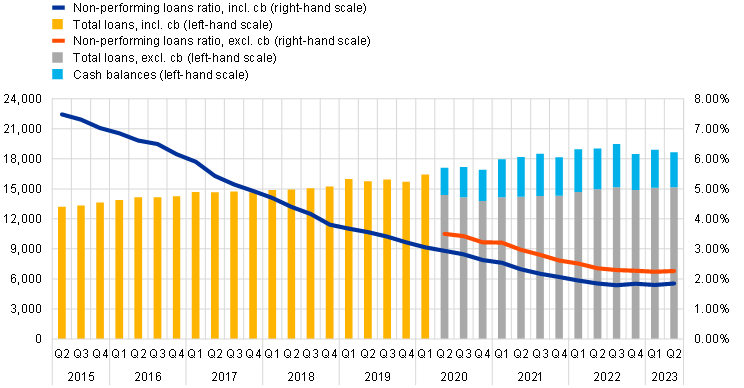

Asset quality

The non-performing loans (NPL) ratio excluding cash balances at central banks and other demand deposits remained stable, standing at 2.26% in the second quarter of 2023. The stock of NPLs (numerator) increased by €4 billion to €343 billion, while loans and advances excluding cash balances (denominator) increased slightly to €15,157 billion.

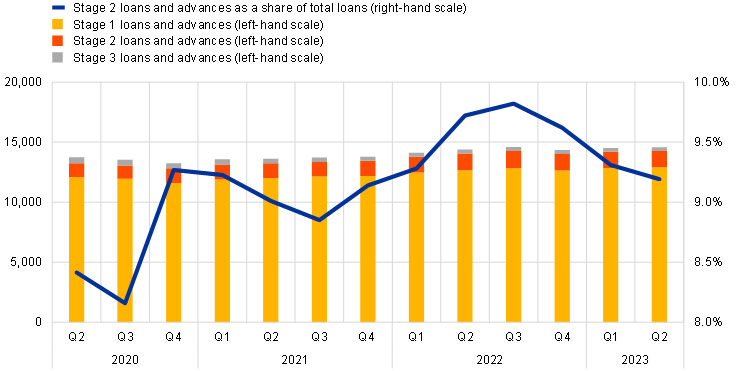

Aggregate stage 2 loans as a share of total loans decreased to 9.19% (down from 9.31% in the previous quarter). The stock of stage 2 loans amounted to €1,339 billion (compared with €1,351 billion in the previous quarter).

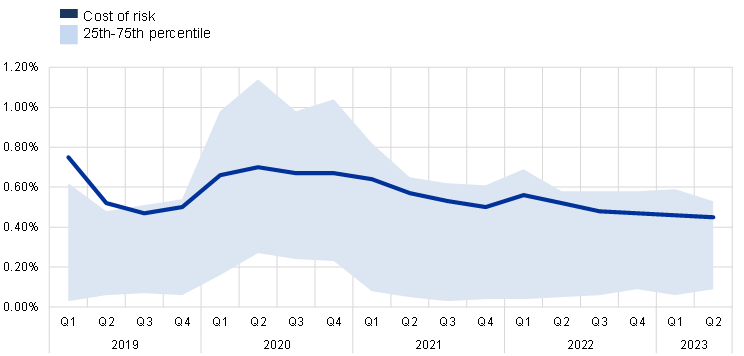

Cost of risk was stable, standing at an aggregate level of 0.45% in the second quarter of 2023 (compared with 0.46% in the previous quarter). Across significant institutions, the interquartile range narrowed to 0.44 percentage points (down from 0.53 percentage points in the previous quarter).

Chart 4

Non-performing loans

(EUR billions; percentages)

Source: ECB. Note: “cb” refers to cash balances at central banks and other demand deposits.

Chart 5

Loans and advances subject to impairment review

(EUR billions; percentages)

Source: ECB.

Note: Stage 1 includes assets where credit risk has not increased significantly since initial recognition, stage 2 includes assets that have shown a significant increase in credit risk since initial recognition, and stage 3 includes assets that have objective evidence of impairment at the reporting date.

Chart 6

Cost of risk

(percentages)

Source: ECB.

Return on equity

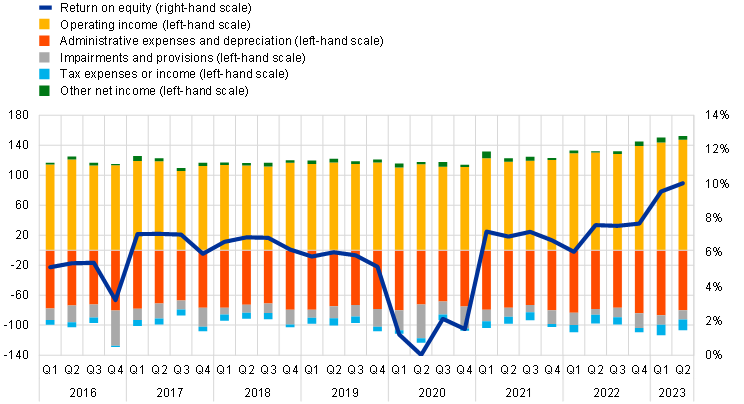

The aggregated annualised return on equity increased significantly to 10.04% in the second quarter of 2023 (compared with 7.59% in the second quarter of 2022). An increase in operating income (driven by higher net interest income, which rose by 24% year on year) and a decrease in impairment and provisions were the main contributors to the increase in aggregate net profit (the numerator of the return on equity). In the second quarter of 2023 the net interest margin increased to 1.53% (compared with 1.23% one year previously), while still showing structural differences across countries.

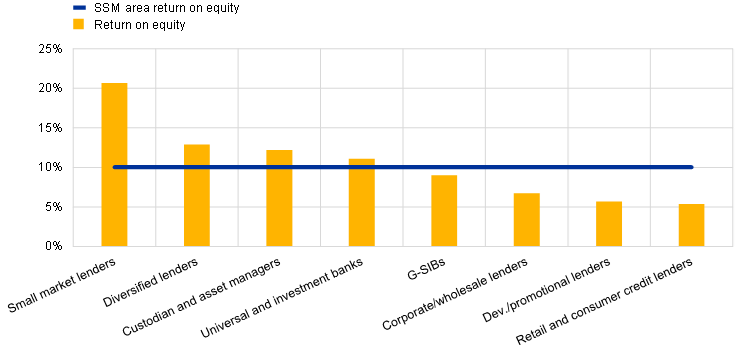

Across Single Supervisory Mechanism business model categories, the aggregate annualised return on equity ranged from 5.39% for retail and consumer credit lenders to 20.65% for small market lenders.

Chart 7

Return on equity and composition of net profit and loss

(EUR billions; percentages)

Source: ECB.

Chart 8

Return on equity by business model for the second quarter of 2023

(percentages)

Source: ECB. Note: “G-SIBs” stands for “global systemically important banks”. “Dev./promotional lenders” stands for “Development/promotional lenders”. SSM stands for “Single Supervisory Mechanism”.

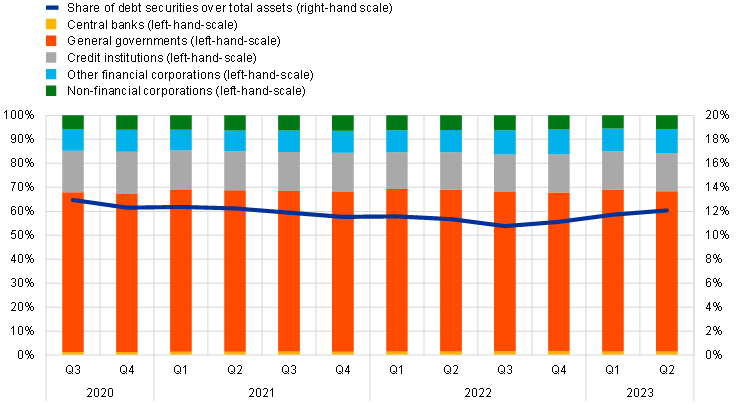

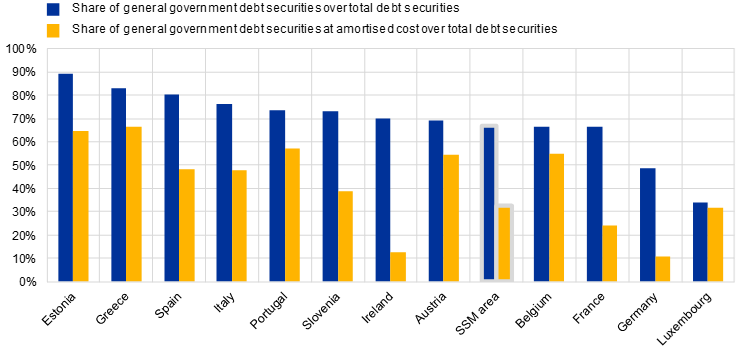

Debt securities by counterparty

Debt securities as a share of total assets stood at 12.07% in the second quarter of 2023. General government debt securities accounted for 66.89% (€2,126 billion) of this share, and those measured at amortised cost for 32.50% (€1,033 billion), with considerable variation across jurisdictions in both cases. Estonia reported the highest value for the former (89.19%), while the latter ranged from 66.46% in Greece to 10.58% in Germany.

Chart 9

Share of debt securities by counterparty

Source: ECB.

Chart 10

Share of general government debt securities by country for the second quarter of 2023

Source: ECB.

Note: Some countries participating in European banking supervision are not included in this chart, either for confidentiality reasons or because there are no significant institutions at the highest level of consolidation in that country. SSM stands for “Single Supervisory Mechanism”.

Factors affecting changes

Supervisory banking statistics are calculated by aggregating the data that are reported by banks which report COREP (capital adequacy information) and FINREP (financial information) at the relevant point in time. Consequently, changes from one quarter to the next can be influenced by the following factors:

- changes in the sample of reporting institutions;

- mergers and acquisitions;

- reclassifications (e.g. portfolio shifts as a result of certain assets being reclassified from one accounting portfolio to another).

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- The complete set of Supervisory banking statistics with additional quantitative risk indicators is available on the ECB’s banking supervision website.