The crypto market is down today after a sharp correction hit Bitcoin (BTC), Ether (ETH) and altcoin over the weekend.. Bitcoin price dropped by 6.5%, losing nearly a week of gains in 20 minutes on Dec. 10.

Opening the week, crypto market price action remains tilted to the downside as investors and money managers further digest the factors behind the abrupt correction.

Futures liquidations send the crypto market lower

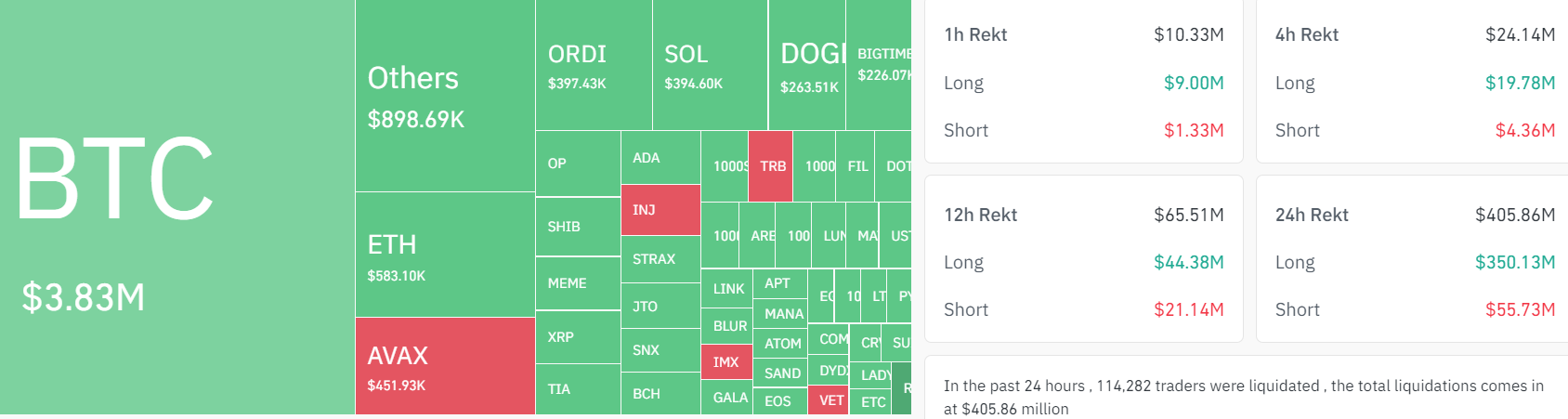

The decline across major cryptocurrencies has led to a rush of liquidations across the derivative market. Bullish traders were caught off guard, leading to a quick spat of long liquidations.

In the past 24 hours, over $350.3 million in long positions have been liquidated across the crypto market, with $44.3 million being wiped out in the previous 12 hours. Crypto market prices are negatively affected when long derivative positions are liquidated without buying pressure from trading volume.

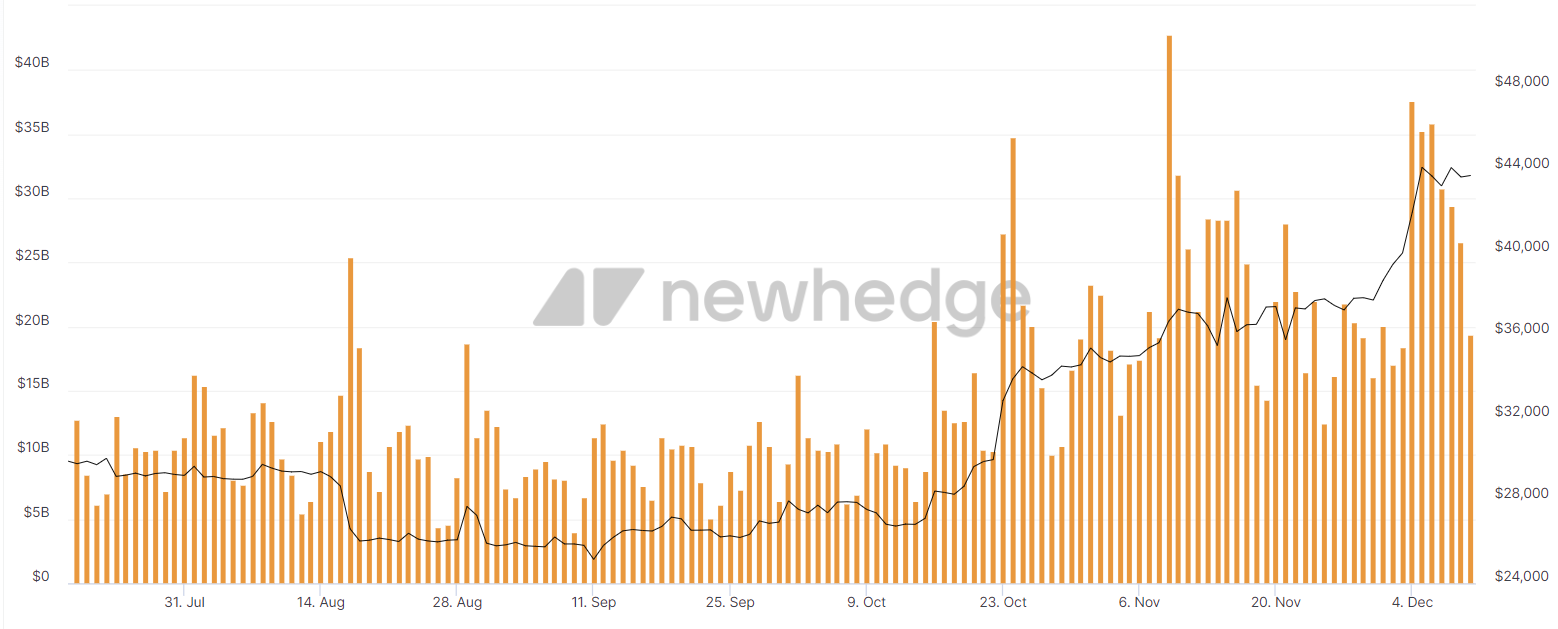

Volumes trend lower

After reaching over $37.6 billion in total market trading volume on Dec. 4, each subsequent day has witnessed a decrease. On Dec. 10, there was only $19 billion in daily trading volume across the crypto market.

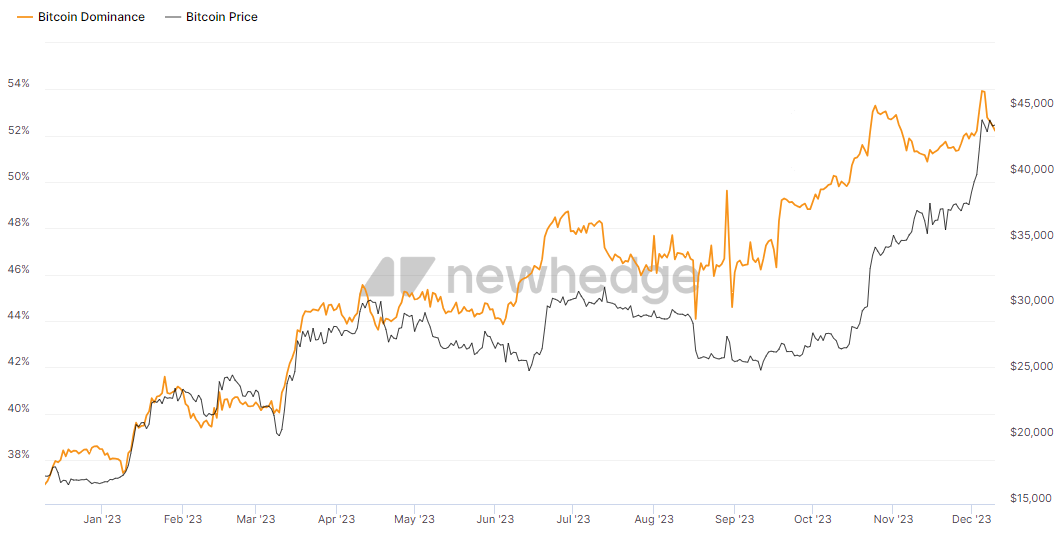

The decrease in market trading volume comes as some analysts grow concerned about Bitcoin’s dominance in the market. On Dec. 4, Bitcoin dominance reached the monthly peak, similar to trading volume.

Typically, decreasing Bitcoin dominance is positive for crypto markets, signaling a potential altseason, but the results have yet to arrive.

Related: Binance’s CZ must stay in U.S., Elon Musk seeks $1B for AI, and other news

US-led regulatory pressure against crypto is in full-steam-ahead mode

The cryptocurrency industry and regulators have a long history of not getting along either due to various misconceptions or mistrust over the actual use case of digital assets.

On Nov. 21, the United States Department of Justice announced enforcement actions and a settlement related to CZ and Binance in which both pleaded guilty.

Binance’s compliance obligations were unsealed on Dec. 8 and outlined extensive monitorship by the DOJ. Binance’s new compliance obligations include cooperation to grant U.S. authorities access to all documents, records and resources upon request.

Related: Is the Bitcoin price dip toward $40K a bear trap?

Risk assets are heavily impacted by investor sentiment, and this trend extends to Bitcoin and altcoins. To date, the threat of unfriendly cryptocurrency regulation or, in the worst case, an outright ban continues to impact crypto prices on a monthly basis.

For now, traders are likely securing profits after a multi-month rally sent prices to yearly highs. In the short term, the cryptocurrency market will continue to navigate multifaceted challenges, and the ebb and flow of various economic and regulatory factors will undoubtedly shape its trajectory for the foreseeable future.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.