This week, popular trading platform Robinhood announced the launch of Robinhood Crypto, its cryptocurrency trading app, across the European Union. The Robinhood Crypto rollout aims to capitalize on growing crypto interest in the region by offering Bitcoin rewards scaled to users’ trading volumes.

Keypoints

- Robinhood launched its crypto trading app Robinhood Crypto in the European Union

- EU users will get up to 0.325% of their monthly trading volume back in Bitcoin rewards

- There is also a referral program offering up to 1 BTC for signing up friends to Robinhood Crypto

- The app launches with over 25 tradeable cryptocurrencies including Bitcoin and Ethereum

- Robinhood cited the EU’s crypto asset legislation MiCA as a factor in anchoring expansion there

According to Robinhood’s press release, the app is now accessible to all eligible adult customers based in the EU. The launch comes right on the heels of Robinhood debuting its broader investing platform in the United Kingdom last week.

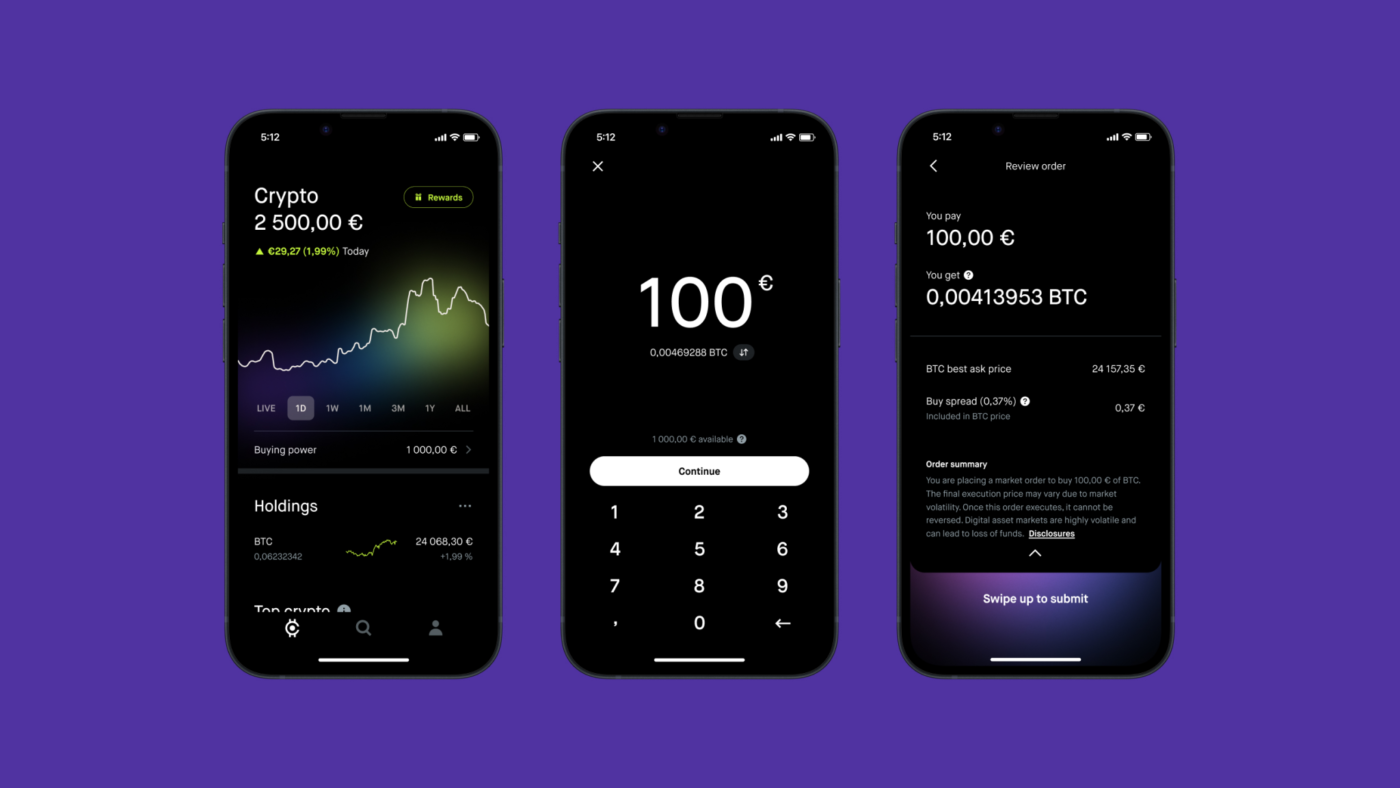

A main feature intended to attract users is Robinhood Crypto’s “Crypto Back” rewards program. Based on their total monthly trading volume across the 25+ available cryptocurrencies, customers will receive a percentage back in Bitcoin.

The BTC rewards start at 0.10% for volumes between €0.10 and €100,000, reaching 0.325% for over €1 million in volume. However, traders must exceed €100 in order volume each month to qualify for payouts, otherwise rewards accrue until meeting the threshold.

Robinhood Crypto also introduces a referral program where current users can earn up to 1 BTC for signing up friends. The company notes the average bonus sits around €10-€20 in BTC, with only 2% of participants receiving the full 1 BTC maximum.

Part of Robinhood’s crypto value proposition includes no trading fees. The interface displays bid-ask spread transparency as well, delineating the trading rebates that Robinhood receives behind the scenes from its venue partners.

The ability to transfer cryptocurrencies on- and off-platform will roll out later, though. For now, EU users can only trade between the 25+ coins and tokens supported at launch.

Robinhood cited the EU’s forward-looking crypto regulations as a major factor in prioritizing expansion into the region. Rules like the Markets in Crypto-Assets (MiCA) legislation take a cohesive approach to governance across the 27 EU states.

By securing legal approval to operate in one country, a platform can then easily expand into others. MiCA also enforces standards around disclosure, cybersecurity policies, and reserve backing of coins.

Ultimately, Robinhood is aiming to capitalize on blossoming crypto adoption, as digital asset ownership in Europe has tripled since 2019 according to the company’s research. With crypto rewards and a smooth user experience, Robinhood Crypto hopes to capture a significant piece of the current growth phase.