(Bloomberg) — European Union finance ministers are expected to discuss a set of guardrails aimed at making governments rein in deficits and debt while leaving room for green and defense investment as they push for an agreement on new fiscal rules this week.

Most Read from Bloomberg

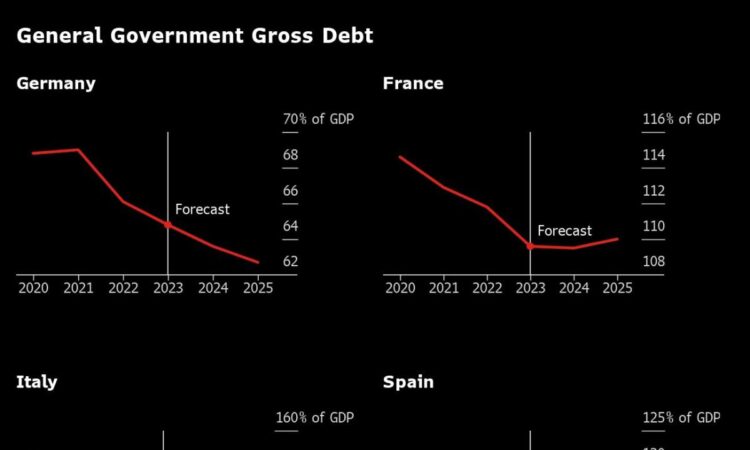

A proposal from Spain, which holds the EU presidency, would see countries forced to cut debt as a proportion of output by an average of 1 percentage point a year over an adjustment period while it exceeds 90% of gross domestic product, a senior EU diplomat told Bloomberg. Countries with debt between 60% and 90% of GDP should trim it by half that.

Member states would also need to build a fiscal buffer of 1.5% of GDP below the EU’s deficit threshold of 3% of GDP, the person said on condition of anonymity as discussions are ongoing.

The proposal also aims to give governments leeway to finance the green transition and bolster the bloc’s military capability after lessons were learned on how austerity in the aftermath of the financial crisis depressed the European economy, the person added.

EU finance ministers are due to consider the Spanish plan at a gathering in Brussels on Dec. 7-8, though an agreement is far from certain.

The proposal is more demanding than a framework put forward by the European Commission, the EU’s executive arm, in April, and the fiscal buffer is seen as a concession to a hawkish group of countries led by Germany, people familiar with the matter said.

The Spanish proposal also tolerates a small deviation from governments’ expenditure ceiling, which will become the key indicator to keep budgets in check. Potential options include a maximum of 0.25% or 0.5% annually and as much as 0.5% or 0.75% cumulatively during a period yet to be determined.

Prioritizing defense when assessing member states’ expenditure is broadly accepted, but other investment areas remain open, the people said. This includes whether Covid recovery-fund loans or national money allocated to EU-funded projects would slow down the fiscal effort required over a period of four or seven years, depending on investment and reforms proposed by capitals.

The French are also concerned that rules applying to countries with deficits above 3% of GDP would be applied too strictly, leaving no flexibility for investment in core priorities, according to an official familiar with the negotiations.

Speaking at a conference in Paris on Tuesday, French Finance Minister Bruno Le Maire said the rules are fundamental to rebuilding fiscal health but said they mustn’t lead to austerity.

“You can’t tell me to repair public finances in the next three years, but during this time you’re not allowed any investment in the climate, no investment in security or green industry,” he said. “That will be no.”

The EU suspended its fiscal rules during the Covid pandemic and subsequent energy crisis to allow for massive spending to protect businesses and households. With the old Stability and Growth Pact no longer considered fit for Europe’s eclectic economies, member states are trying to agree a revamp that has underscored tensions between countries that call for strict numerical targets and those that want flexibility.

France and Germany, the EU’s two biggest economies, have ramped up efforts in recent weeks to push for a compromise, though German finance chief Christian Lindner has been snarled in a budget crisis after a shock court ruling threw his country’s financial planning into disarray.

Le Maire has said a December deal is essential for the EU’s credibility. The old fiscal rules will come back into force on Jan. 1, but capitals want to leave enough time to put in place a legislative reform ahead of EU parliament elections in June.

European Central Bank President Christine Lagarde has also called for a political accord in 2023. In order to be eligible for the ECB’s so-called fragmentation tool, a country would have to comply with the EU fiscal framework.

–With assistance from Kamil Kowalcze and Alessandra Migliaccio.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.