(Bloomberg) — The UK’s quantitative tightening program is helping create an arbitrage opportunity for banks, allowing them to profit from the difference in short-term borrowing and lending rates.

The arbitrage was created by a liquidity facility set up by the Bank of England last year to alleviate cash shortages as it winds down its bond-buying program. The weekly short-term repo operation allows banks to borrow cash at the BOE’s key rate in return for pledging gilts for a week. Meanwhile, the price investors pay to obtain cash on the repo market reached eight basis points above the BOE’s key rate last week.

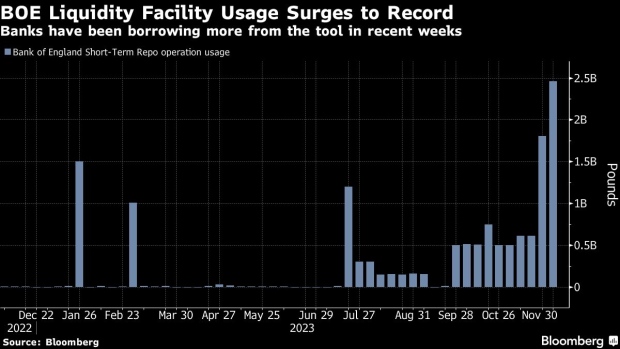

Banks borrowed £2.46 billion ($3.1 billion) from the facility on Thursday, the most since it was introduced in October 2022. While the users of the facility and their motivations are not public, the increase could reflect banks profiting from the arbitrage, according to Imogen Bachra, Head of Non-Dollar Rates Strategy at NatWest Markets. “It makes sense to me as repo cheapens,” she said.

Banks aren’t doing anything wrong by exploiting the arbitrage opportunity. In fact they’re helping to correct the widening spread between short-term money market rates and Bank Rate as quantitative tightening gets underway.

“The BOE don’t want money market rates to diverge particularly from Bank Rate, otherwise Bank Rate ceases to be a relevant tool for monetary policy,” Bachra said.

The so-called Repurchase Overnight Index Average, or RONIA, reached a high of 5.33% last week, while Bank Rate is only 5.25%. That’s the largest premium since April 2020.

The BOE all but endorses the arbitrage in the explanatory note issued when it set up the liquidity facility. The purpose of the vehicle is to “ensure that short-term market rates remain close to Bank Rate” by making sure “commercial banks have little need to pay up in money markets for reserves (since they can borrow additional reserves from the STR at Bank Rate.)”

As excess liquidity dwindles because of BOE bond selling, there’s a risk the STR is used more frequently by banks in need of reserves, according to Sanjay Raja, an economist at Deutsche Bank. The BOE’s explanatory note in 2022 said the point at which reserves become scarce in this way is “probably several years” away.

“The STR is intended to be used ‘freely’ as they wish to access reserves as necessary,” Raja said. “We will need to see how this evolves more closely over the coming months to get a sense around whether we are hitting the Bank’s preferred minimum range of reserves.”

©2023 Bloomberg L.P.