Gold hits record high and bitcoin breaks $40,000; Spotify to cut headcount by 17% – business live | Business

Introduction: Gold at all-time high on rate cut hopes

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Gold has climbed to a record high for the second session in a row, as investors flock to the traditional safe haven asset amid hopes of interest rate cuts in the months ahead.

The gold price has hit $2,111.39 per ounce, taking it over the record set on Friday night and further above the previous record set in August 2020.

Gold has strengthened amid hopes that the cycle of interest rate increases over the last couple of years has now ended, and that central banks will turn their attention to cutting borrowing costs in 2024.

That has led to a weaker US dollar, which pushes up the gold price (as it’s priced in dollars).

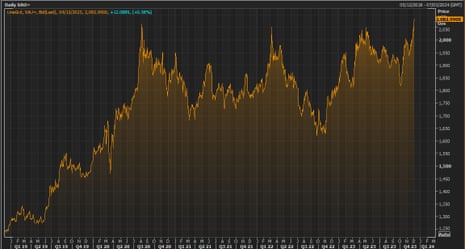

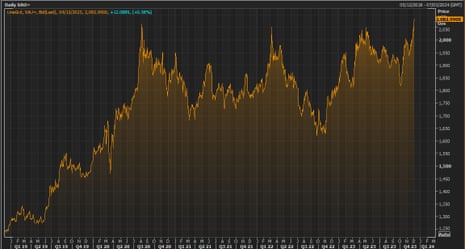

As this chart shows, gold has climbed pretty steadily since the start of October, when it was changing hands at $1,820 per ounce.

Crypto assets are also on a charge, with bitcoin hitting $40,000 for the first time this year today, with some traders betting the US Federal Reserve could start cutting US interest rates next spring.

Kyle Rodda, senior financial market analyst at Capital.com, explains:

Markets are piling in on bets of Fed rate cuts next year, possibly as soon as March. That pushed gold and Bitcoin to critical levels, with the former busting to record highs and the latter hitting $US40,000 for the first time since May 2022.

Gold’s move boasted all the hallmarks of a technical melt-up, as the break of previous all-time highs set off stops and buy orders.

A lower interest rate environment would favour gold, which doesn’t generate a yield (unlike bonds, equities or current cash savings accounts).

Also coming up today

The UK economy will be under the microscope, as the Resolution Foundation thinktank holds an all-day event examining a better economic strategy for the country.

Its work has shown that British workers are missing out on £10,700 a year after more than a decade of weak economic growth and high inequality.

Resolution will hear from Labour leader Sir Keir Starmer, who is expected to warn that he would not “turn on the spending taps” if he wins the next election

The Guardian reports this morning that Starmer will say:

“Anyone who expects an incoming Labour government to quickly turn on the spending taps is going to be disappointed … It’s already clear that the decisions the government are taking, not to mention their record over the past 13 years, will constrain what a future Labour government can do.”

“This parliament is on track to be the first in modern history where living standards in this country have actually contracted. Household income growth is down by 3.1% and Britain is worse off.

“This isn’t living standards rising too slowly or unequal concentrations of wealth and opportunity. This is Britain going backwards. This is worse than the 1970s, worse than the recessions of the 1980s and 1990s, and worse even than the great crash of 2008.”

The agenda

-

7am GMT: German trade balane statistics for October

-

9.30am GMT: Resolution Foundation holds event examining UK economy in 2030

-

2pm GMT: ECB president Christine Lagarde gives a speech at the Académie des Sciences Morales et Politique’s conference in Paris

-

3pm GMT: US factory orders for October

Key events

UK mortgage borrowers, and those with childrem face higher interest rates

UK homeowners with a mortgage have been hit by a higher rate of personal inflation than renters, new statistics show, as rising interest rates pushed up repayment costs.

The Office for National Statistics has reported that the average owner occupiers still paying for their house experienced an annual inflation rate of 9.3% in September.

That is 2.1 percentage points higher than the rate experienced by private renters and was primarily because of mortgage interest payments, the ONS says.

It’s latest household cost index, which measures of how changing costs affect different subsets of the UK population, has also found that those of working age experienced a higher inflation rate (8.3%) than retired households (whose costs rose by 7.8% over the last year).

Households with children experienced a higher annual inflation rate of 8.4% in September 2023, compared with 8.1% for households without children.

Overall, UK household costs, as measured by the Household Costs Index (HCI), rose 8.2% in the 12 months to September 2023, the ONS says.

And it claims there was “little difference in annual inflation rates for high- and low-income households”, which were 8.3% and 8.2%, respectively in September 2023.

[However, poorer households may not have any spare resources to cover this increase]

The HCI’s are weighted to reflect spending habits. Poorer households spend a greater share on essentials like food and energy, while wealthier ones spend more on mortgages, which grew more expensive as UK interest rates hit 15-year highs.

Our first quarterly Household Costs Indices (HCIs), UK: January 2022 to September 2023 article gives an insight into inflation as experienced by different types of households and most closely reflects their lived experience.

➡️ https://t.co/oE1TlXIFDo pic.twitter.com/u3XzrVIWQw

— Office for National Statistics (ONS) (@ONS) December 4, 2023

Jeremy Hunt, chancellor of the exchequer, then takes the stage at Resolution Foundation’s event on the need for a new economic strategy for Britain.

And he gets a reminder of political mortality, with Zanny Minton Beddoes, editor-in-chief of The Economist, introducing Hunt as “at least for the moment” the man in charge of sorting out the UK economy.

Hunt presses for a clarification, can’t we say “subject to the next election”?

“Subject to the next election, blah blah blah”, Minton Beddoes concedes.

But then she asks Hunt for his view of why the UK is in such a mess – how much blame should the government take?

Hunt replies that it’s wrong to take the view that the UK has been an outlier.

We were been hit by the worst financial crisis since the second world war, he points out, adding that since 2010 the UK has grown faster than Spain, Portugal, France, Italy, the Netherlands, Austria, Germany and Japan.

Hunt says:

It’s absolutely right to say ‘why have we all fallen into this low-growth paradigm and what can we do to get out of it?’

But I don’t think this is something we are uniquely in a bad situation with respect to.

This is affecting all westen nations, and you have to have a plan to get out of it.

Q: We have been doing significantly worse, though, if you look at living standards over the last 15 years. Is there anything, with hindsight, you’d have done differently?

Hunt prefers to talk about what he’s doing now. He says productivity is the key to raising living standards, and points to his decision in the autumn statement to make ‘full expensing’ permanent (allowing businesses to offset investment against their tax bills).

That will help lift business investment by £20bn a year, Hunt says, closing half of the gap between the UK and France, Germany and the US.

The chancellor then claims that the UK has the most untapped potential to become the most prosperous 21st century economy.

Why? Partly because the UK’s introspection, and also because the UK’s potential in technology and innovation.

Q: But what’s your growth strategy?

Hunt says he wants to improve productivity, by increasing business investment

Secondly, you need a very clear view as to where the UK’s competitive advantage lies. Outside the US, it has the best higher education sector, and the best financial sector, he says.

He says it needs to focus on innovation, to create a world-beating technology sector and a new Silicon Valley.

Our Politics Live blog has more coverage, here:

Here are some more highlights from Resolution Foundation’s report into the UK economy.

It shows that the UK is the second-biggest services exporter in the UK, after the US, but ahead of Germany and France:

But here’s the damage caused by over a decade of relative economic decline:

Productivity growth has been half the rate seen across other advanced economies. Wages have flatlined as a result, costing the average worker £10,700 a year in lost pay growth. pic.twitter.com/E0SKOjqvHo

— Resolution Foundation (@resfoundation) December 4, 2023

Productivity growth has been half the rate seen across other advanced economies. Wages have flatlined as a result, costing the average worker £10,700 a year in lost pay growth. pic.twitter.com/E0SKOjqvHo

— Resolution Foundation (@resfoundation) December 4, 2023

Back in the crypto market, Bitcoin is still trading at an 18-month high.

Bitcoin is up over 7%, and has traded as high as $41,800, the highest since April 2022.

Rania Gule, market analyst at broker XS.com, say the prospect of bitcoin exchange-traded fund winning approval (as has been oft-rumoured) is one factor:

The cryptocurrency market is now eagerly anticipating the impact of both Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD) regarding the expected approval dates for the Exchange-Traded Fund (ETF).

I believe developments in the Bitcoin ETF will influence the current upward trend, pushing it towards $50,000. This is especially true with signs of slowing inflation, and investors gaining confidence that the Federal Reserve has concluded its series of interest rate hikes. Attention has shifted to expectations of potential interest rate cuts next year, supporting the current rise in global markets.

Resolution Foundation’s Torsten Bell then shows the impact of the UK’s wage stagnation since the financial crisis of 2008.

He shows a graph showing that French middle-income households are now 9% richer than middle- income British households. German households are 20% richer.

Most people think of those countries as ones we’re similar too, but we are not any more.

Low growth + high inequality = a toxic combination for low-and-middle income Britain, says @TorstenBell. Low-income families in the UK are 27% poorer than their French and German counterparts (we’ve included Italy in this chart to make us feel a little better, Torsten adds…) pic.twitter.com/NPwb1jRkQP

— Resolution Foundation (@resfoundation) December 4, 2023

The squeeze is worse for low-income households, Bell says.

The typical poor French and German household is 27% richer than its UK counterpart, or about £4,500 per year.

That’s why many families struggled to cope with the cost of living crisis, as they didn’t have any spare money to cover the jump in prices of essential goods.

Resolution Foundation conference on UK economy underway

An all-day conference on ending Britain’s economic stagnation, organised by the Resolution Foundation, is starting now in Londons QE II centre.

It’s the culmination of three year’s work into the UK’s slow growth and high inequality, which is “proving toxic for low- and middle-income Britain”, they warn (costing British workers over £10,000 a year).

Resolution’s chief executive, Torsten Bell, begins by telling the audience one of the key lessons he learned when he was special adviser to Alistair Darling, the former chancellor who sadly died last week.

Bell says Darling taught him that “economic policy isn’t some abstract game”.

It’s not about your fancy charts…. it’s not about your theories. It’s about the bread and butter of people’s lives.

In 2008, in the financial crisis, Darling’s first thought was always about ordinary people who wouldn’t be able to into the shops and do their weekly shopping if their bank failed, says Bell.

He adds that he can see several people at today’s conference who were “thrown out of meetings” with chancellor Darling for “abstract discussion of fiscal rules”, because he wanted it to stop.

Out today: the Final Report of The Economy 2030 Inquiry, our hugely ambitious three-year project with @CEP_LSE, funded by @NuffieldFound – which we’re launching with an all-day conference! Attendees are grabbing copies of the report and getting ready for our great line up of… pic.twitter.com/7pDv7SnRZc

— Resolution Foundation (@resfoundation) December 4, 2023

Miles Brignall

Average house prices in the UK will fall by 1% next year as competition increases among sellers, Britain’s biggest property website has forecast.

Sellers were likely to have to price more competitively to secure a buyer in 2024, while mortgage rates would settle down though “remain elevated”, said Rightmove.

A year ago, Rightmove predicted that average asking prices would fall by 2% in 2023. On Monday, the company said the average was 1.3% lower than in 2022 as the property market continued to contend with significantly higher mortgage costs and a cost of living crisis that refused to go away.

The website records asking prices rather than the actual one properties are sold for. It said it was predicting that these would typically be 1% lower nationally by the end of 2024.

The market was continuing its transition to “more normal levels” of activity after the busy post-pandemic period, it added. More here.

In London, the stock market has opened lower, failing to follow gold’s lead.

The FTSE 100 index down 39 points or 0.5% at 7490 points, having ended at a six-week high on Friday.

Mining stocks are among the big fallers on the blue-chip index, with Anglo American down 3%, although the biggest faller is gambling group Flutter (-3.5%).

Small rival 888 Holdings, which owns William Hill, is up 13% though, leading the FTSE 250 index of medium-sized firms, after the Sunday Times reported it had been the target of a £700m approach from gambling tech provider Playtech.

Victoria Scholar, head of investment at interactive investor, comments:

The M&A speculation has skyrocketed shares in William Hill’s parent company today which is trading up by around 13%. 888 currently has a market cap or around £355 million, sharpy below the reported offer price from Playtech.

Shares in 888 have had a tough time this year, shedding over 20% year-on-year even after today’s surge and 50% in the past five years, highlighting the potential for an opportunistic takeover. Playtech is not the only party reported to be interested – in November, the Financial Times reported that US betting group DraftKings was also eyeing up a bid for 888 over the summer.

888 has suffered a series of setbacks lately with a profit warning in September, UK regulatory headwinds amid a clampdown on player safety, and a series of C-suite changes including the departure of its former CEO in January which sent shares tumbling at the time.”

It’s worth keeping an eye on gold, says market strategist Bill Blain of Shard Capital, after it hit its record high this morning.

Blain says:

Gold has hit new record dollar levels – reflecting not just current uncertainty, but also the de-dollarisation narrative and it’s attractions as an inflation and market hedge, and long-term value.

He argues there are very good reasons to include gold as part of a diversified asset portfolio, especially in uncertain times.

He writes:

Let’s get the “desirability” and emotional aspects out the way. I am told a significant influence on the price of gold is the weather – a good monsoon in India means farmers buy more bangles for their daughters’ weddings from the gold souks. It is beautiful. It is lustrous. It is unblemished. It is Gold. Always believe in… Gold! There will always be demand for gold for personal adornment – which is pretty much irrelevant when it comes to its proposition as an investment asset.

As an investment in its own right gold performs well; over the last 50 years Gold prices have risen over 3000%, compared to a 3500% gain in the S&P 500. However, in periods of financial instability gold outperforms stocks – notably over the past 20-years even though the prices of financial assets were artificially juiced by the effects of zero interest rates! In terms of risk, companies come and go, but Gold is forever. If the world remains unstable – and no reason to think it won’t – then gold should be front and centre on your radar – no matter how archaic you consider it.

Victoria Scholar, Head of Investment at interactive investor, points out that Spotify’s share price has more than doubled this year – but that hasn’t prevented today’s job cuts,

She writes:

“Spotify is planning to reduce its total headcount by approximately 17% across the company, equivalent to around 1,500 positions, having already laid off 6% of its staff in January. The digital music service said it wants to right size its costs in order to achieve its financial goals.

In October, Spotify reported improving financials – better than expected monthly active users and subscribers as well as its first quarterly profit since 2021. In an expensive move, it has been investing heavily in the expansion of its podcast business. Plus it has been grappling with ‘dramatically’ slowing economic growth, a weak consumer backdrop and ballooning costs.

Shares in Spotify could open higher today, extending this year’s sharp rebound with the stock up over 120% year-to-date.

However shares are still trading substantially lower than their covid-era highs after a painful period for price action between the 2021 highs and the lows at the start of this year after the 2022 ‘tech-wreck’.”

Spotify staff will learn quickly today if they are in the 17% of staff losing their jobs.

CEO Daniel Ek said in his message to staff this morning:

If you are an impacted employee, you will receive a calendar invite within the next two hours from HR for a one-on-one conversation.

These meetings will take place before the end of the day tomorrow.

Those losing their jobs will receive an average of five month’s pay as severance (although the precise amount will depend on local notice period requirements and employee tenure), plus all unused vacation will be paid out too.

Spotify to cut headcount by 17%

Many “smart, talented and hard-working people” are to lose their jobs at Spotify, as the music streaming company cuts its workforce for the third time this year.

CEO and founder Daniel Ek has decided to slash Spotify’s total headcount by 17%, as he takes “a substantial action” to bring down costs.

That will affect about 1,600 posts.

Ek told staff this morning that Spotify is not immune to the impact of slowing economic growth and more expensive capital.

So as part of Spotify’s push to drive profitability and growth, one in six staff will lose their jobs as Ek tries to become “right-sized for the challenges ahead”.

He told staff this morning:

I recognize this will impact a number of individuals who have made valuable contributions. To be blunt, many smart, talented and hard-working people will be departing us.

Spotify also announced 600 job cuts back in January, when it admitted it had expanded too quickly during the Covid-19 pandemic and been too slow to cut cost.

In June, it cut 200 jobs from its podcast unit, as Spotify restructured its business after years of heavy investment.

Today, Ek insists that Spotify’s cost structure is still too big.

He told staff that he understands the job cuts announced today will be “incredibly painful for our team”, before reminding them of how the company expanded when capital was much cheaper in the pandemic:

To understand this decision, I think it is important to assess Spotify with a clear, objective lens. In 2020 and 2021, we took advantage of the opportunity presented by lower-cost capital and invested significantly in team expansion, content enhancement, marketing, and new verticals.

These investments generally worked, contributing to Spotify’s increased output and the platform’s robust growth this past year.

However, we now find ourselves in a very different environment.

In the eurozone economy, Germany’s trade performance has deteriorated again.

German exports fell by 0.2% in October compared with the previous month, dashing hopes of a 1.1% rise.

Geeman imports contracted too, down 1.2% compared with September.

On an annual basis, statistics office Destatis estimates that exports decreased by 8.1% and imports fell by 16.3% compared with October 2022.

Investors don’t appear to be listening to the warnings coming from central bankers that it’s too early to cut interest rates. Or they don’t believe them.

As well as the weakening US dollar, we’ve seen bond prices rally over the six weeks or so, pushing down bond yields.

The market is pricing in earlier and more aggressive cuts from the central banks and inflation appears set on a path lower, says Mohit Kumar, chief economist europe at investment bank Jefferies.

That’s despite efforts on both sides of the Atlantic to push back against this narrative.

Las Friday, Federal Reserve chairman Jerome Powell insisted it would be “premature to conclude with confidence” that interest rates have now peaked, or to speculate on when they might be cut.

Some analysts are predicting that gold could continue to push higher, adding to the record high of $2,111/ounce set this morning

UOB’s Head of Markets Strategy, Global Economics and Markets Research, Heng Koon How, told CNBC:

“The anticipated retreat in both the USD and interest rates across 2024 are key positive drivers for gold,”

He estimated that gold prices could reach up to $2,200 by the end of 2024.

Everett Millman, chief market analyst at Gainesville Coins, also sees more short-term gains, saying:

“Gold has had a Santa Claus rally and I expect that to continue until the end of this year.

Full story: Bitcoin over $40,000

Although bitcoin isn’t yet at a record high, today’s surge takes it to the highest level since April 2022.

Bitcoin has broken above $40,000 for the first time this year as it – like gold – rides a wave of enthusiasm about U.S. interest rate cuts.

The world’s biggest cryptocurrency is currently trading at $41,455, up almost 7% since Friday night, as the crypto market continues to emerge from the downturn that began last summer.

A 50% rally since mid-October has “seemed to mark a decisive shift away from the bearishness of 2022 and early 2023,” said Justin d’Anethan – head of business development for Asia-Pacific at Keyrock, a digital assets market making firm.

He said evidence of institutional buying through November showed a new leg of interest and that although reversals ahead are not inconceivable, lows hit around $16,000 a year ago “probably marked the bottom”.

Some traders are also anticipating the imminent approval of U.S.-stockmarket traded bitcoin funds, Reuters adds:

A spot bitcoin ETF could allow previously wary investors access to crypto via the stock market, ushering a new wave of capital into the sector.

Introduction: Gold at all-time high on rate cut hopes

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

Gold has climbed to a record high for the second session in a row, as investors flock to the traditional safe haven asset amid hopes of interest rate cuts in the months ahead.

The gold price has hit $2,111.39 per ounce, taking it over the record set on Friday night and further above the previous record set in August 2020.

Gold has strengthened amid hopes that the cycle of interest rate increases over the last couple of years has now ended, and that central banks will turn their attention to cutting borrowing costs in 2024.

That has led to a weaker US dollar, which pushes up the gold price (as it’s priced in dollars).

As this chart shows, gold has climbed pretty steadily since the start of October, when it was changing hands at $1,820 per ounce.

Crypto assets are also on a charge, with bitcoin hitting $40,000 for the first time this year today, with some traders betting the US Federal Reserve could start cutting US interest rates next spring.

Kyle Rodda, senior financial market analyst at Capital.com, explains:

Markets are piling in on bets of Fed rate cuts next year, possibly as soon as March. That pushed gold and Bitcoin to critical levels, with the former busting to record highs and the latter hitting $US40,000 for the first time since May 2022.

Gold’s move boasted all the hallmarks of a technical melt-up, as the break of previous all-time highs set off stops and buy orders.

A lower interest rate environment would favour gold, which doesn’t generate a yield (unlike bonds, equities or current cash savings accounts).

Also coming up today

The UK economy will be under the microscope, as the Resolution Foundation thinktank holds an all-day event examining a better economic strategy for the country.

Its work has shown that British workers are missing out on £10,700 a year after more than a decade of weak economic growth and high inequality.

Resolution will hear from Labour leader Sir Keir Starmer, who is expected to warn that he would not “turn on the spending taps” if he wins the next election

The Guardian reports this morning that Starmer will say:

“Anyone who expects an incoming Labour government to quickly turn on the spending taps is going to be disappointed … It’s already clear that the decisions the government are taking, not to mention their record over the past 13 years, will constrain what a future Labour government can do.”

“This parliament is on track to be the first in modern history where living standards in this country have actually contracted. Household income growth is down by 3.1% and Britain is worse off.

“This isn’t living standards rising too slowly or unequal concentrations of wealth and opportunity. This is Britain going backwards. This is worse than the 1970s, worse than the recessions of the 1980s and 1990s, and worse even than the great crash of 2008.”

The agenda

-

7am GMT: German trade balane statistics for October

-

9.30am GMT: Resolution Foundation holds event examining UK economy in 2030

-

2pm GMT: ECB president Christine Lagarde gives a speech at the Académie des Sciences Morales et Politique’s conference in Paris

-

3pm GMT: US factory orders for October