Mooners and Shakers: SBF arrested! Bitcoin and Ethereum flat ahead of US inflation data

It’s a big week for stocks, Bitcoin, Ethereum and crypto in general as Jerome Powell and his Fed mates decide whether they’re whacking on the Santa suits or hurling the markets lumps of coal.

Meanwhile, FTX founder Sam Bankman-Fried (aka SBF) has now been arrested in the Bahamas, according to reports just in. More on that, below.

But first…

The year’s final Federal Open Market Committee meeting takes place on Dec 13 and 14 in the YOO ESS of EH (Washington, DC) and it’s the last time this puppet mastery will occur until February 1, 2023.

And thank Christ for that, really, because they’re always a right barrel of laughs.

But could this time be different? The last four have resulted in market-deflating 75 basis points rate hikes, but many hopeful traders and investors are expecting, if not a “pivot”, a slowdown to 50bps. That’ll only be a chance if the December 13 US CPI data figures show that inflation in the States is continuing to somewhat moderate.

It’s not just the numbers, though – Fed Chairman Powell’s press conference and tone will also be anxiously awaited. Let’s hope he’s in good voice. Maybe then we might see a Bitcoin rally to infin… er, US$18k and beyond. Yeah, maybe.

SBF arrested, Do Kwon in… Serbia?

Per Reuters, embattled former FTX boss Sam Bankman-Fried has just been arrested by Bahamas police and taken into custody.

Bahamas authorities reportedly received formal notification from the United States of criminal charges against him. The actual charges are as yet undisclosed.

USA Damian Williams: Earlier this evening, Bahamian authorities arrested Samuel Bankman-Fried at the request of the U.S. Government, based on a sealed indictment filed by the SDNY. We expect to move to unseal the indictment in the morning and will have more to say at that time.

— US Attorney SDNY (@SDNYnews) December 12, 2022

Earlier today, SBF had said in a Twitter Spaces chat that he wouldn’t be making an appearance in person at this week’s House committee hearing in the US capital.

And that was apparently due to the “paparazzi effect” his presence would cause. Yep, he’s always got everyone’s best interests at heart. Then again, maybe he just wanted to dial in while he played League of Legends. Or maybe Illuvium’s new Overworld beta release.

SBF admitted he is playing video games while on Twitter Spaces right now.

So many people lost so much in his FTX scam, and he is playing video games in the Bahamas while he gives out half-baked answers to some of the most important questions people have.

— Benjamin Cowen (@intocryptoverse) December 12, 2022

SBF officially arrested in the Bahamas

Will this mark the bottom for #Bitcoin???

— Kevin Svenson (@KevinSvenson_) December 12, 2022

“I didn’t ever try to commit fraud,” Bankman-Fried said in a November 30 interview at the New York Times’ Dealbook Summit, adding that he doesn’t think he has any criminal liability.

Meanwhile, Do Kwon, another “much-loved” crypto industry figure – the founder of the Terra Luna project and the man seen as largely responsible for its collapse earlier in the year – is apparently currently located in Serbia. According to South Korean online publication Chosun.

Kwon has been something of a crypto fugitive ever since the Terra collapse and is being hunted worldwide by South Korean authorities and Interpol. Meanwhile he keeps showing up on Twitter and the odd podcast and interview here and there, commenting on SBF and FTX.

For instance, here he is, in a Twitter thread that suggests the FTX sister company Alameda Research was responsible for a planned financial attack that led to the collapse of the Terra ecosystem stablecoin UST.

What’s done in darkness will come to light

— Do Kwon

(@stablekwon) December 8, 2022

James Bond, Jason Bourne and Bitboy Crypto are all heading to Serbia to confront him there, angrily demand their money back and be told off by security staff, while generating great clicks for their social content. Possibly.

Top 10 overview

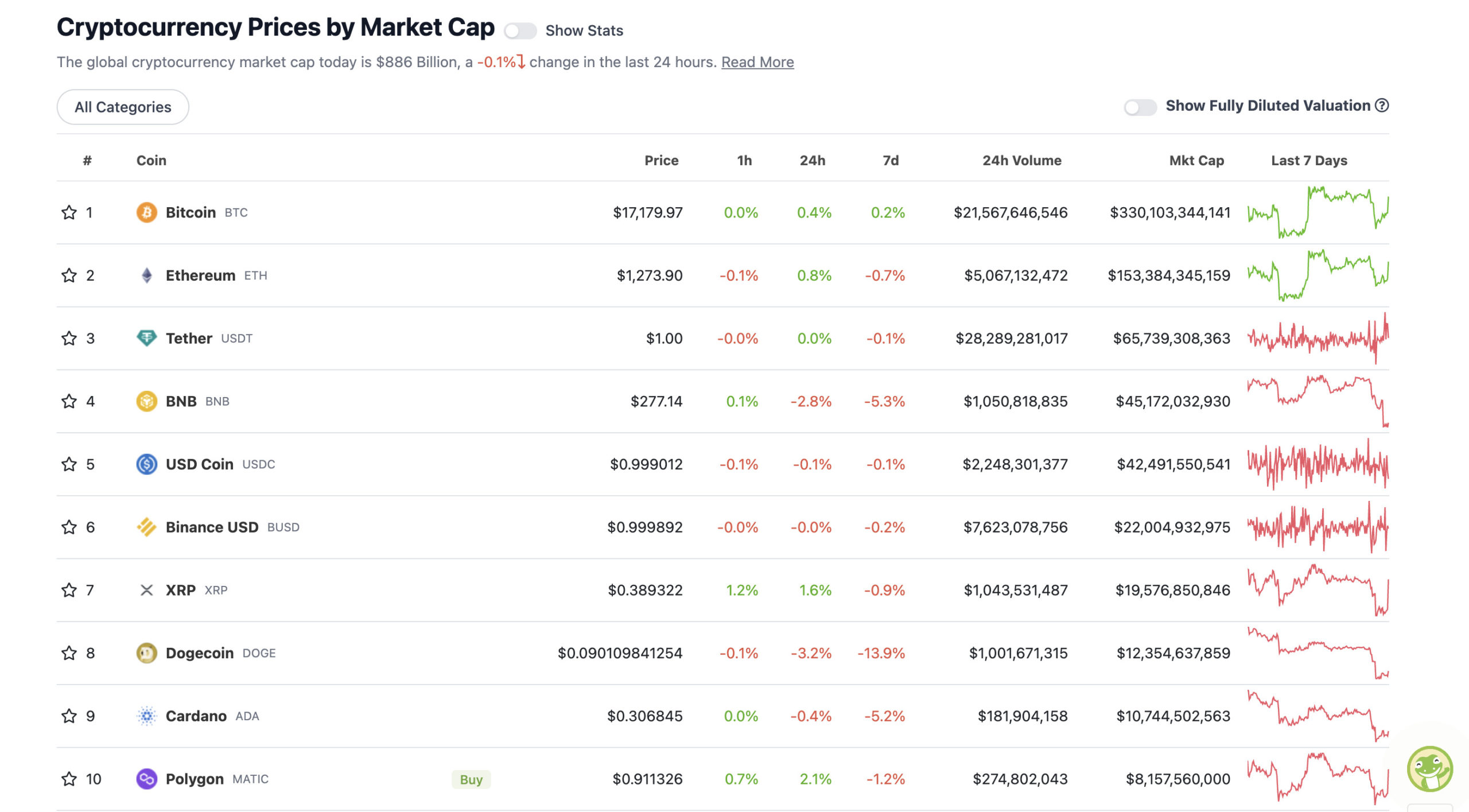

With the overall crypto market cap at US$886 billion, pretty flat since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin and pals have actually made something of a recovery since this time yesterday.

BTC was languishing down below US$17k for much of Monday, but perhaps the hopium surrounding a potential Fed rate-hike slowdown this week has sections of the market believing in an end-of-year rally.

December’s historically been a decent month for Bitcoin and crypto on average, although Dec 2021 certainly wasn’t (-18.75%), so past performance really is no indicator here. In fact, forget we even mentioned it.

Two very different takes from two very different Crypto Twitter trader/analysts here:

#Bitcoin getting into resistance now, but a good bounce and therefore pretty decent daily candles across the markets.

Tomorrow and Wednesday are going to be fire. pic.twitter.com/NkxkHCs2rm

— Michaël van de Poppe (@CryptoMichNL) December 12, 2022

$BTC 1D

Huge lack of volume on this push up from 15.5k. Looking like a dead cat bounce to retest prior support level 17.5-18k.

MACD/RSI looking reset for another leg down. MACD bear cross in the works.

HTF charts look ready to dump.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/I6W1JH4VDB

— Roman (@Roman_Trading) December 12, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$6.1 billion to about US$329 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Stacks (STX), (market cap: US$422 million) +9%

• Bitcoin SV (BSV), (mc: US$900 million) +7%

• GMX (GMX), (mc: US$489 million) +6%

• Dash (DASH), (mc: US$539 million) +4%

• Lido DAO (LDO), (mc: US$861 million) +3%

DAILY SLUMPERS

• Trust Wallet (TWT), (market cap: US$981 million) -11%

• Axie Infinity (AXS), (market cap: US$880 million) -4%

• Chiliz (CHZ), (mc: US$739 million) -4%

• Tezos (XTZ), (mc: US$874 million) -3%

• Aptos (APT), (mc: US$588 million) -3%

Around the blocks

Some randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

Some commentary on SBF’s arrest already rolling in…

SBF really gave us so much content for the inevitable documentary. Should be a blockbuster.

— Dennis Porter (@Dennis_Porter_) December 13, 2022

— Frank Chaparro (@fintechfrank) December 13, 2022

Members of the inner circle of power at FTX formed a chat group called “Wirefraud” and were using it to send secret information about operations in the lead-up to the company’s spectacular failure.https://t.co/4nlXcFcdaS pic.twitter.com/pHmAobtjQ0

— db (@tier10k) December 12, 2022

Moving on…

Phygital would have to be the worst, it just sounds wrong. Like fidget but mashed up in the worst possible way. Ape in or apeing in is another term with bad connotations, it just makes us all sound like gamblers (which we are, but don’t tell the normies that haha

)

— CryptoJay

(@0xCryptoJay) December 12, 2022