The Dow Jones Industrial Average jumped Monday, clawing back some of the steep losses from the previous week, as traders looked ahead to a highly anticipated Federal Reserve meeting and new inflation data.

The blue-chip Dow added 504 points, or 1.4%. The S&P 500 jumped 1.4%, and the Nasdaq Composite rose 1.2%.

A lift in Boeing shares pushed the Dow higher following reports that the airline is close to a deal with Air India. Elsewhere, energy stocks rose as oil prices steadied, following several weeks of declines.

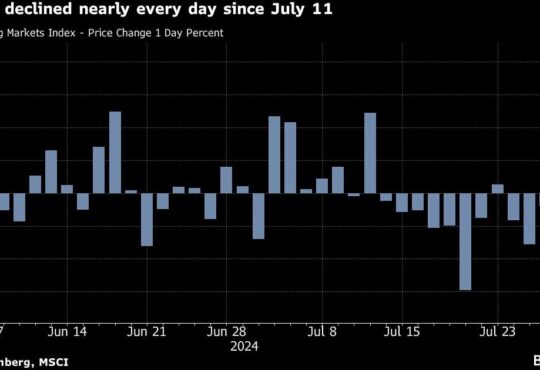

Wall Street is coming off a rocky week that saw all three major averages lose ground. The Dow and S&P 500 had their worst weekly losses since September, falling 2.77% and 3.4%, respectively. The Nasdaq dropped 4%.

“Today’s action is mostly a reflex bounce after last week’s poor performance,” said Yung-Yu Ma, BMO Wealth Management chief investment strategist. “There’s probably some cautious optimism ahead of tomorrow’s CPI report, but also some underlying concern. We can see that concern today in an up market for equities that actually has the VIX rising quite sharply.”

“Europe, which outperformed last week is down today while the U.S. is bouncing,” he added. “It speaks to a choppy market with low conviction; strong markets have better uniformity.”

A slew of dealmaking activity boosted sentiment. Coupa Software and Horizon Therapeutics were among biggest movers on Monday after the companies announced they’ve agreed to be bought.

Meanwhile, a New York Fed survey showed consumers had grown more optimistic about inflation in November. The bank’s survey of of Consumer Expectations showed consumers expected one-year inflation to run at a 5.2% pace, down 0.7 percentage point from October.

On Tuesday, the November consumer price index will be released and traders will be looking for a sign that inflation is slowing. The same day, the Federal Reserve will begin its two-day meeting and is expected to announce another rate hike on Wednesday, though traders are anticipating a smaller move than in recent months.

In addition to the expected rate hike, the Fed’s updated economic projections and Chair Jerome Powell’s press conference could be key signals for what the central bank wants to do in the coming months.

“Financial conditions have eased dramatically since the October CPI reading released last month, so the Fed will likely use the December FOMC meeting to walk those back,” said Cliff Hodge, chief investment officer for Cornerstone Wealth. “We think the markets are too sanguine on rates after the first quarter and we expect Powell to take a more hawkish tone and for the dots to indicate higher rates for a longer period of time than what is currently being priced in by the futures markets.”