Liubomyr Vorona/iStock via Getty Images

I’ve written about Legal & General Group Plc (OTCPK:LGGNF) (OTCPK:LGGNY) a few times in the past, and own a small stake in the UK-based insurance company, which is mostly in the L&H segment. To call the stock historically stable in terms of price would be going too far. There’s plenty of volatility to Legal & General Group Plc, and the company has outperformed broader markets.

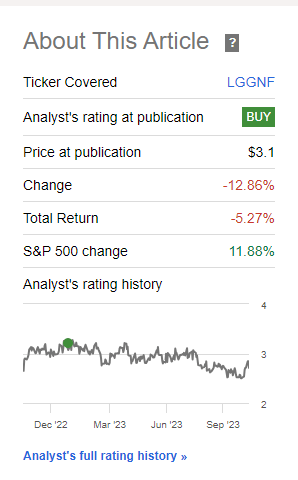

Not since my last article though. Since that particular piece, we’ve seen a significant downturn directly in opposition to the S&P500. In layman’s terms, the company is down 5.27% inclusive of dividends, and the market is up almost 12%. This is how the RoR currently looks.

Seeking Alpha LGEN RoR (Seeking Alpha LGEN RoR)

I bought shares a few times over the past 1-2 years and my position is currently in the green – though this includes the positive FX compared to my native currency, the SEK, we’ve seen since then.

My last coverage on the company can be found here – so this is an update. I don’t expect a massive upturn until we see a change in macro – but this is the time to expand your initial position in a Life and health insurance company with a credit rating of A.

Let’s see what we have here.

Legal & General – The upside here is very significant

Legal & General Group Plc, hereafter called L&G, is a British-based multinational financial service and asset management company. The company has been through substantial changes and corporate adjustments for the past couple of years, which has resulted in the company having investment management with lifetime mortgages, pensions, annuities, and life insurance. LGIM, the company’s investment management arm, is the 10th-largest in the world and the second-largest in all of Europe.

These things are crucial to understand – because the company is not only one of the largest investment managers on the planet, it’s also the biggest L/H provider in all of the UK in terms of insurance. After divesting what non-core assets and areas the company had and focusing on organic growth, what remains in L&G is a focus on the UK, USA, Japan, and China, and also insurance coverage in the Indian market, a logical choice given the history of Great Britain.

The company’s plan is to synergistically improve the relationships and savings between this business while de-risking its substantial pension assets. With interest rates now climbing, this is becoming substantially easier. The fact that the company has moved out of equity investments is another addition to this. L&G is also becoming a market leader/amongst market-leading in lifetime mortgages, with continued growth in individual annuities. (Source: Legal & General 1H23)

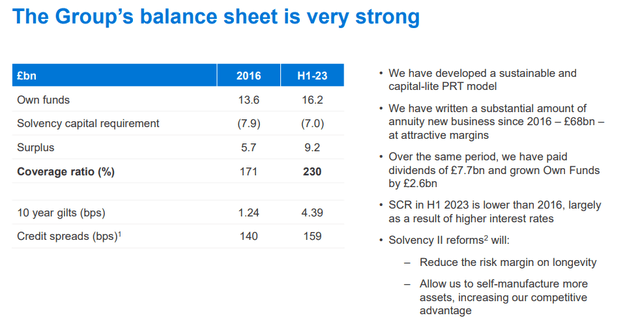

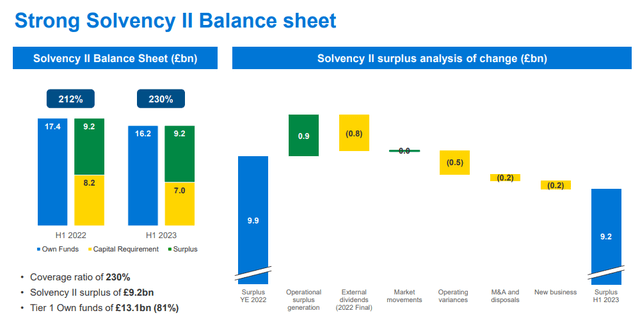

Based on the company’s share price development, you’d expect the company’s latest set of results to be poor – even significant decline in operational results. That is not the case. The company’s operational profit was in fact almost on par with YoY results, higher in operational surplus, a 1,800 bps improvement in solvency ratio, and a 5% dividend increase.

LGEN IR (LGEN IR)

The company is on track to meet its 2024E targets, with around £9B in cumulative capital generation, with £6.7B for 2023E, and the target reachable for the next year. The company also wants the company’s earnings to grow faster than its dividend, and this is the current case here.

The company also wants a net surplus generation to exceed dividends, again to make this high dividend rate sustainable, while still managing to grow the payout at 3-6% per year. (Source: Legal & General 1H23)

The company’s results were quite resilient for what is a very volatile economic backdrop, with good capital generation and an already growing dividend. The balance sheet is not weaker, but stronger than before.

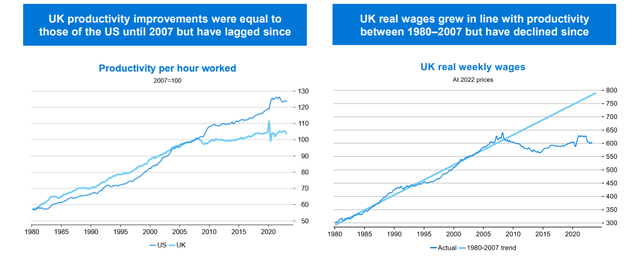

Part of the problem UK-based businesses have had since the GFC is that the UK productivity and investment growth has lagged the US for over 13 years. The same is true for real wages, which have mostly flat-lined for again, the past 13+ years.

LGEN IR (LGEN IR)

This has meant, among other things, broad stock-market underperformance on the UK side for years. However, this has also left the entire UK market in a very attractive valuation-related position. It currently trades at a forward valuation of 10.6x P/E, which is compared to Europe at 12.3x and the World at 17.3x, very attractive. Part of the reason for this is that the UK hasn’t been able to build high-growth productive businesses and sectors for some time. Many of the revolutionary companies for the past 10 years have been in Europe, and USA, and Asia – but very few in the UK. (Source: Legal & General 1H23)

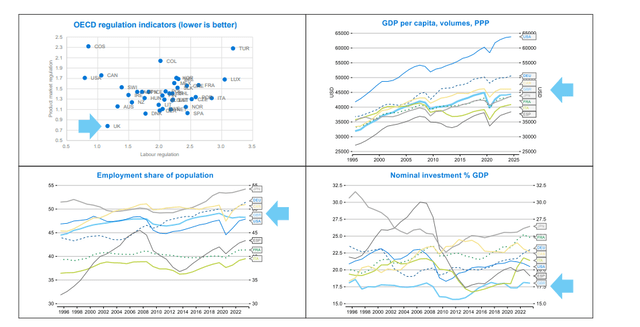

However, there are many points in favor of the UK, and with the valuation “right” here, L&G is driving investment-led growth.

LGEN IR (LGEN IR)

The company is partnering with businesses and partners in universities and Education, Energy, Housing, Finance, Specialist commercial real estate, and other strategic co-investors in the field here.

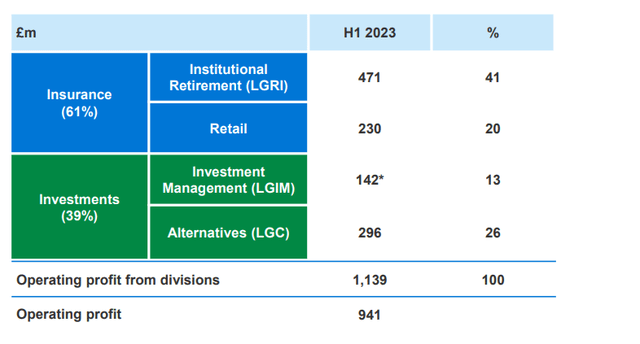

And, in the fields where the company is active, LGEN has managed some truly excellent performance over 1H23, with almost £1B of operating profit.

LGEN IR (LGEN IR)

What I like the most though, is that the company’s earnings profile has evolved to a much better state than it was before. We’re talking only 41% from LGRI, with growing contributions from Retail, LGIM, and LGC. The annuity portfolio remains a bit of an issue here, but the company expects a full self-sustainability in this portfolio for the end of the year – and with the current state of the balance sheet, I have no worries on the fundamental side when it comes to this company.

LGEN IR (LGEN IR)

L&G now 4 very attractive segments with good earnings potential, from the capital-light PRT model from LGRI, and the resilient performance of LGC, to the scaled asset management model of LGIM, and the now-integrated retail model with 8 (among other things) adjacent fintech businesses.

The company is one of the clearest and most offensively-positioned dividend-payer here, and the company has very clearly stated its intention to maintain its progressive dividend policy, so this 8%+ yield, is something you can “get” going forward as well. At more than one time for the past 3 months, the company was at over 9% yield, which is one of the best A-rated yields in the entire global insurance space. That is no small feat.

With the current expectation of the CSM balance releasing into profit over time and all of the company’s segments positioned to deliver solid profits over time, I expect the business to continue to deliver its dividends and its improved returns over the long term.

Let me show you what this could mean for you as an investor and a shareholder here.

Legal & General IR (Legal & General IR)

Legal & General – Why there is such an upside.

In my last article, I made it clear that the company fulfilled every single one of my investment criteria. That is still the case at this time – and I’m also not changing my price target a single penny. To remind you, that target was £3 conservatively for the native LGEN, and “cheap” under £2.5/share. The company currently trades at £2.21 for the native, at the time of writing this piece.

Even if just using projected FCF based on historical numbers, we’re looking a potential share price of over £6/share, and a Graham number that at least puts the company at £2.4/share. And that’s before even pointing out that the company actually manages a sector-beating/90th-percentile FCF margin and a superb ROE. Despite this, the company’s price is now at a 3-year low, and the dividend yield is now at a 3-year high. If you’re seeing fundamental risks here, then I’d love to hear about them. The PB ratio for the company is steadily improving, and whatever risks the company currently has are bond to improve in the next few years.

This is why the price targets for analysts following the company, including myself, remain at relatively high levels. It’s down from my last article, but not down in any significant way. From an average of around £2.9 to £3, we’re down to £2.8, from 14 analysts at a range of £2.3 on the low side to £3.5 on the high side. I would agree with this range and still stick to my target of around £3 here. More than half of the analysts still have the company as a “BUY” or “Outperform” here – the same as in my last article.

If we look at the company’s closest overall peers, L&G still remains undervalued. The competition includes Manulife (MFC), Swiss Re, MetLife (MET), and other insurance players – and in terms of overall P/E, none of the company’s peers here trades at lower multiples than L&G.

Given the combination of yield, upside, fundamentals, and size, I see no scenario that is realistic, where LGEN in the longer-term future is going to be delivering a very negative RoR – that is why I continue to invest here.

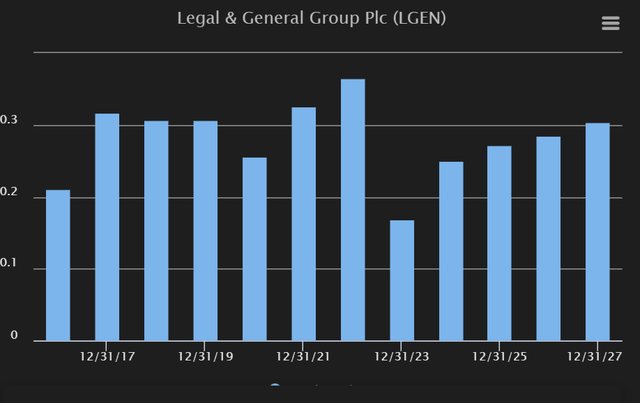

GAAP EPS for 2023 is expected to decline in 2023E – but only momentarily for this year. The earnings are then expected to reverse, and climb year by year until at least 2027.

LGEN Upside (Tikr.com)

The dividend is expected to grow at about the same pace as well (Source: TIKR.com). The appeal of L&G remains its high and covered yield, as well as its potential for climbing higher towards the £3 mark to align more closely with its non-UK peers, most of which trade at double digits, and some of which trade over 18x.

The UK remains riskier than other markets for the time being, but I for one am positive about the British economy and the longer-term implications, especially with the average P/E that I’ve shown you the market there holds here.

We can look at an Embedded value for the company here, even at a WACC close to the double digits, and we’re still seeing an implied share price of close to £3.05/share, bringing the company to an upside over 20% here. You can impair it further if you want, but in order to get down to the current share price level, you really have to go for share price levels that I do not consider likely in the long term.

For that reason, and for the other reasons mentioned here, I consider LGEN to be a “BUY” here.

Thesis

- Legal and General is a great UK-focused insurance and retirement protection/asset management shop, one of the largest on earth, and one of the most significant in all of the United Kingdom. At the right valuation, this company becomes a strong contender for being able to generate 6-8% simply from the company’s well-covered dividend, together with more upside from normalization.

- We’ve seen the company drop to appealing levels over the past few months, and even with the normalization since September, the company remains attractive at below £2.5/share.

- I rate L&G a “BUY” with an adjusted PT of £3/share for the native.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Legal & General Group Plc fulfills all of my fundamental requirements at this time, and it’s therefore a “BUY.”

This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.