United States Steel (X -0.12%) is one of the oldest steelmakers in North America and an industry icon. That doesn’t make it a good or bad stock, just a well known one. If you are looking at U.S. Steel today you need to know three things. The first is fundamental, the second is transitional, and the third could change the entire story.

1. The steel industry is highly cyclical

Before you even consider hitting the buy button with U.S. Steel, or any steel company, you need to understand a very fundamental thing — the steel industry is cyclical. Don’t underestimate the importance of this. Steel demand tends to ebb and flow along with economic activity, so the performance of steel stocks varies dramatically depending on whether there is a recession or an economic expansion.

Image source: Getty Images.

In fact, just when steel stocks are performing best from a business perspective could be the least opportune time to buy them. Wall Street probably will have pushed up the stock prices based on the good underlying performance which, in the end, will only prove temporary. And when revenue and earnings decline during an economic pullback, investors will dump the stocks. Then they’ll look highly unattractive even though it is probably the best time to buy them.

So before you buy U.S. Steel or any other company in the steel industry, make sure you have an understanding of where the economy is at that point in time. It may be counter intuitive, but downturns are the the time to buy if you don’t want to overpay.

2. U.S. Steel is near the end

Historically, U.S. Steel has used blast furnaces. This is an older steel-making technology that has high fixed overhead costs, which exacerbates the cyclical swings of the industry. Basically, just keeping its mills operating results in U.S. Steel losing money when times are tough. But the company is in the process of building an electric arc mini-mill fleet. Electric arc mini-mills use newer technology and are more flexible through the business cycle (they are easier to ramp up and down with demand) and, thus, can often continue to be profitable even during industry weak patches.

Although having a mix of the old and new technology won’t eliminate the inherent business swings, U.S. Steel will likely end up a more consistent performer. Adding the electric arc mini-mills has required a lot of capital investment. However, that spending is coming to a close, which means that U.S. Steel will be a much more robust company, as soon as 2024, than it has been historically.

During the company’s third quarter 2023 earnings call Chief Executive Officer Dave Burritt stated, “Simply put, we believe that the trajectory of our performance both today and tomorrow has not been fully appreciated by the market.” That fairly bold statement is largely driven by the changes being made via the soon to be completed spending spree.

3. U.S. Steel is “in play”

Point two kind of leads into point three because U.S. Steel is currently reviewing bids from potential acquirers. The interest is likely related to the fact that the company is just about done repositioning its portfolio, the benefit of which may not be fully reflected in the stock price. But, still, it is an important issue to examine.

A little while ago, industrial conglomerate Esmark made a takeover offer that U.S. Steel rebuffed. That bid served to bring out more potential buyers. The board has an obligation to consider the offers and is doing so right now. It may pick a winner or may reject all of the offers, depending on what it believes is best for the company and its shareholders. So if you buy now you are getting in amid a bidding war.

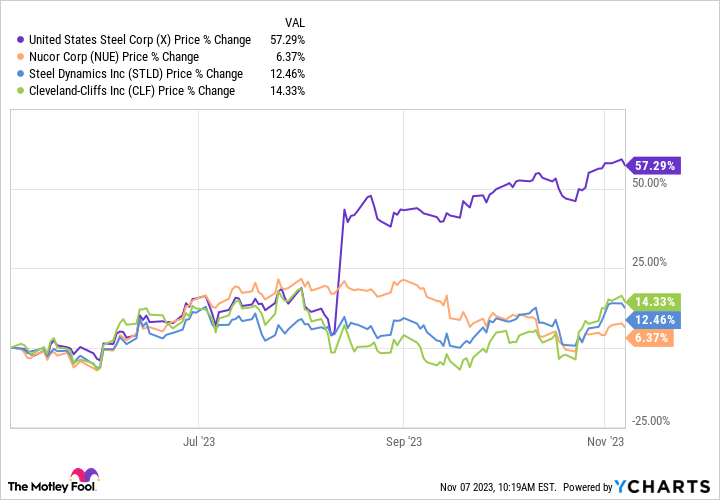

Data source: YCharts

That’s a big issue because, as the chart above shows, news of the first offer sent U.S. Steel’s stock sharply higher. Wall Street has clearly priced in a lot of good news, likely assuming that the company will end up agreeing to sell itself to the highest bidder. If no deal comes out of this, however, the stock will probably fall just as sharply as it rose. At the other end of the spectrum, there may be limited upside to the shares unless you believe that the deal will come at a substantially higher price than where the stock currently trades. That seems unlikely given the market’s reasonably strong history of discounting future events like this.

Go in with your eyes open

There are a lot of moving parts today when it comes to United States Steel. First it is a cyclical business prone to dramatic swings, like all steel mills. Second it is nearing the end of a capital investment cycle that should help to smooth out the typical industry ups and downs. And third it is in the midst of evaluating buyout offers that may end up with the company being swallowed up by a competitor or fizzling out and leaving it standing alone.