Surging insurance valuations are enticing US banks to cash out and use the proceeds strategically.

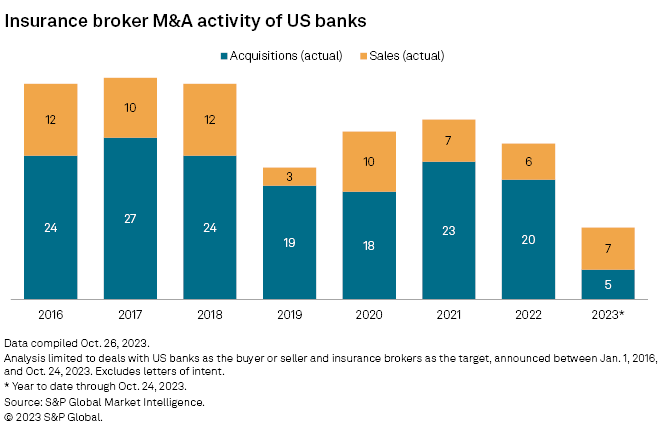

For the first time in at least eight years, US banks are selling off their insurance units at a quicker pace than they are acquiring them. So far in 2023, the banking industry has announced seven insurance business sales, outpacing the number of acquisitions by two.

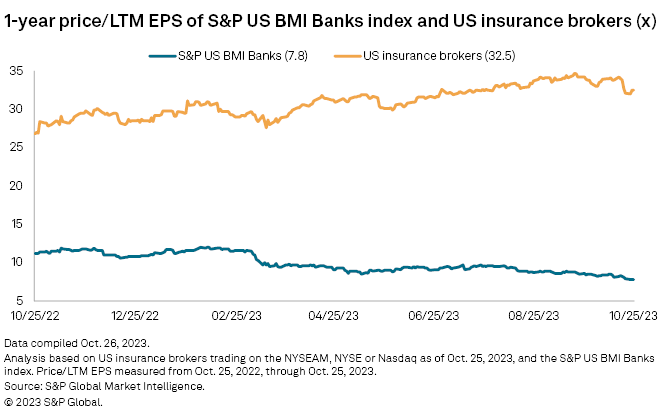

The uptick in exits comes at a time when the gap between the two industries’ valuations has drastically widened, with insurance valuations surging and bank valuations hitting one of the lowest points since the Great Financial Crisis. Moreover, at a time when capital is king for the banking industry, banks are enticed by the large payday a sale brings and the strategic options for using that cash, such as restructuring their underwater securities books.

“At the end of the day, the reason that [banks] are showing their arms has a lot to do with capital and the fact that this saves them from having to capital raise,” said Christopher Marinac, a director of research at Janney Montgomery Scott. “Part of the challenge is that banks don’t want to recognize losses because that’s a permanent change to book value versus being temporary. But if they have a gain to offset it, then it makes that decision more palatable.”

Valuations gap leads to strategic sales

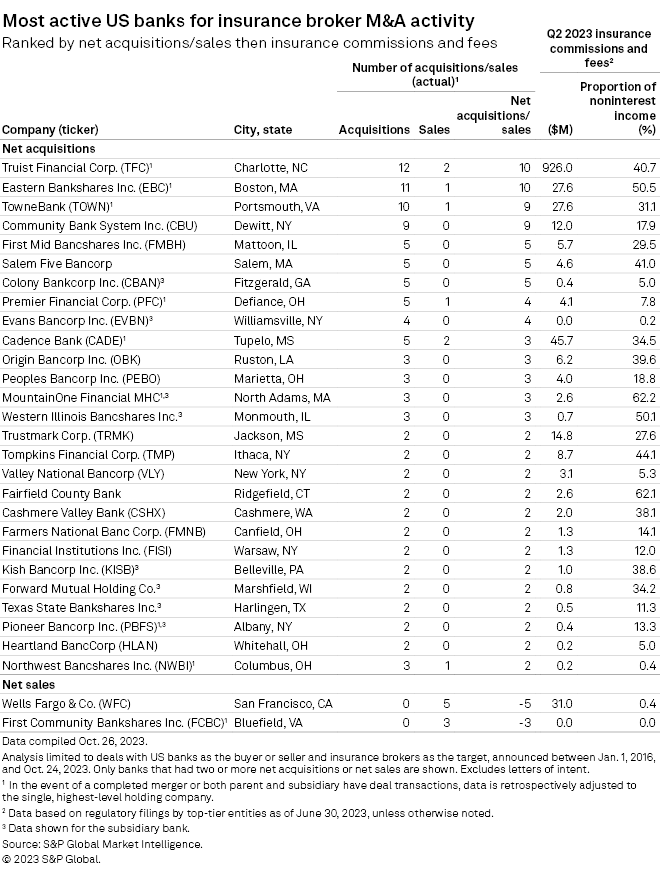

Some of the most active acquirers historically have changed their tune this year and announced full or partial sales of their insurance operations, such Eastern Bankshares Inc., the second-most active acquirer of insurance units since 2016; Truist Financial Corp., the most active acquirer since then; and Cadence Bank, the 10th-most active buyer since 2016.

All three banks said current insurance industry valuations attracted them to strike deals.

The demand for consolidation via M&A activity combined with hard market pricing driving premium increases is raising insurance broker valuations, according to Marcos Álvarez, head of insurance for DBRS Morningstar.

“A brokerage basically charges a fixed percentage of whatever premium the insurance company charges the final client, and so the revenues of brokers are going up as the hard market continues,” Álvarez said. “It’s an interesting time for anybody interested in buying a broker or brokerage business because the revenues of these markets are going up this year, next year and probably into 2025.”

Banks are opting to cash out on those increasing valuations and using the proceeds from the large paydays strategically. By selling insurance units that make up a smaller portion of their revenue, banks can strengthen their capital without having to get cash other ways, such as disposing of securities and recognizing those currently unrealized losses, Álvarez said.

That is exactly what Cadence is doing with the money it will gain from the sale of Cadence Insurance Inc. to Arthur J. Gallagher & Co. for nearly $1 billion. With the estimated $620 million Cadence will bring in, the company plans to restructure its balance sheet by paying down wholesale borrowings and exiting low-yielding securities, which will improve its future profitability, executives said on the company’s third-quarter earnings call.

“The opportunity to monetize this business at historically high valuation levels is a huge win for our shareholders,” Chairman and CEO James Rollins III said. “This transaction gives us some tools in our tool kit to allow us to improve.”

The $904 million purchase price valued Cadence’s insurance unit at 5.4x last-12-months revenue.

Separately, Eastern’s sale of Eastern Insurance Group LLC to Arthur J. Gallagher valued the company’s insurance unit at 35x price-to-earnings based on the insurance agency’s expected net income of $14 million in 2024. Eastern put that cash to work immediately, striking a bank deal in conjunction with the sale of its insurance unit.

“The decision to sell Eastern Insurance was made to capitalize on its strong valuation and allow us to focus on the growth and strategic initiatives of our core banking business, such as the merger with [Cambridge Bancorp],” Eastern’s Chairman and CEO Robert Rivers said on an investor call.

Truist’s sale of a 20% stake in Truist Insurance Holdings LLC to Stone Point Capital LLC valued the unit at $14.75 billion. The company has not closed the door on a full sale.

Fleeting fee income

While banks are using the proceeds strategically, the exits will take a chunk out of their noninterest income and strip away some of their income diversity. According to data compiled by S&P Global Market Intelligence, insurance comprised a good portion of Cadence and Eastern’s noninterest income at over 50% for Eastern and nearly 35% for Cadence.

“I look at it as ‘Would Warren Buffett be selling the insurance business?’ and the answer is most likely not,” Marinac said.

Still, banks will likely be able to replace the earnings lost from broker sales without much difficulty.

“Strategically, I think we’ll look back on this and say that these companies probably would have preferred not to have sold the business, but it won’t necessarily be a long-term problem,” Marinac said.

But not every US bank is enticed by current valuations. During a third-quarter earnings call, Provident Financial Services Inc. President and CEO Anthony Labozzetta said the bank was not interested in turning its insurance division into a financial transaction, particularly because the company is looking to increase its percentage of noninterest income to total revenue.

“It’s such an integral part of our business: the way it links with our commercial platform, the rate of growth, the value add that it provides to our customers. At this time, it’s not in our consideration,” Labozzetta said. “That, to us is an important piece of business that is not considered for sale right now.”