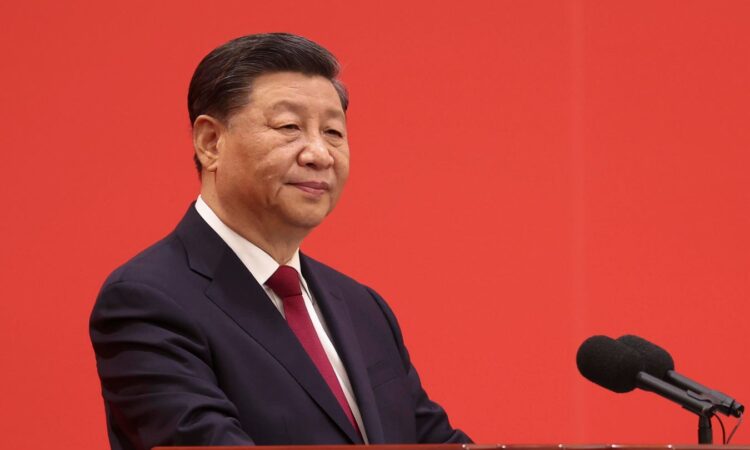

Getty Images

Given the growing dissatisfaction among participants in China’s Belt and Road Initiative (BRI), Beijing had to feel pressure for some gesture at rejuvenation at this year’s summit. But while Chinese President Xi Jinping spoke glowingly of the future, he effectively described the same arrangements that have long prevailed: China would provide less developed nations financing and skills to build needed infrastructure and manage the projects once completed. He said little to address the overwhelming fact that many BRI projects have failed to pay adequate returns, leaving participants with debts they cannot repay. Nor did he offer an answer to the increasing burdens imposed on Chinese lenders by these questionable loans. It seems clear from this weak performance that the BRI will continue to weaken and certainly fail Beijing’s once-vaunted ambitions for the project.

This year’s summit failed in other ways as well. Fewer nations participated than in the past. The 2022 summit gathered some 40 heads of state. This year barely half that number attended. Many nations sent lower ranked representative than in the past. Representatives from Europe and North America were hard to find. Italy and Greece had noticeably low profiles. Both have expressed disappointment with the arrangements. Italy seems ready to pull out of the BRI altogether. Aside from Xi, the most prominent figure at the summit was Russia’s Vladmir Putin. He spoke of the “Power of Siberia 2” pipeline to bring Russian natural gas through Mongolia to China. He also touted Russia’s northern sea route to carry shipping between Asia and Europe via the Arctic and avoid the Suez Canal. All understood his presence and dependence on China, but all also noted that neither project is part of the BRI.

Each participant had specific problems, but all had the same roots. Whether the BRI projects were done in Central Asia, Africa, or Europe, all reflected political and diplomatic rather than economic calculations. Many, unsurprisingly, have failed to throw off enough income to repay the loans originally advanced by state-owned Chinese banks. Already, Sri Lanka, Chad, Ethiopia, and Zambia are in restructuring negotiations, while Pakistan, an early member and the recipient of a good deal of Chinese money, has had to turn to the International Monetary Fund (IMF) for help with its debts. Work at the independent National Bureau of Economic Research estimates that some 60 percent of all BRI loans lie with nations that are in financial distress, in large part because of BRI decisions.

Long before this recent summit, the lack of enthusiasm had already slowed the growth of BRI arrangements. According to calculations done by The Wall Street Journal the BRI has dramatically cut back activity in Africa. Last year, it recorded commitments the equivalent of $1.0 billion, far below the $8.5 billion figure of 2019. Total BRI-related deals totaled the equivalent of some $40 billion during the first six months of this year, the most recent period for which data are available. That is a slightly faster pace than 2022, which totaled $68 billion for the whole year, but it is far short of the $100 billion a year averaged at the initiative’s height.

Resistance to the initiative has also risen among China’s state-affiliated banks. As BRI clients have had difficulty paying, the banks have complied with Beijing’s demand that they accommodate delayed payments and do so quietly so as not to embarrass the initiative. The banks have extended loan maturities in the vain hope that failing projects will in time pay enough to discharge the associated financial obligations. Among bankers the world over, this practice is derisively called “extend and pretend.” Some Chines banks have gone so far as to ask Beijing for letters with the moniker “policy designated” to indicate that the decision to make the loan came out of the government and not the bank’s management.

Resistance has become increasingly intense in recnet months, as banks have had to deal with growing numbers of internal financial failures. The Evergrande collapse has gathered the most headlines, but banks have seen their loan portfolios also threatened by the failures of several other residential property developers, most recently another giant property developer, Country Garden. Adding to the strain is the growing tendency for individual Chinese to refuse payment on mortgages for apartments that the fialed developers will likely never complete. Nor is there any sign that Beijing will offer the banks relief from these huge financial burdens.

New life might have returned to the BRI had Xi put practical remedies foreword, but little was forthcoming. Far from offering ways to relieve the debt, Xi’s speech never even mentioned the problem. The best he could do was offer an injection of the equivalent of $47.9 billion through the China Development Bank and the Import-Export Bank of China, hardly enough to make much difference.Otherwise, he mentioned only two additional measures. One was that the BRI would shift toward smaller projects in the future. Small mistakes are certainly better than the big mistakes of the past. But the continuation of mistaken projects was assured in the second measure announced at the gathering. The BRI would, the guests were told, orient its efforts to “more targeted projects,” such as green energy and healthcare, in other words, more politically and diplomatically determined efforts, the same thing that produced poor payouts in the past.

No doubt, the BRI will stumble on for some time to come. Beijing has too much prestige wrapped up in the project to let it go. But it is hardly the vehicle to extend Chinese power than it once seemed to be. Nothing is clearer from this year’s summit than that.

Follow me on Twitter.