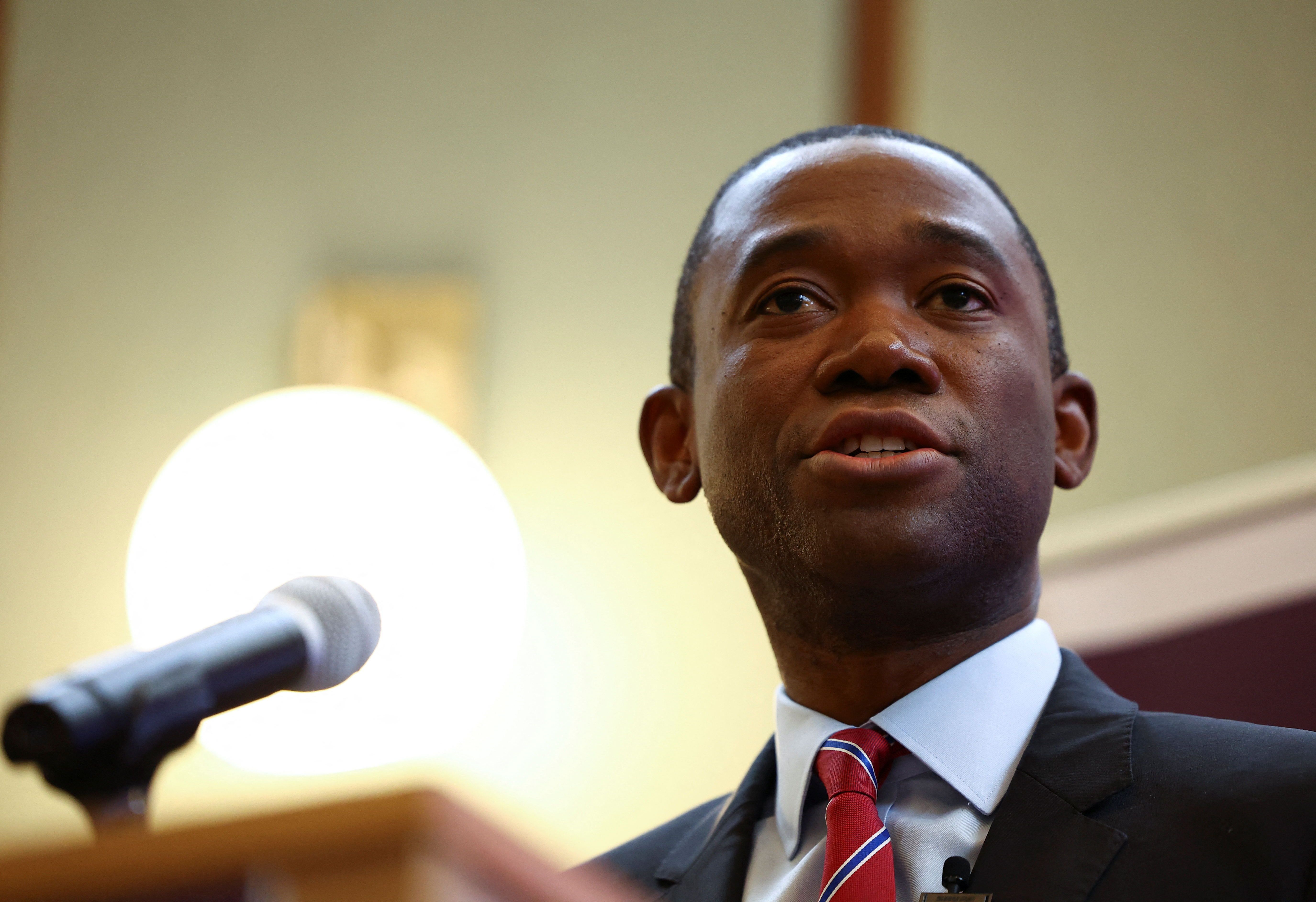

U.S. Deputy Treasury Secretary Wally Adeyemo speaks at the Royal United Services Institute in London, Britain, October 27, 2023. REUTERS/Hannah McKay/File Photo Acquire Licensing Rights

LONDON, Oct 27 (Reuters) – The United States on Friday said some firms in the digital asset space were not doing enough to stop the flow of illicit finance – a subject which has come under renewed scrutiny following the deadly attacks in Israel by Palestinian militant group Hamas.

U.S. Deputy Treasury Secretary Wally Adeyemo, speaking at an event in London, said the “vast majority” of financial institutions want to help root out terrorist financing.

But, he said: “there are those, especially (in) the digital asset space, who wish to innovate without regards to its consequences, including protecting against illicit finance.”

“Our expectation is that financial institutions and digital asset companies and others in the virtual currency ecosystem take steps to prevent terrorists from being able to access resources. If they do not act to prevent illicit financial flows, the United States and our partners will,” Adeyemo added.

Adeyemo is on a visit to London and then to Brussels as part of efforts by the U.S. government to coordinate a crackdown on Hamas using parts of the international finance system to bypass international sanctions.

The U.S. last week issued sanctions aimed at disrupting funding for Hamas, singling out people involved in its investment portfolio and a Gaza-based cryptocurrency exchange among other targets.

On Friday, the U.S. Treasury issued a second round of sanctions that targeted additional assets in a Hamas investment portfolio and people it said were facilitating sanctions evasion by Hamas-affiliated companies.

TRACKING CRYPTO

Cryptocurrency wallet addresses are pseudonymous, meaning people can send and receive cryptocurrency without revealing their identity.

But U.S. Treasury officials said on Friday that groups such as Hamas can be identified at the point where they try to convert cryptocurrencies into traditional currencies, such as the dollar, which can be used to make purchases. Officials said identifying these points, including outside of the U.S., is a big part of their work.

Asked whether crypto firms were willing to help solve the problem, the officials said that firms at first say they have little knowledge or control over how their platforms are used, but then change their attitude over time once the U.S. Treasury makes it clear that, if the firm does not take action itself, the Treasury can act.

Adeyemo said that although crypto did not currently make up the majority of funding for terrorist groups and other groups seeking to hide their money, the U.S. was taking action now to prevent the technology being more widely used for illicit finance in future.

The U.S. Treasury Department’s Financial Crimes Enforcement Network (FinCEN) last week proposed increasing transparency around cryptocurrency “mixers”, to combat the use of the tool by malicious actors, including Hamas.

Reporting by Elizabeth Howcroft, Andy MacAskill; Editing by William James and Jonathan Oatis

Our Standards: The Thomson Reuters Trust Principles.