Blockchain Bites: A Tokenised Future for Australia’s Financial System? Seize and burn? UK to “destroy” illicit crypto, Running drills: Preparing for a blockchain hack, California passes crypto bill; Governor calls for consultation, Korea’s CBDC pilot eyes digital future

A Tokenised Future for Australia’s Financial System?

At last week’s AFR Crypto Summit, Assistant Governor (Financial System) of the Reserve Bank of Australia (RBA), Brad Jones, delivered a speech exploring the future role of tokenised assets and money in Australia’s future financial system and the potential economic benefits.

Historical Lessons

Mr Jones highlighted the co-dependence of commercial and monetary systems throughout history, drawing parallels between the chronic shortage of high-value coinage in China’s Song Dynasty and the challenges faced by European merchants during the Renaissance era. In both cases, new technologies, such as paper money and the printing press, led to innovative solutions for facilitating trade.

Mr Jones emphasised that the interdependence between commerce and money continued to drive progress. The industrial revolution, which fuelled global trade expansion, was preceded by various financial and monetary innovations:

Among [those innovations] were novel forms of money like bills of exchange, alongside new types of financial infrastructure and intermediaries – think of the double-entry book-keeping administered on paper ledgers by the Medicis of Florence. The socio-economic forces unleashed in this period were immense: the corporation was born, capitalism flourished and the new merchant class became a political force. Turning to the computerised age of more recent decades, the dematerialisation of finance saw paper-based forms of assets, money and record ledgers give way to electronic variants. This fuelled efficiencies that must have seemed unimaginable half a century ago.

Mr Jones noted that the two-tier monetary system comprising the central bank and commercial private banks, had proven to be highly effective in combining the strengths of public and private money. This is where “tokenisation” comes into play, presenting new opportunities for Australia’s financial system.

Tokenisation and Its Possibilities

Mr Jones identified a number of potential benefits of tokenised assets, comparing them to traditional physical assets and electronic assets as shown in the table below:

Source: https://www.rba.gov.au/speeches/2023/sp-ag-2023-10-16.html#fn1

Mr Jones analogised a tokenised asset as:

…digital bearer instruments that represent claims on underlying assets that exist in the real (traditional finance, ‘off chain’) world. They also contain rich, unique information that can be updated instantaneously, and can be programmed via smart contracts to perform functions that are not currently performed in traditional finance applications.

With the ability to exchange tokenised assets 24/7 on decentralised ledgers, Mr Jones noted that tokenisation may potentially reduce the need for intermediaries and manual record reconciliation.

Having identified the potential benefits of tokenisation, Mr Jones noted:

threshold policy question is what potential benefits could tokenisation crystalise, and are the downsides manageable?

Mr Jones identified the potential benefits including:

- Increased asset liquidity, informational transparency and auditability;

- Reduced risks, costs, and improved capital efficiency from shorter settlement cycles; and

- Reduced intermediary and compliance costs.

The challenges included regulatory uncertainty, interoperability between different technologies (i.e. interactions between distributed ledger technology like blockchain and other “traditional” information systems), and the impact of prefunding on transactional liquidity.

Regulatory concerns are particularly prominent, as innovations in tokenised finance often operate in a regulatory grey zone. In that regard, Mr Jones highlighted the recent learnings from Australia’s CBDC pilot and opined that enhancements to the regulatory sandbox arrangements in Australia, possibly informed by the UK’s recent experience, are worthy of consideration.

Tokenised money

Mr Jones’ speech discussed the prospects of different forms of tokenised money, which could include unbacked cryptocurrencies, asset-backed stablecoins, tokenised bank deposits, and a wholesale central bank digital currency (CBDC). Mr Jones observed that unbacked cryptocurrencies are risky due to their price volatility and lack of regulatory oversight. With respect to stablecoins, Jones noted:

It is certainly plausible that stablecoins issued by well-regulated financial institutions and that are backed by high quality assets (i.e. government securities and central bank reserves) could be widely used to settle tokenised transactions.

However, stablecoins might face collateral limitations and perceived credit risk.

Tokenised bank deposits were presented as a potentially viable option for settling transactions, given their similarity to the current banking system.

Contrasting these options with a wholesale CBDC, Mr Jones stated:

only a wholesale CBDC would be completely free of credit and liquidity risk. In representing the ultimate form of safe money, it could help to anchor and spur innovation in the financial system – including realising the full benefits of atomic settlement and programmability.

Concluding, Mr Jones noted that a wholesale CBDC would represent an evolution rather than a revolution for Australia’s two-tier monetary system. He did not, however, go on to consider the prospect of a retail CBDC and the potential policy challenges which may arise in implementing one, such as privacy concerns.

Hypothetical cost saving of asset tokenisation

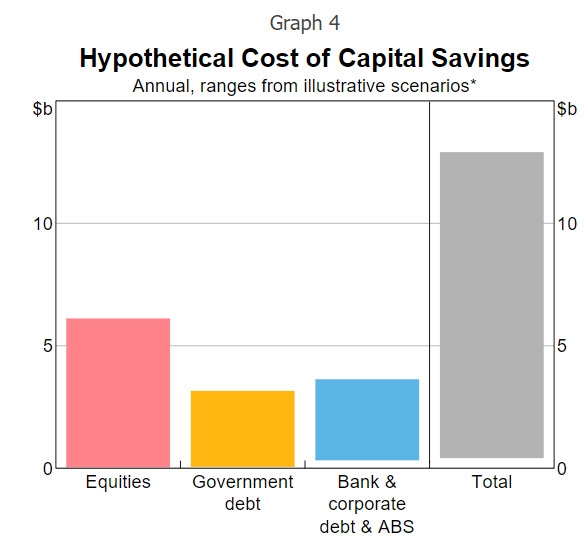

Mr Jones quantified some of the hypothetical cost-savings that asset tokenisation may bring to the Australian financial system. One such hypothetical estimate suggested that savings of up to AUD$13b per year could be generated for Australia’s capital markets.

Source: https://www.rba.gov.au/speeches/2023/sp-ag-2023-10-16.html#fn1

The two factors driving the reduced costs were as follows: (1) tighter bid-ask spreads reflecting the increased trading volumes of tokenised assets; and (2) gains from atomic settlement (i.e. 24/7 instant settlement) driving down other fees, including those currently paid to corresponding banks involved in cross-border payments, savings from reduced collateral requirements, and reduced fees from a lower incidence of settlement fails.

The RBA’s Future of Money Work Program

Mr Jones’ speech concluded by outlining the RBA’s future plans:

So where is the Bank on its future of money journey? Our overarching position is that we remain open-minded as to the functional forms of digital money and supporting infrastructure that could best support the Australian economy in the future.

Mr Jones stated that the RBA had an “active research program” underway and highlighted some of its key focus areas over the next year:

- The RBA is in the early stages of planning for a new project assessing how different forms of digital money and infrastructure could support the development of tokenised asset markets in Australia.

- The RBA and Treasury will publish a joint report around the middle of 2024 that will provide a stocktake on CBDC research in Australia and set out a roadmap for future work.

- The Bank will continue to actively contribute to international work streams, including those aimed at reducing the frictions in cross-border payments.

- The Bank will step up its engagement with a range of external stakeholders on the future of money. This will take a variety of forms and include industry, academia, government agencies, other central banks and the wider public.

It is apparent from Mr Jones’ speech that the RBA keenly understand the potential benefits of asset tokenisation to the financial system and economy, and that those potential benefits are quantifiable. The RBA is however continuing to explore what a tokenised future might look like, and to that end, it is taking cautious steps to research and plan for that future, while mitigating the potential downsides. In this regard, the RBA is part of an ongoing global conversation among Government officials and policy makers on the future of our digital economies. Of course, the future of money is a question which does not just touch central bankers. It is one that is likely to be heavily debated by experts and policy makers of different stripes, and the public at large.

Seize and burn? UK to “destroy” illicit crypto

The UK’s Economic Crime and Corporate Transparency Act 2023 received Royal assent this week in response to concerns over digital financial crimes.

The UK’s National Crime Agency (NCA) estimates that in 2021, over GBP1B in illicit cash was transferred overseas in cryptoasset transactions. The UK’s new legislation allows authorities to take prompt action to seize cryptoassets where there is strong evidence of criminal activities, without needing to wait for a conviction. Further, it introduces provisions to expedite freezing orders of cryptoassets associated with crime.

Part 4 of the Act, titled ‘Cryptoassets’, amends the existing confiscation regime under the Proceeds of Crime Act 2002, incorporating new powers in respect of orders involving cryptoassets. The Government’s announcement states:

In exceptional circumstances, there will also be a power to destroy seized cryptocurrency.

This power arises for instance when the seized cryptoasset, upon release, is not claimed back within a year and in circumstances where it is contrary to the public interest to realise the cryptoassets. A cryptoasset is ‘destroyed’ if it is:

disposed of, transferred, or otherwise dealt with, in such a way as to ensure, or to make it virtually certain, that it will not be the subject of further transactions or be dealt with again in any other way.

Interestingly, the act provides that where cryptoassets are destroyed, the accused will be taken to have paid the amount equivalent to the market value of the cryptoassets ‘towards satisfaction of the confiscation order’.

An accompanying impact assessment by the Home Office emphasizes the rationale for this new forfeiture power:

[cryptoassets] cannot currently be recovered as easily…due to their unique technological qualities.

The Government welcomed the new legislation, stating:

Law enforcement agencies will benefit from greater powers to seize, freeze and recover cryptoassets.

The Government’s announcement highlights the challenge of ensuring that new legislation is fit for purpose when it comes to crypto-assets. The notion of “destroying” crypto-assets is something of a misnomer, and perhaps a relic of another era in which the proceeds of crime were, more often than not, physical objects that could be destroyed. With the new legislation receiving Royal Assent, it will be interesting to see how the Government implements its new powers to “destroy” crypto-assets in practice.

The new legislation follows stringent measures introduced by the UK’s Financial Conduct Authority (FCA) earlier this month around crypto promotions, which are intended to protect individuals from misleading or deceptive practices by crypto firms. The FCA has issued over 200 warnings to crypto firms to date, which resulted in Binance temporarily suspending new user registrations in the UK while they review compliance.

Running drills: Preparing for a blockchain hack

Yesterday, renowned blockchain security expert, Samczsun, announced the public launch of the SEAL Drills initiative. SEAL Drills aims to help blockchain protocols and projects prepare for a potential blockchain hack by conducting a simulated attack against a protocol. The initiative is a collaboration between Sam, Isaac Patka, and a number of other Whitehat hackers and researchers.

The goal of the initiative is practicing detection, diagnosis and swift response during a blockchain attack. Having battle tested its attack simulation model with Compound DAO and Yearn, the SEAL Drills team has opened expressions of interest for other protocols looking to test systems. In the Yearn simulation, a group of core contributors to the protocol encountered a mock attack on an oracle price feed intended to drain certain vaults of funds. In the scenario, the team responded by activating an emergency shutdown procedure to return funds to a vault.

According to Chainalysis, nearly $3.8 billion was stolen in blockchain hacks last year, nearly half of which has been linked to North Korean hackers. The SEAL Drills initiative highlights the importance of crisis management experience and planning in responding to blockchain hacks and cyber threats.

Proper planning is also vitally important in responding to the legal implications of a cyber attack. It helps to have a crisis management plan in place that can be activated in the event of an incident. Precious time will invariably be wasted marshalling a plan after an attack occurs.

Some of the key considerations for legal counsel in formulating a crisis management plan include:

- Assembling the right team, including subject matter experts (which may include, security teams, legal counsel, communications, executive, among others).

- Have clear lines of decision making to manage the incident.

- Ensure secure communication between the response team.

- Take steps to secure systems and data, and trace and freeze assets (which, in a blockchain context, may involve engaging blockchain analytics firms and external legal counsel to trace and injunct stolen assets).

- Have a communications strategy: Issue a holding statement to manage stakeholders and public relations. It is often better to say less than more where not all facts are known and speculation would be unhelpful. However, timely and clear communication is vital to maintain confidence and trust.

- Consider reporting obligations to relevant authorities, including anti-money laundering, privacy or sanctions authorities.

- Notifying insurers where applicable.

- Investigate the incident and identify learnings.

The SEAL Drills model addresses a number of these items under extreme time constraints.

As the old adage goes, fail to plan, plan to fail. Given today’s heightened cyber threat environment, crisis management planning is vitally important to address what can be an existential threat for any business or start-up.

California passes crypto bill; Governor calls for consultation

In a move that echoes the recent movements in global cryptocurrency regulation (for example see Australia and Hong Kong), Californian Governor Gavin Newsom has signed Assembly Bill 39, set to take effect in July 2025. Known as the Digital Financial Assets Law, this legislation marks California’s answer to New York’s “BitLicense” and could signify a positive step towards regulatory clarity for the blockchain industry in California.

However, the Digital Financial Assets Law has faced heavy industry criticism. Despite this, it successfully passed through the state’s Assembly in September 2022, establishing the groundwork for regulation and enforcement in the cryptocurrency sector.

The core features of the law entail empowering California’s Department of Financial Protection and Innovation (DFPI) to craft a comprehensive regulatory framework for blockchain dealings. This framework encompasses a licensing regime and grants the DFPI enforcement authority and rulemaking within the sector. Licensed crypto firms will be subjected to examinations, record-keeping, and fee disclosures to customers, ensuring a responsible and transparent cryptocurrency landscape. The DFPI has been allotted an 18-month implementation period to make changes to the regime.

Governor Newsom emphasised the need for striking a balance between consumer protection and fostering responsible innovation, stressing the collaborative nature of the process. Newsom articulated:

It is essential that we strike the appropriate balance between protecting consumers from harm and fostering responsible innovation, and I look forward to working with the author of the bill to achieve this.

The cryptocurrency community has long been wary of the “BitLicense” in New York, with CoinDesk saying it was ‘lethal to start-ups’, but could California’s approach offer a glimmer of hope on the West Coast? With Congress and federal regulators taking a backseat in shaping Federal regulations for digital assets, other States have stepped in to set standards.

The California Governor had previously vetoed a similar bill but is now keen to improve upon it through industry collaboration. The crypto industry will have some opportunities to provide input and shape the regulatory landscape before the law’s full implementation in 2025. California, like many jurisdictions, says it wishes to strike the right balance between fostering innovation and safeguarding consumers, and industry feedback along the way is a key part of that journey.

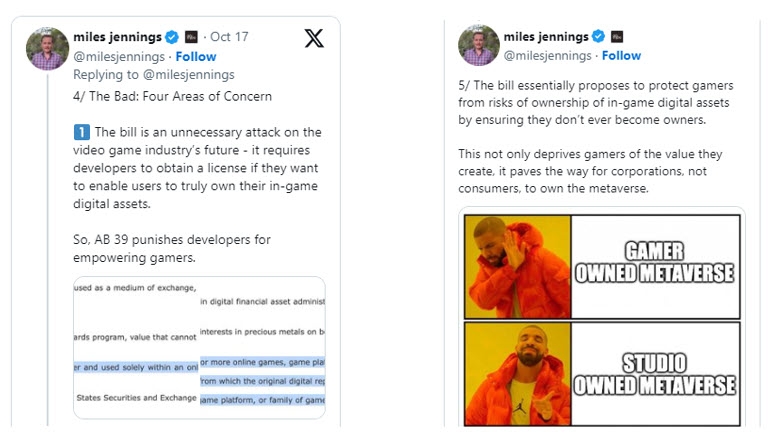

Miles Jennings, General Counsel of a16z, posted his reservations on an X thread regarding the potential negative impact on gamers and the otherwise ambiguous definitions in the draft bill:

Of concern is that this same approach to in-game assets has been proposed in the Treasury consultation on Digital Asset exchange licensing.

While most lawmakers, lobbyists, and federal regulators believe that new federal laws are necessary, Congress remains divided on the issue. The SEC, under Chair Gary Gensler, has been active in a regulation by enforcement campaign, which is both expensive and economically inefficient, and the need for comprehensive regulation remains.

In the absence of Congressional action, California’s Digital Financial Assets Law stands as a positive step towards responsible blockchain regulation and governance, demonstrating the potential for a collaborative approach between industry and regulators in shaping the future of the blockchain ecosystem, if industry concerns are heard, particularly around in-game and other NFT based assets.

Korea’s CBDC pilot eyes digital future

Earlier this month, the Bank for International Settlements (BIS) and the Bank of Korea (BOK) released a report titled “A step toward new financial market infrastructure: Bank of Korea’s initiative“. In line with BIS’ role in “fostering responsible innovation within the central banking community”, the paper outlines its advice on Bank of Korea’s Central Bank Digital Currency (CBDC) pilot project.

BOK established a CBDC research group back in 2020 committed to ‘constructive and responsible innovation’. In recent years, there have been numerous experiments focused on retail CBDC and collaborations with commercial banks, designed to test a CBDC’s functionalities and lifecycle operations, from ‘minting, issuance, circulation, redemption and destruction’. By connecting BOK’s test CBDC system with commercial bank test servers, the ‘seamless performance’ of previous experiments affirmed the potential for real-world applications.

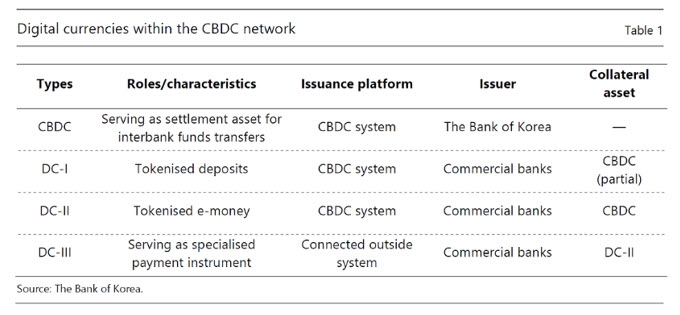

BOK’s new pilot project will take this a step further, to establish a CBDC network that will facilitate the issuance and circulation of digital currencies, including tokenised deposits and tokenised e-monies. The new project envisions a CBDC as ‘an anchor’ which enables ‘seamless exchanges’ between tokenised deposits and tokenised e-monies.

The project’s key objectives are:

- Redirecting the public’s interest in crypto assets towards a more innovative, constructive, and responsible channel

- Supporting the integration of tokenisation into the realm of assets

- Enhancing payment system efficiency by leveraging CBDC’s programmability

- Realising the unified ledger suggested by BIS for interoperability

While the BOK will remain in charge of the development and implementation of the CBDC system, commercial banks will be granted ‘exclusive participation rights’ to act as node operators and hold CBDCs for inter-bank settlements, as collateral or reserve assets. Commercial banks will also be able to issue digital currencies (type DC-I and DC-II, see table below), however they will need to comply with a ‘common technical standard’ for interoperability.

The paper identified the following challenges and considerations for retail CBDC implementation in Korea:

- CBDCs may lack notable advantages in light of Korea’s advanced payment infrastructure;

- Widespread adoption of retail CBDC may lead to bank disintermediation;

- Concerns over privacy infringement;

- Concerns of interoperability between banks’ independent systems and risks of a siloed financial infrastructure.

BOK’s digital currencies have been designed and structured to comply with obligations imposed on regulated entities under current Korean financial services regulations to avoid the need for amendment of the Bank of Korea Act. Following the project, BOK and the Financial Services Commission (FSC) plans to review the legal status of the DC-I and DC-II currencies against existing and future regulations.

The BIS paper recognises the varied approaches taken by jurisdictions in regulating digital assets, noting the exclusion of deposits from the scope of Europe’s MiCA and Singapore’s distinguishing of tokenised deposits and stablecoins. In doing so, the paper suggests that there may be a need to construct a brand-new framework in the future, instead of retrospectively fitting digital currencies into existing regulations.

Although the BOK believes Korea does not immediately need a retail CBDC, it insists:

It is necessary to be prepared for scenarios in which…CBDC becomes necessary due to changes in the financial and economic landscape.

Korea’s approach makes sense in light of the global decline in cash usage and the continued rise of digital economies. The Federal Reserve Bank of New York, the Central Bank of Brazil and numerous other countries, including Australia, are undertaking similar efforts to prepare for a future in which digitally native money is an important feature of the economy.